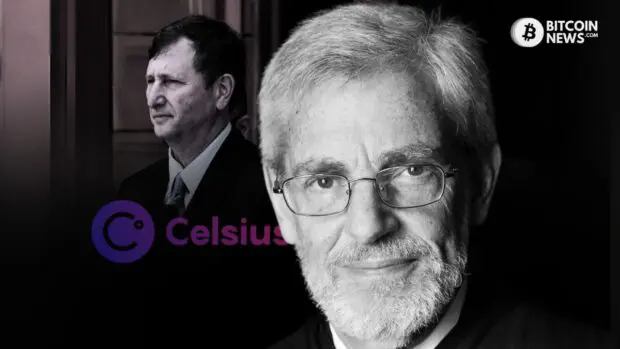

Celsius Network, a prominent player in the digital asset lending space, finds itself navigating rough waters in its bid to shift gears toward becoming a Bitcoin mining entity. Recent developments in court sessions ruled over by U.S. Bankruptcy Judge Martin Glenn shed light on the challenges ahead for Celsius.

Regulatory Roadblocks and Judge’s Concerns

Judge Martin Glenn expressed concerns about the significant deviation from the initial deal that creditors had agreed upon. The proposed transformation into a Bitcoin mining business raises red flags for Judge Glenn. He insisted that this decision potentially necessitates a new vote from the creditors, raising the issue that this pivot represents a stark departure from the direction originally endorsed by those invested in Celsius.

The Proposal to Switch to Bitcoin Mining

Robert Campagna, Managing Director of Alvarez & Marsal, has submitted a declaration in support of Celsius Network’s joint motion with the committee seeking court approval for a significant shift toward Bitcoin mining.

The motion outlines the transition from the initially planned NewCo Transaction to the MiningCo Transaction. Campagna emphasizes the influence of the United States Securities and Exchange Commission (SEC) guidance in steering the decision towards the MiningCo Transaction, highlighting the desire to maximize value and promptly return Liquid Cryptocurrency assets to Account Holders.

The declaration details the progress made in preparations for both transactions, including negotiated agreements with PayPal and Coinbase for digital asset distributions. The declaration underscores the approach taken by Celsius Network and the Committee in selecting US Bitcoin Corp. as the mining manager for the proposed MiningCo Transaction.

Campagna provides a comprehensive overview of the financial aspects, comparing recoveries under the MiningCo Transaction and the orderly wind down. A budget of approximately $75 million is outlined for the efficient winding down of Celsius Network’s estates.

The allocation of responsibilities among US Bitcoin Corp., the Plan Administrator, and the Litigation Administrator is proposed to facilitate the resolution of outstanding issues. Additionally, a “Disputed and Contingent Claims Reserve” is suggested to hold Liquid Cryptocurrency and MiningCo Common Stock for unresolved claims, emphasizing a proactive approach to address potential challenges.

SEC’s Skepticism and Company’s Response

Celsius Network’s altered strategy stems from the skepticism of the SEC regarding its previous business plans. While the SEC didn’t favor Celsius’ bankruptcy plan, the agency’s reluctance to endorse crypto lending and staking forced Celsius to narrow its focus exclusively to Bitcoin mining.

This shift, according to Celsius attorney Chris Koenig, aligns with the court-approved bankruptcy plan, giving the company the leeway to transition without necessitating a fresh vote, as it purportedly benefits creditors equally. Judge Glenn disagreed with these claims, and stated this decision necessitates a fresh round of voting.

Judge’s Displeasure and Creditor Opposition

Judge Glenn’s discontent with Celsius’ sudden pivot highlights his repeated advisories to the company, emphasizing the importance of reaching an agreement with the SEC. The divergence from the initially proposed plan might encounter significant opposition from creditors, raising doubts about the smooth execution of Celsius’ revised strategy.

As per the Reuters report mentioned earlier, two customers, without legal representation, have expressed their opposition in court filings, advocating for Celsius’ complete liquidation instead of proceeding with the revised deal.

Celsius Network Journey from Bankruptcy to Revised Plans

Celsius filed for Chapter 11 protection in July 2022, amidst a wave of digital asset lenders facing financial turmoil during 2021-2022. The revised Celsius proposal aims to free up $225 million in assets previously under the control of external investors known as the Fahrenheit consortium. This updated plan forecasts a 67% recovery for Celsius creditors, surpassing the 61.2% recovery projected in the previous arrangement involving the consortium.