The Financial Accounting Standards Board (FASB), the entity responsible for establishing accounting standards for financial reporting within the United States, has officially adopted “Fair Value Accounting” for Bitcoin, allowing corporations to recognize “fair value” changes in their BTC holdings. This new FASB Bitcoin rule can potentially encourage corporations to adopt Bitcoin as a treasury reserve asset.

New FASB Bitcoin Rule

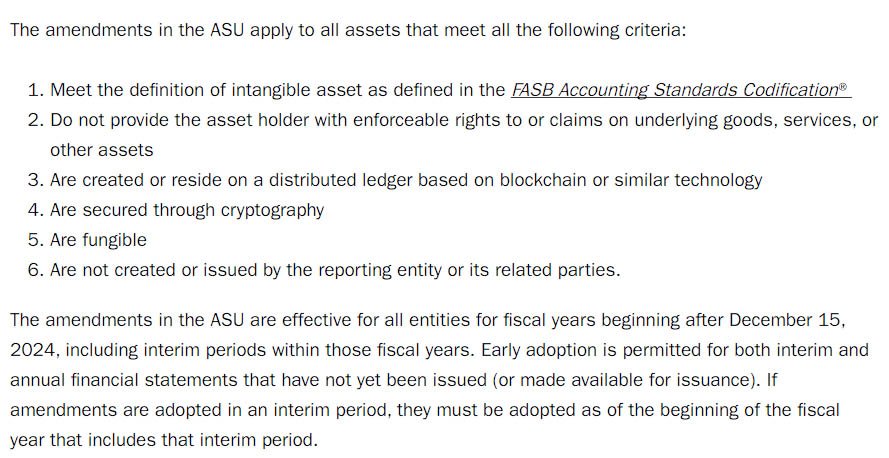

As per a publication by the FASB, corporate entities will be able to provide information on their Bitcoin holdings more efficiently for fiscal years beginning after December 15, 2024. The recognized organization by the U.S. Securities and Exchange Commission finalized the updated rules on December 13.

“Accounting for only the decreases, but not the increases, in the value of crypto assets in the financial statements until they are sold does not provide relevant information that reflects (1) the underlying economics of those assets and (2) an entity’s financial position,” the document stated.

Importance of New Rules

Under current rules, all companies operating in the United States and holding Bitcoin on their balance sheets are required to report a loss if the digital asset they hold is worth less than the purchase price, irrespective of whether they have sold it or not.

However, under the new rules, companies will be required to report the fair value, cost basis, and types of assets they’re holding. The document from the FASB states that stakeholders provided crucial feedback to the FASB regarding the existing rulebook, adding that the existing guidance did not provide useful information for investors or other parties.

“Stakeholders’ feedback, including respondents to the 2021 FASB Invitation to Comment (ITC), Agenda Consultation, indicated that improving the accounting for and disclosure of crypto assets should be a top priority for the Board,” the document read. “Nearly 500 respondents to the 2021 ITC requested that the Board add to its agenda a project related to crypto assets.”

New Standards will Increase the Adoption of BTC

According to Bitcoin enthusiast Michael Saylor, the founder and former CEO of MicroStrategy, the largest corporate holder of Bitcoin, the ASU (Account Standards Update) will “facilitate the adoption of $BTC as a treasury reserve asset by corporations worldwide.”

Corporates will be able to easily reveal information regarding contractual sales, specific holdings, and changes in net income from their Bitcoin holdings. Saylor believes that with the introduction of these new rules, more corporate entities will include BTC on their balance sheets as the popularity of the digital asset continues to surge.

Notably, companies like MicroStrategy, Coinbase, and others will also benefit greatly from these rules. David Marcus, the former President of PayPal and co-founder and CEO of Lightspark, an interoperable payment network, shared an optimistic view on the new rules, stating that 2024 will be an important year for Bitcoin.

He added:

“You may think this is a small accounting change that doesn’t mean much. It’s actually a big deal. This removes a large obstacle standing in the way of corporations holding Bitcoin on their balance sheets. 2024 will be a landmark year for BTC.”