In a recent legal battle, Custodia Bank, a digital asset bank based in Wyoming, has faced a setback in its quest to obtain a Federal Reserve master account. This crucial asset allows banks direct access to the Federal Reserve’s payment systems. Analyzing details of this case could highlight its implications for Custodia Bank.

Court Ruling Against Custodia Bank

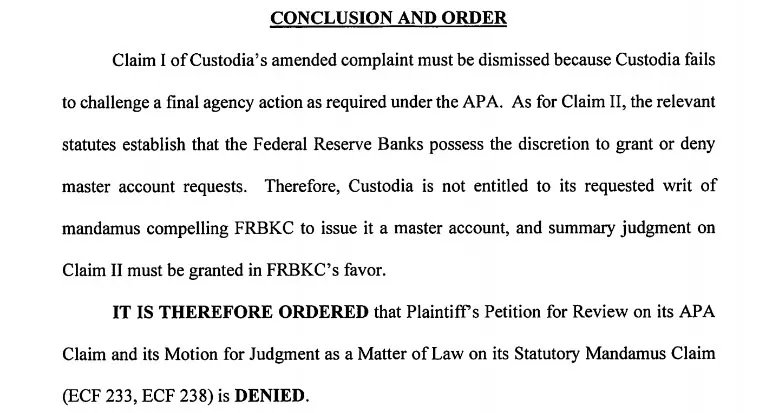

Custodia Bank‘s attempt to secure a Federal Reserve master account hit a roadblock as the United States District Court ruled against its bid. The decision, handed down by Judge Scott Skavdahl, dismissed Custodia’s plea for a declaratory judgment, highlighting the court’s stance on the matter.

It argued:

“Custodia is not entitled to its requested writ of mandamus compelling FRBKC to issue its master account, and summary judgment on Claim II must be granted in FRBKC’s favor.”

Challenging the Fed’s Decision

Custodia Bank argued vehemently for its entitlement to a Federal Reserve master account, citing concerns over competitive disadvantage without it. The bank contended that not having this account limits its operations, rendering it dependent on intermediary banks and positioning it as a “second-class citizen” in the banking sector.

The bank stated:

“Without a master account, if Custodia is able to operate at all, it is a second-class citizen, relegated to dependency on and fealty to an intermediary bank.”

Legal Battle Unfolds

The legal tussle dates back to Custodia’s initial application for a master account in October 2020. However, the Federal Reserve Bank of Kansas City (FRBKC) rejected Custodia’s application in January 2023, citing concerns over the bank’s involvement in digital-asset-related activities.

Judge Skavdahl’s ruling underscored the discretion afforded to the Federal Reserve in granting master accounts. He emphasized that the law does not mandate the Federal Reserve to provide master accounts to every eligible depository institution. This ruling could have significant implications for Custodia Bank’s operations and its vision of integrating digital assets within regulated banking frameworks.

The judge wrote:

“Thus, unless Federal Reserve Banks possess discretion to deny or reject a master account application, state chartering laws would be the only layer of insulation for the U.S. financial system […] And in that scenario, one can readily foresee a ‘race to the bottom’ among states and politicians to attract business by reducing state chartering burdens through lax legislation, allowing minimally regulated institutions to gain ready access to the central bank’s balances and Federal Reserve services.”

Custodia’s Response

Despite the setback, Custodia Bank remains resilient, expressing its intention to explore all available options moving forward. Nathan Miller a spokesperson for Custodia Bank emphasized the company’s commitment to its vision, stating:

“challenging the Fed’s strong-arm tactics has always been an uphill battle, but Custodia Bank remains committed to our vision of creating a safe, tech-enabled bank. We are reviewing the Court’s decision and all of our options, including appeal.”

Future Prospects

As Custodia Bank navigates through the aftermath of this legal ruling, the future remains uncertain. However, the bank’s determination to continue its fight underscores the significance of this case in the evolving landscape of digital asset banking.

The recent court ruling denying Custodia Bank a Federal Reserve master account marks a significant development in the bank’s ongoing legal battle. As Custodia explores its options and reaffirms its commitment to integrating digital assets within regulated banking frameworks, the implications of this decision reverberate across the banking sector.