The European Union (EU) has taken a significant step in its fight against money laundering by introducing new regulations targeting digital asset transactions. These regulations aim to curb the anonymity associated with digital asset transactions, particularly through self-hosted wallets. The new EU ban, tightening restrictions to aid fight against money laundering and terrorism financing, could have dire circumstances for Bitcoin users in Europe who prefer to use self-custody and open-source wallets.

EU Ban on Anonymous Digital Asset Payments

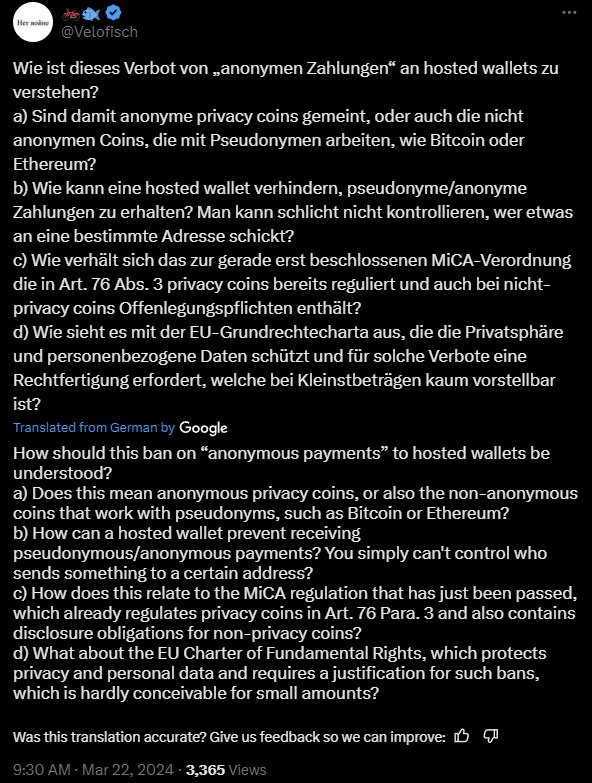

The EU has passed legislation that prohibits anonymous digital asset payments such as bitcoin, specifically targeting transactions made through self-custody wallets. These wallets, which allow users to manage their own private keys without relying on third-party services, have come under scrutiny due to their potential for facilitating illicit activities, as there is no need for KYC to create these wallets.

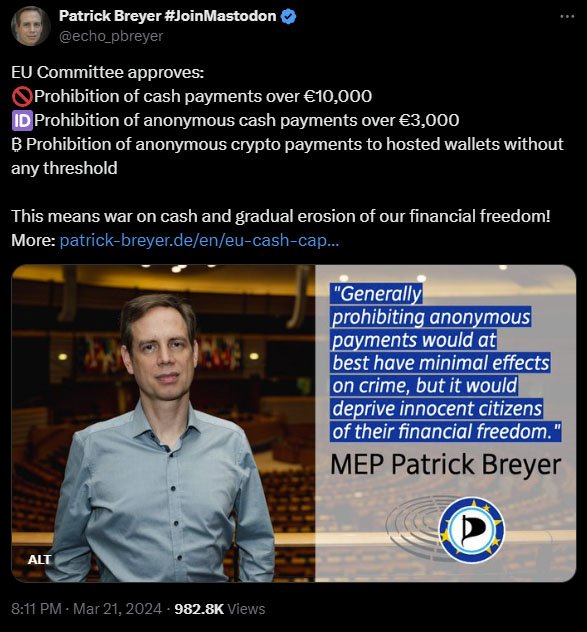

Patrick Breyer, a member of the European Parliament, expressed concerns about the impact of these regulations on individual freedoms. He emphasized the importance of anonymity in financial transactions, stating:

“Generally prohibiting anonymous payments would at best have minimal effects on crime, but it would deprive innocent citizens of their financial freedom […] We also have the right to be able to pay and donate in cryptocurrencies online without our payment behavior being recorded for no reason and personally. If the EU believes it can regulate virtual currencies on its own, it has not understood the global internet.”

Impact on Financial Privacy

The new regulations have raised concerns about financial privacy and autonomy. Critics argue that the ban on anonymous transactions could disproportionately affect law-abiding citizens while doing little to deter criminal activities.

Related reading: Blockchain Forensics: Balancing Crime and Privacy Rights

German Member of the European Parliament (MEP) Patrick Breyer highlighted the potential consequences of increased surveillance. He noted that increased monitoring of financial transactions may unintentionally aid hackers and infringe on personal liberties:

“This EU war on cash will have nasty repercussions! For thousands of years, societies around the world have lived with privacy-protecting cash. With the creeping abolition of cash, there is a threat of negative interest rates and the risk of banks cutting off the money supply at any time. Dependence on banks is increasing at an alarming rate. This kind of financial disenfranchisement must be stopped.

More than 90% of responding citizens spoke out against such a step. Respondents considered paying anonymously in cash an “essential personal freedom” and that restrictions on payments in cash are ineffective in achieving the potential objectives.”

Resistance and Opposition

Despite the EU’s efforts to combat money laundering, there has been considerable resistance to the new regulations. MEPs like Patrick Breyer and Gunnar Beck have voiced opposition, citing concerns about violations of financial privacy and autonomy.

Breyer emphasized the need to find a balance between safety and individual liberties, stating:

“We need to find ways to bring the best features of cash into our digital future.”

Implementation and Timeline

The new regulations are expected to be fully implemented within three years from their entry into force. However, there are suggestions that their implementation might occur sooner, indicating a swift response to the perceived threat of money laundering through digital asset transactions.

Dillon Eustace, an Irish law firm, expects the legislation to become fully operational earlier than anticipated, signaling a rapid change in the digital assets landscape.

Patrick Hansen, Circle’s Director of Research and Policy, clarified that self-custody wallets and their transactions remain unaffected by the ban. Furthermore, peer-to-peer transfers are specifically exempted from the regulatory measures.

He stated:

“Paying with crypto (for example to merchants) with a non KYC’d self custody wallet will be more difficult/banned depending on the merchants set up. This change, as well as the lower thresholds for anonymous cash payments, has unfortunately been agreed months ago.”

Impact on Broader Digital Asset Community

The digital asset community has expressed mixed reactions to the EU’s regulatory measures. While some acknowledge the necessity of anti-money laundering laws, others fear an overreach that could stifle innovation and hinder widespread adoption of bitcoin.

Daniel “Loddi” Tröster, host of the Sound Money Bitcoin Podcast, highlighted the practical challenges introduced by the legislation. He pointed out the potential hindrance to personal financial privacy and the broader application of digital assets within the EU.

Conclusion

The EU’s implementation of stricter regulations on digital asset transactions reflects its commitment to combating money laundering and ensuring financial transparency. However, these regulations have sparked debate regarding their impact on financial privacy and individual freedoms. As the digital assets landscape continues to evolve, finding a balance between regulatory oversight and innovation remains a key challenge for policymakers and stakeholders alike.