In a recent development, Genesis, a bankrupt digital asset lending firm, has formally petitioned a United States Bankruptcy Court for an approval to sell its assets, including more than 30 million Grayscale Bitcoin Trust (GBTC) shares currently held in Gemini Earn program.

This move comes as the exchange aims to expedite its exit from bankruptcy and ensure a faster repayment process for creditors.

GBTC, recently transformed into a spot Bitcoin Exchange-Traded Fund (ETF) following SEC approval, holds around 3.2% of the total circulating Bitcoin. Notably, GBTC shares constitute a significant portion of Genesis’ assets, comprising around 87% of the company’s total shares across three Grayscale trusts, with a value of $1.38 billion.

Motivation for Asset Sale

Genesis, in its filing, emphasized the urgency of obtaining approval for the sale, citing the need to mitigate potential risks associated with price fluctuations in the underlying assets of the GBTC.

The firm aims to capitalize on the sale to maximize capital for creditors and facilitate a swift exit from bankruptcy. The filing states:

“The Debtors believe it would be beneficial to have the authority to sell and liquidate the Trust Assets to reduce any risk that fluctuations in price might have on the Debtors’ estates and to facilitate distributions to creditors.”

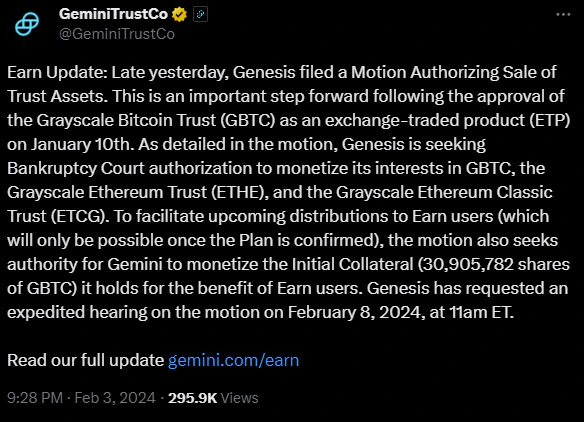

Moreover, the lending firm filed a separate motion seeking a shortened timeline for relevant deadlines, intending to present the sale motion at the next bankruptcy court hearing scheduled for February 8.

Involvement of Gemini Earn and Pending Legal Issues

The GBTC shares earmarked for sale were initially collateralized by Genesis and subsequently transferred to Gemini as part of the Gemini Earn program.

The motion seeks authority for Gemini to monetize this Initial collateral, comprising 30,905,782 GBTC shares, held for the benefit of Earn users. This collateral, initially pledged to Gemini, has become a subject of legal dispute.

Gemini, in response to the filing, emphasized its cooperation and highlighted the significance of the asset sale following the SEC’s approval of GBTC as an Exchange-Traded Product (ETP). The company announced its intentions to utilize the sale proceeds for the benefit of Earn users.

Earlier this week, Genesis agreed to pay a $21 million fine to the SEC, derived from remaining funds post-bankruptcy, settling a lawsuit related to the operation of the Gemini Earn program. Notably, Gemini had previously filed a lawsuit against Genesis, asserting that the bankrupt firm lacked rights to GBTC shares used as collateral for loans via the Earn program.

Ongoing Legal Tensions

The legal saga involving Gemini, Genesis, and Digital Currency Group (DCG) continues, with DCG being the parent company of both firms. Cameron Winklevoss, co-founder of Gemini, had previously issued a warning about a lawsuit against DCG in January 2023, alleging harm to Earn users and others duped by Genesis.

As both firms navigate the complexities of the bankruptcy proceedings, the request for court approval to sell these substantial GBTC assets reflects the strategic move to secure liquidity and expedite creditor repayments.