Changpeng Zhao (CZ), former CEO of Binance, faces repeated setbacks in his attempts to travel outside the United States before his scheduled sentencing in February. U.S. District Court Judge Richard Jones rejected Zhao’s multiple motions seeking permission to visit the United Arab Emirates (UAE), where his family resides.

Former CEO of Binance: Legal Battles and Flight Risks

The court’s decisions stemmed from concerns about Zhao being a potential flight risk due to his considerable wealth and the absence of an extradition treaty between the U.S. and the UAE. He pled guilty to violating the Bank Secrecy Act, as part of a $4.3 billion deal involving Binance and U.S. authorities.

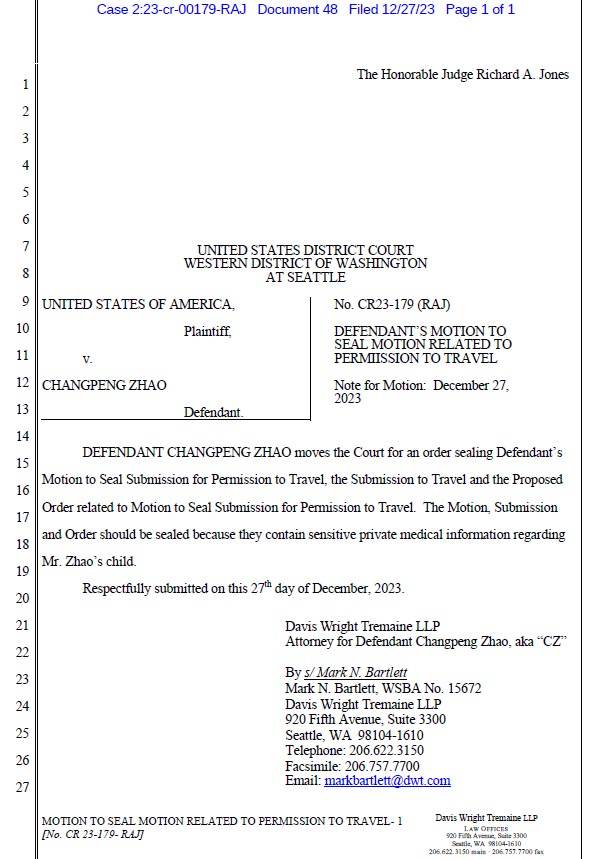

Judge Jones sealed the details behind Zhao’s travel requests, with CZ’s legal team hinting at the inclusion of medical information regarding Zhao’s child. Despite efforts to argue against travel restrictions, the court upheld its decision, marking the second instance Zhao’s travel bid was denied.

Legal Turmoil and Financial Impact

Despite the legal battles, Zhao’s wealth surged by approximately $25 billion in 2023, catapulting his net worth to over $37 billion, that makes him currently the 42nd richest person globally, according to the Bloomberg Billionaires index. This growth occurred amidst the turbulence surrounding his guilty plea and impending sentencing.

Changpeng Zhao, former Binance CEO, faces travel restrictions despite being on a $175 million bond. In contrast, former Celsius CEO Alex Mashinsky, accused of misleading users, secured a $40 million bond. Sam Bankman-Fried, ex-FTX CEO, initially used his parents’ residence in California as part of a $250 million bond post-extradition. However, he faced remand after allegations of witness intimidation emerged in 2022. These varied bond scenarios highlight the complex legal journeys of prominent digital asset figures.

Binance’s Regulatory Challenges

Binance, a major player in the digital asset market, faced scrutiny for lapses in compliance measures, allowing misuse of the platform for illicit activities. This highlighted regulatory concerns about money laundering and inadequate know-your-customer (KYC) protocols.

Zhao’s case mirrors broader regulatory efforts to establish control in the decentralized digital asset markets. Governments globally, especially in the U.S., are intensifying efforts to enforce Anti-Money Laundering (AML) and KYC protocols in this traditionally unregulated sector.

Impact on Digital Asset Exchanges

The outcome of Zhao’s legal proceedings could significantly influence the future operations and regulations of digital asset exchanges worldwide. It raises crucial questions about balancing innovation in decentralized finance with compliance within established financial frameworks.

CZ’s situation epitomizes the challenges faced by international business leaders in rapidly evolving Bitcoin markets. The clash between innovation and regulatory compliance underscores the complexities of navigating emerging technological territories.

Broader Regulatory Pressures

As Changpeng Zhao’s legal saga continues, the implications of his case extend beyond personal legal battles. They encompass the evolving landscape of digital asset regulation, the future of decentralized finance, and the intricate balance between innovation and regulatory adherence in emerging markets.

This legal showdown signifies a pivotal moment not only for CZ and Binance but for the broader digital asset industry, prompting reflections on the future of decentralized systems within a market that has been mostly unregulated.