FTX, the digital asset exchange that collapsed in November 2022, is set to repay its customers in full and even offer additional compensation. This fresh FTX bankruptcy news comes as a welcome relief to those affected by the exchange’s downfall.

According to reports from various sources, including court filings and statements from FTX itself, the exchange has amassed enough funds to cover the losses incurred by its customers.

Estimates suggest that FTX owes creditors around $11 billion, but the company has between $14.5 billion and $16.3 billion to distribute, leaving a surplus even after full repayments.

FTX CEO John J. Ray III expressed satisfaction with the proposed repayment plan, stating:

“We are pleased to be in a position to propose a chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors.”

FTX Bankruptcy: Repayment Plan

The repayment plan, which is still subject to court approval, outlines that creditors with claims below $50,000 will receive a 118% compensation. This means that almost all customers will not only get their money back but also receive additional funds.

Attorney Andrew Dietderich said: “The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in the dumpster were simply too high.”

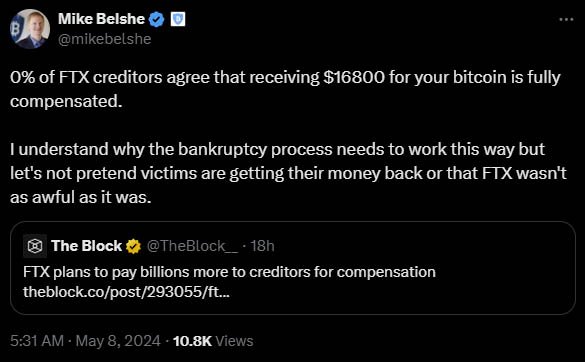

However, some critics argue that the plan falls short of fairness.

They highlight that the compensation is based on the value of assets at the time of FTX’s bankruptcy in 2022, rather than current market prices. Since then, the digital asset markets have seen a significant resurgence, with bitcoin alone rising by nearly 280%.

Mike Belshe, CEO of BitGo, expressed dissatisfaction with the proposed plan, stating, “I understand why the bankruptcy process needs to work this way, but let’s not pretend victims are getting their money back.”

FTX’s ability to raise funds for repayment is attributed to various factors. The exchange sold off a diverse collection of assets, including venture investments and litigation claims. Notably, FTX managed to monetize assets held by Alameda Research, a sister company central to the exchange’s collapse.

The company stated:

“FTX has achieved this recovery level by monetizing an extraordinarily diverse collection of assets, most of which were proprietary investments held by the Alameda or FTX Ventures businesses, or litigation claims.”

The reorganization plan aims for a “centralized distribution,” ensuring that all FTX customers and creditors affected by the collapse receive compensation, regardless of the location of their assets. Repayments are scheduled to occur within 60 days after the plan’s effective date.

FTX’s collapse in 2022 was marked by fraudulent activities and mismanagement by its executives.

Founder and former CEO Sam Bankman-Fried was convicted on multiple criminal counts related to defrauding customers and investors. The collapse of FTX left many questioning the integrity of the digital asset exchange industry.

FTX said in a press release:

“Accordingly, the Debtors have not been able to benefit from the appreciation of these missing tokens during the chapter 11 cases. Instead, the Debtors have had to look to other sources of recoverable value to repay creditors.”

Despite the challenges, FTX’s current management, led by John J. Ray III, remains committed to addressing the fallout from the exchange’s demise. Ray stated that attempts to relaunch FTX were deemed unfeasible due to high costs and risks involved.

Ray, drawing from his extensive 40-year legal and restructuring background, conveyed astonishment at the lack of corporate controls and reliable financial data, describing it as an unprecedented failure. He emphasized that such circumstances were unheard of even in the context of bankruptcy.

Former customers of FTX have criticized the decision not to relaunch the exchange. However, Ray defended the decision, stating that serious investors were unwilling to provide adequate proposals.

Ray added that serious investors were unwilling to offer significant value due to factors like costs, delays, and other considerations. Additionally, there were no substantial bids for intellectual property since the code is outdated and the brand is associated with fraud.