In a dramatic turn of events, a U.S. judge decided that Binance former CEO Changpeng Zhao CZ must stay in US prior to his trial. Meanwhile prosecutors are intensifying their pursuit of a maximum 10-year prison sentence for him. The recent court filing on November 24 revealed the prosecution’s determination to argue for the statutory maximum, elevating CZ’s legal battle to unprecedented heights.

The court documents disclosed the gravity of the situation, asserting, “The reality is that the top-end of the Guidelines range may be as high as 18 months, and the United States is free to argue for any sentence up to the statutory maximum of ten years.”

Notably, according to the U.S. Sentencing Guidelines, Zhao would likely receive a 12–18-month sentence at a minimum-security prison. However, the former CEO’s legal team suggests the possibility of no jail time. They argue that their client could be “eligible to serve half of any term of imprisonment in a non-jail setting,” including home detention or community confinement.

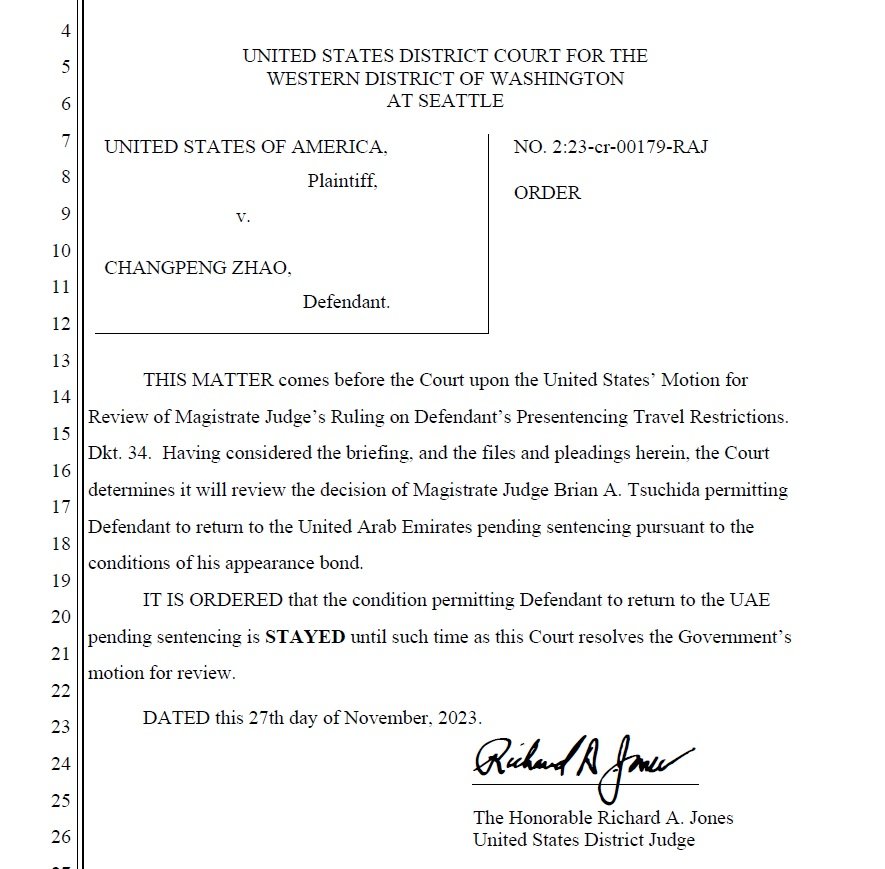

Federal Judge Decides CZ Must Stay in US

In addition, in response to CZ’s recent plea against strict detention measures, DOJ lawyers stress the need for reasonable restrictions. The federal judge, Richard Jones in Seattle, has temporarily suspended a decision on CZ’s travel outside the United States. He ruled that CZ cannot return to his home in the United Arab Emirates (UAE) for now, further complicating the legal landscape.

Possibility of a 10-Year Sentence

Notably, the Department of Justice (DoJ) warns of a “substantial risk” in letting Zhao fly to the UAE. Its key focus centers on CZ’s potential flight risk, emphasizing his ties to the UAE. Despite CZ’s voluntary appearance to face charges related to a Bank Secrecy Act violation, prosecutors express concerns about his substantial connections in the UAE, raising doubts about his likelihood of returning if allowed to fly.

It is important to note that last week, CZ paid $4 billion in settlements with federal regulators, including the Justice Department, Treasury Department, and Commodity Futures Trading Commission. This settlement involves charges related to anti-money laundering and sanctions violations. Binance, under scrutiny, allegedly failed to prevent “suspicious transactions with terrorists” and allowed bad actors on their platform, including those linked to narcotics and child sex abuse.

Zhao pleaded guilty to these charges and stepped down as the CEO of the exchange. He admitted that he made mistakes, stating that he must “take responsibility” and do what’s best for the digital asset community and Binance. However, CZ noted that the resolution does not allege that his exchange misappropriated user funds or engaged in any market manipulation.

Richard Teng Takes Over

On a separate note, Richard Teng recently published his first blog post as the CEO of Binance. Notably, Teng has a longstanding experience in traditional financial markets, having previously served in executive roles at Dhabi Global Market (ADGM), the Singapore Exchange (SGX), and the Monetary Authority of Singapore. He commented on his company’s compliance practices by stating:

“We have turned the page on Binance’s historical challenges, and we are, in fact, stronger today than we have ever been. Over the course of the past two years, Binance has systematically worked to address its past compliance issues through a series of significant efforts to recruit, hire, and retain the right personnel to strengthen Binance’s compliance program and culture.”

Regulatory Landscape for Digital Assets in the US

The final determination of Zhao’s travel permissions now lies in the hands of Judge Jones, who will assess whether restrictions should be imposed on Zhao’s travel to the UAE. As events transpire, the digital asset sector and its supporters recognize the far-reaching consequences this case may exert on regulatory scrutiny and compliance within the sector.

Related reading: Regulatory “Siege” Underway For U.S. Exchanges — Warns Ex-SEC Official

The recent legal battle marks the culmination of a months-long initiative to address purported unlawful practices within the industry. Binance, along with competitors Coinbase and Kraken, confronts legal action from the Securities and Exchange Commission (SEC), accused of evading mandatory registration as securities exchanges.

On the other hand, FTX co-founder Sam Bankman-Fried faced a conviction for fraud in November following the collapse of his digital asset empire last year.