In a showdown in Washington, the U.S. Congress has taken steps to challenge the Securities and Exchange Commission (SEC) over a controversial policy related to digital assets.

The issue centers on the SEC’s Staff Accounting Bulletin No. 121 (SAB 121), which has sparked fierce debate among lawmakers, the Bitcoin community, and banking executives.

SAB 121, introduced in 2022, requires banks and other publicly traded companies to account for customers’ digital assets on their balance sheets and maintain capital against them.

This rule aims to enhance transparency and protect investors by highlighting the obligations and risks associated with safeguarding these assets.

However, critics argue that the policy complicates financial reporting, increases operational burdens, and stifles innovation in the burgeoning digital asset sector.

On May 16, both the House of Representatives and the Senate voted to overturn SAB 121.

The House passed H.J. Res. 109, introduced by Representatives Mike Flood (R-Neb.) and Wiley Nickel (D-N.C.), while the Senate companion measure was introduced by Senator Cynthia Lummis (R-Wyo.).

The Senate vote was 60-38 in favor of the resolution, with a notable bipartisan effort seeing a dozen Democrats join the majority of Republicans in opposition to the SEC’s rule.

Senator Lummis described SAB 121 as “a disaster” and criticized its lack of consumer protection. She stated:

“This is a win for financial innovation and a clear rebuke of the way the Biden administration and Chair Gary Gensler have treated crypto assets and marks the first time both chambers of Congress have passed standalone crypto legislation.”

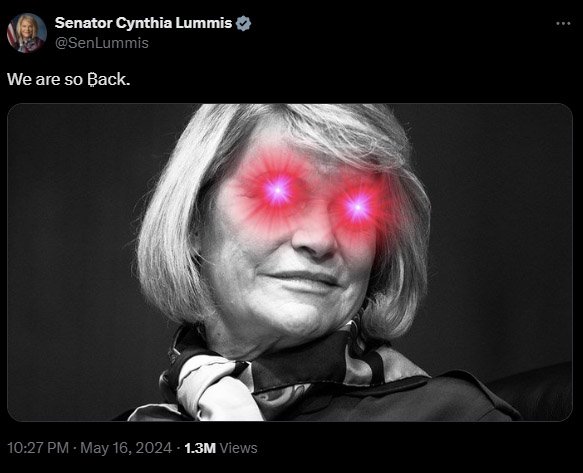

She also celebrated the win with a “laser eyes” post on social media platform, X, captioned: “We are so ₿ack.” Interestingly enough, the letter b in “back” is the bitcoin’s logo.

Senator Lummis emphasized that President Biden should pay attention to the bipartisan backing the Congressional Review Act (CRA) garnered in both the House and Senate, urging him to sign it into law.

The Blockchain Association advocacy group expressed surprise by the 60 ‘Yeas’ votes, which demonstrated significant disapproval of the rule from both chambers of Congress.

Despite the strong congressional support for overturning SAB 121, the resolution now faces a significant hurdle: President Joe Biden’s veto threat.

Representative Mike Flood echoed these sentiments, praising the bipartisan support and urging President Biden to reconsider his veto threat.

The White House had expressed concerns that repealing the rule could undermine investor protection and financial stability. A statement from the White House administration highlighted the potential risks, stating:

“SAB 121 was issued in response to demonstrated technological, legal, and regulatory risks that have caused substantial losses to consumers.”

The administration emphasized that restricting the SEC’s capacity to regulate digital-assets effectively could lead to significant financial instability and uncertainty in the market.

Nevertheless, the SEC’s rule has drawn sharp criticism not only from lawmakers but also from key figures in the Bitcoin industry.

Congressman Wiley Nickel has been vocal in his opposition, arguing that SAB 121 amounts to a “prohibitively expensive regulatory burden” and forces U.S. consumers to rely on “riskier offshore custody solutions.”

He warned that the SEC’s approach to digital assets is misguided and criticized the enforcement of the rule as a breach of the traditional rulemaking process.

Congressman Nickel added:

“The SEC’s open hostility toward the digital assets industry isn’t serving President Biden’s best interests. The SEC is turning cryptocurrency regulation into a political football and forcing President Biden to choose sides[…]”

Austin Campbell, founder of Zero Knowledge Consulting, described SAB 121 as “insanity,” suggesting that it could have contributed to the collapse of FTX by preventing regulated custodians from serving customers and exchanges.

He emphasized the need for a more balanced regulatory framework that doesn’t lock major financial institutions out of the growing demand for Bitcoin services.

US House majority whip Tom Emmer also emphasized that President Joe Biden faces strong scrutiny over whether he’ll approve or reject the CRA before the elections.

Rob Nichols, President and CEO of the American Bankers Association, praised congressional leaders, particularly Sen. Lummis and Reps. Nickel and Flood, for their leadership in guiding the CRA resolution of disapproval for the SEC’s SAB 121 through both chambers.

He emphasized the bipartisan nature of the votes, portraying them as a rebuke of the SEC’s decision to alter accounting treatment for custodied assets, which could jeopardize banks’ ability to offer secure digital asset services to consumers.

Nichols stressed the importance of bank custodianship for digital assets, warning that without it, consumers would be left with poorly regulated options for safeguarding their assets.

He urged President Biden to promptly sign the resolution into law to protect American consumers.

The debate over SAB 121 comes at a time when countries around the world are grappling with how to regulate the rapidly evolving Bitcoin market.

In India, regulators are proposing a multi-regulator oversight framework for digital assets trading, while Switzerland plans to implement the Crypto-Asset Reporting Framework (CARF) to enhance tax transparency.

In the U.S., the outcome of the SAB 121 controversy could have significant implications for future Bitcoin legislations.

Representative Mike Flood has suggested that this resolution could pave the way for the Financial Innovation and Technology for the 21st Century Act, which aims to define the regulatory roles of the SEC and the Commodity Futures Trading Commission (CFTC) concerning digital assets.