Bankrupt digital asset exchange FTX creditors were surprised as debtors recently disclosed their estimated U.S. dollar values for digital asset prices. These numbers tend to be a lot lower than today’s prices, triggering a wave of criticism within the community.

The revelation came through a filing on December 27 in the United States Bankruptcy Court for the District of Delaware, where FTX debtors sought a “fair and reasonable value” for customer claims based on digital assets when Sam Bankman Fried’s exchange collapsed in November last year.

Related reading: Binance Launches Speculative Attack Against FTX, And Wins

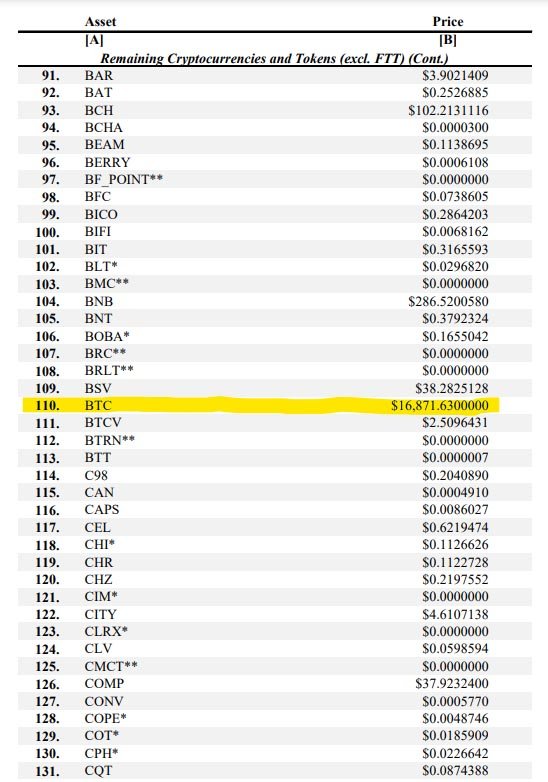

The proposed valuations cover a diverse range of approximately 500 assets in both fiat and digital assets, reflecting the values at the time of FTX’s bankruptcy filing. While an estimated FTX Token (FTT) price was excluded from this list, the proposal encompassed valuations for leveraged tokens, tokenized stocks, spot derivatives, and digital asset futures. Notably, the proposal suggests that Bitcoin claimants could potentially receive $16,871 per coin.

The filing emphasizes the court’s broad discretion in choosing a methodology to estimate claim valuations based on digital assets. It states:

“This Court has broad discretion to choose whatever method it deems best-suited to the particular circumstances to estimate the valuation of Claims based on Digital Assets. Courts consider all factors and circumstances surrounding the claims, but do not seek to estimate claims with mathematical precision.”

The proposed plan outlines a strategy for calculating claims in respect of digital assets by converting their value into cash as of the petition date, using rates from the Digital Assets Conversion Table, and making distributions in cash.

FTX Creditors in Shock: Community Reacts

To estimate digital asset prices, the debtors relied on data from Coin Metrics, a reputable source in the digital asset industry. However, this motion has not been well received by FTX creditors, including Sunil Kavuri, who lost $2.1 million in the collapse, expressing dissatisfaction. Kavuri highlighted that the motion significantly undervalues digital assets and urged creditors to fight back.

It is important to note that clients who disagree with the motion are required to submit objections by January 11, with a hearing on this matter scheduled for January 25. The proposed plan has also faced objections on social media platforms like X, where users claiming to be former FTX users displayed strong criticism. Customers of the defunct exchange’s clients have been unable to access their funds since November 2022, leading some to sell their claims to third parties at reduced values.

Controversial Proposal

The controversy surrounding the proposed plan becomes even more pronounced as digital asset holders risk missing out on gains from certain price surge. With Bitcoin’s price shooting up over 150% since FTX’s collapse to over $42,000, the stakes are high for the community.

Despite the severely low value proposed by debtors, many FTX creditors want to settle the matter down and accept what the debtors are offering. One X user stated:

“What a scam, honestly. BUT instead that the whole thing goes for another 10 years with unknown outcome and more billions in lawyer costs. I would rather take what they offer and multiply it in the market.”

The court’s decision on the pending motion will undoubtedly shape the future landscape for FTX creditors and the broader digital asset market.