In the latest development in SBF trial, an FTX and Alameda transfer of $10.5 million sparked controversy in the digital asset community.

The firms made significant digital asset transfers worth $10.5 million to Binance, Wintermute, and Coinbase. These transfers, involving multiple addresses, have raised speculation in the community.

FTX and Alameda Transfer

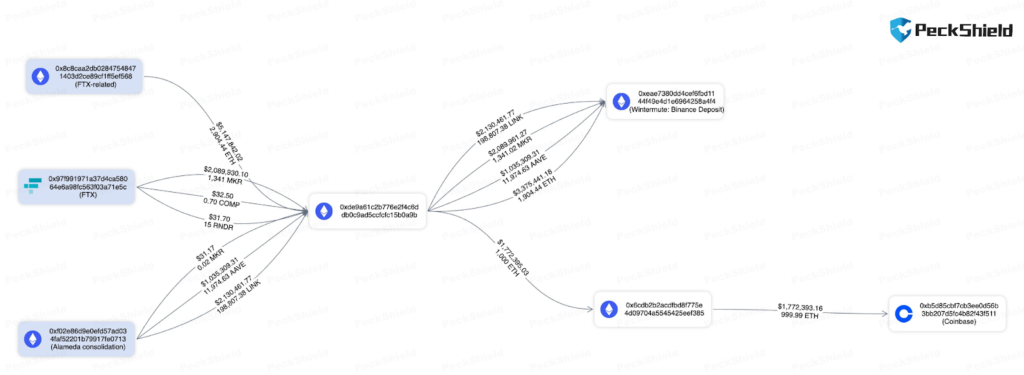

On October 24, FTX and Alameda started transferring digital assets to an address tagged as 0xde9. A few hours later, they moved these funds to another address, 0xEae, which has been reportedly identified as a Wintermute-hosted Binance deposit address, according to blockchain analytics firm Nansen.

PeckShield, another renowned blockchain analytics firm, also shared on-chain data from these transactions. It reveals that the moved digital assets include $5.18 million in Ether (ETH), $2.2 million in Chainlink (LINK), $1 million in Aave (AAVE), and $2 million in Maker (MKR), totaling around $10.5 million.

These movements coincide with the trial of the firm’s former CEO Sam Bankman-Fried in the United States, creating questions about their timing and intent.

While Nansen clarified that it does not track off-chain movements, it suggested that the substantial transfers may signal asset sales or preparations for such actions. Notably, FTX gained court permission in September to sell its digital asset holdings with a weekly limit of $100 million.

Three Bidders Seeking to Restart FTX

On an interesting note, investment banker Kevin Cofsky from Perella Weinberg Partners revealed in a court hearing that the firm has been receiving multiple bids for a potential restart. He stated that at least three bidders are actively pursuing the acquisition of the exchange, which, at its peak, handled tens of billions of dollars in daily trading volume.

The decision regarding FTX’s future is expected to be reached by mid-December, pending approval from the Delaware bankruptcy court. Cofsky’s testimony played a crucial role in securing the confidentiality of FTX’s over 9 million users.

Cofsky explained that they have narrowed down the selection of potential partners in what they refer to as the “second round” of the exchange. He stated:

“I am optimistic that we will have either a plan for a reorganized exchange, a partnership agreement, or a stalking horse for a sale on or prior to the December 16 milestone date.”

Meanwhile, the new CEO, John J. Ray III, has criticized FTX’s financial controls and proposed a plan that could potentially see 90% of the estate’s assets returned to creditors. So far, administrators have been successful in recovering around $7 billion in assets, including $3.4 billion in digital assets. Investors are closely watching this development, as it signals a potential resurgence for the troubled exchange.

Related reading: