The rapid growth of digital assets has brought them to the forefront of economic and regulatory discussions worldwide. In the United States, President Joe Biden’s Executive Order 14067, titled “Ensuring Responsible Development of Digital Assets,” aims to address the multifaceted implications of this emerging technology while fostering responsible innovation.

Promoting Responsible Innovation

The order recognizes the potential benefits of digital assets, including their ability to expand access to financial services, reduce transaction costs, and promote innovation.

“We must promote access to safe and affordable financial services. Many Americans are underbanked and the costs of cross-border money transfers and payments are high. The US has a strong interest in promoting responsible innovation that expands equitable access to financial services, particularly for those Americans underserved by the traditional banking system […]. The United States also has an interest in ensuring that the benefits of financial innovation are enjoyed equitably by all Americans and that any disparate impacts of financial innovation are mitigated.”

The claimed order’s overarching goal is to ensure the responsible development and implementation of digital asset technologies, focusing on privacy, security, and defense against illicit exploitation. It emphasizes coordination among relevant agencies, such as the Federal Reserve, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC), to effectively address these issues.

Addressing Consumer Protection and Financial Stability

The order highlights the importance of protecting consumers from fraud, manipulation, and predatory practices in the digital asset ecosystem. It directs relevant agencies to assess and address potential risks to consumers, including information security, data privacy, and market integrity.

Furthermore, the EO emphasizes exchanges and issuers of digital assets, which are increasingly larger and more complex, must act in compliance with the regulatory framework, “in line with the general principle of ‘same business, same risks, same rules.’”

“Some digital asset trading platforms and service providers have grown rapidly in size and complexity and may not be subject to or in compliance with appropriate regulations or supervision. Digital asset issuers, exchanges and trading platforms, and intermediaries whose activities may increase risks to financial stability, should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of “same business, same risks, same rules.””

Combating Illicit Finance and National Security Risks

The order states that digital assets can be used for illicit activities such as money laundering, terrorism financing, and tax evasion. It directs agencies to implement a coordinated action plan to address these risks, including enhanced compliance with Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) obligations.

“We must mitigate the illicit finance and national security risks posed by misuse of digital assets. Digital assets may pose significant illicit finance risks, including money laundering, cybercrime and ransomware, narcotics and human trafficking, and terrorism and proliferation financing. Digital assets may also be used as a tool to circumvent United States and foreign financial sanctions regimes and other tools and authorities.”

This section, which appears to be the foundation of the narrative promulgated by U.S. Senator Warren and her recent bill, completely ignores the numerous studies published during this year, which widely document that, given the transparency provided by Distributed Ledger Technology (DLT), it is extremely difficult to carry out illicit operations in a secret manner using the blockchain, and that the vast majority of illegal trafficking in the world is carried out using traditional payment channels and Fiat currencies, in particular the United States Dollar.

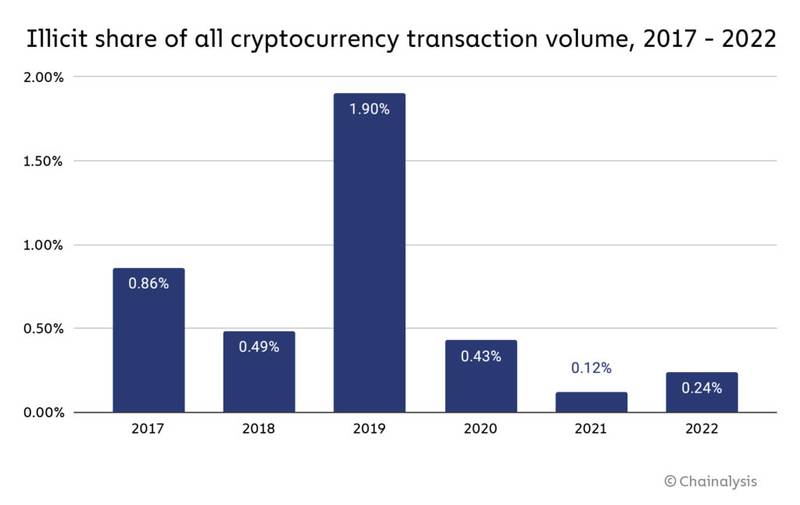

While it is true that there has been an increase in illicit transactions carried out with digital assets in the past, the percentage on the total is so minimal to raise the suspicion, or to justify the extreme attention paid to this topic.

Chainalysis reports state:

“Overall, the share of all cryptocurrency activity associated with illicit activity has risen for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022,”

The order also emphasizes the need to protect national security interests from potential misuse of digital assets, such as cyberattacks, cyber espionage, and the financing of foreign adversaries.

Central Bank Digital Currencies (CBDCs)

The order places a strong emphasis on the role of sovereign currencies, the U.S. Dollar, in a well-functioning financial system. It acknowledges the possibility of developing a Central Bank Digital Currency (CBDC) and directs the Federal Reserve to conduct research and development on its potential design and deployment options.

“Sovereign money is at the core of a well-functioning financial system, macroeconomic stabilization policies, and economic growth. My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC. These efforts should include assessments of possible benefits and risks for consumers, investors, and businesses; financial stability and systemic risk; payment systems; national security; the ability to exercise human rights; financial inclusion and equity; and the actions required to launch a United States CBDC if doing so is deemed to be in the national interest.”

It remains doubtful how in practice the development of a CBDC will adapt to the principles of respect for privacy and human rights to which the executive order appeals.

As the regulatory body develops, it will be increasingly crucial to demand transparency regarding the functioning of this highly controversial technology, in order to avoid the creation of yet another state surveillance tool.

It would be perfectly legitimate for people of the nations to be concerned, and to request that the code be made open source, in order to give anyone the opportunity to determine whether an instrument is compatible with the right to privacy of the individual.

Bitcoin offers virtually absolute transparency, and this will be a factor that a sovereign currency will struggle to offer.

Executive Order 14067: Conclusion

Executive Order 14067 represents a significant step towards establishing a comprehensive framework for regulating digital assets in the United States. It tries to recognize the potential benefits and risks of these technologies and claims to promote responsible innovation while protecting consumers, financial stability, and national security interests.

Noteworthy is the fact that in Section 9, dedicated to the definition of the various technical terms, an explanation of the words “blockchain”, “CBDC”, “cryptocurrencies”, “digital assets”, and “stablecoins” is provided, without the word “Bitcoin.” One would think the very innovation that gave birth to the entire industry, should be mentioned at least once throughout the entire text.

As the digital asset industry continues to evolve, the U.S. administration and relevant regulatory bodies will need to carefully balance the need to foster innovation with the need to address potential risks. The order provides a foundation for this dialogue, but it remains to be seen how the regulatory landscape will develop in the coming years.