Sam Bankman-Fried’s bankrupt digital asset exchange FTX, along with its debtors, are seeking the green light from the United States bankruptcy court in Delaware to sell the trust assets from Grayscale and Bitwise. FTX selling assets worth around $744 million is set to be managed through an investment adviser, as detailed in a November 3 court filing.

The proposed sale or transfer of these trust assets is aimed at preparing for forthcoming dollarized distributions to creditors. According to the filing, this would “allow the debtors to act quickly to sell the trust assets at the opportune time.” It reads:

“Additionally, because the Debtors may sell the Trust Assets to one or more buyers in one or more sales, sales pursuant to the Sale Procedures will alleviate the cost and delay of filing a separate motion for each proposed sale.”

Notably, a trust asset provides a means for investors to gain exposure to digital assets without direct ownership. In general, it plays an important role in facilitating digital asset investments with strong security and oversight.

FTX Selling Assets: Grayscale and Bitwise Trust

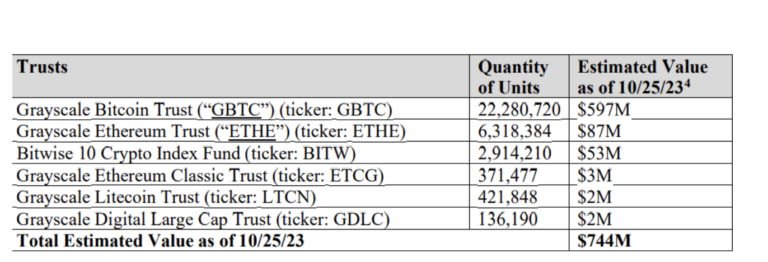

These trust assets consist of five Grayscale Trusts and a Bitwise-managed trust, worth around $691 million and $53 million as of October 25, respectively.

According to the debtors, the sale of trust asset funds would help in proactively mitigating the risk of price fluctuations and preserving the value of these trust asset funds. This would ensure maximum returns to creditors and support an equitable distribution of funds in the debtor’s plan of reorganization, reads the court filing.

Interestingly, the debtors have also proposed establishing a pricing committee with representation from all stakeholders to enhance transparency and fairness. The proposal states that this will enable multiple perspectives in deciding the best timing and conditions for asset sales.

According to the filing, the investment adviser will be required to obtain at least two bids from different counterparties before finalizing asset sales. This would foster a competitive environment benefiting the estate, creditors, and the broader digital asset community.

The Downfall of Sam Bankman-Fried and FTX

FTX, once a major player in the digital asset world, declared bankruptcy in November last year. Its downfall was triggered by revelations of misappropriation of customer funds, notably through its sister company’s hedge fund, Alameda Research LLC.

Recently, FTX founder Sam Bankman-Fried was found guilty of defrauding customers and lenders. A sentencing date has been provisionally set for March 28, 2024, potentially resulting in a lengthy prison term.

It is important to note that the bankruptcy court had previously approved FTX’s request for the sale of around $3.4 billion in digital assets. At the time, the court implemented measures to avoid market disruption by selling digital assets with a limit of $50 million each week. In the following week, that limit was increased to $100 million.

Notably, Mike Novogratz investment firm, Galaxy Digital, had been appointed as FTX’s investment manager to help sell off the company’s remaining digital assets.