Digital asset investors in the United States are getting clearer guidelines on how to report their digital asset transactions to the Internal Revenue Service (IRS). The recently released draft forms by the IRS has details on how brokers should report digital asset transactions, raising both eyebrows and concerns within the industry.

Digital Asset Tax: What the Draft Forms Entail

The IRS has long been grappling with the taxation of digital asset, and now it’s taking steps to bring more clarity to the process. The draft forms, released by the agency, outline how brokers should report transactions involving digital assets.

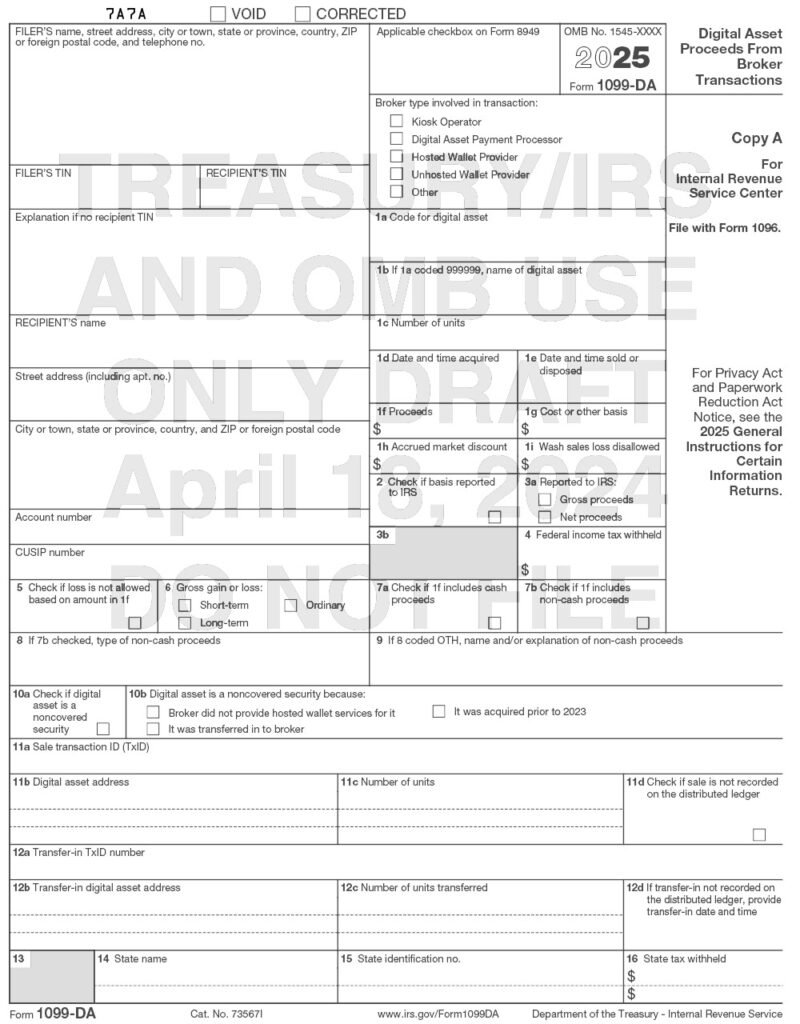

The draft form 1099-DA, shed light on how digital asset transactions should be reported. Brokers, including various entities such as kiosk operators, digital asset payment processors, and wallet providers, are required to report proceeds from digital asset dispositions to both taxpayers and the IRS.

The form asks for crucial details such as token codes, wallet addresses, and blockchain transaction IDs. This detailed reporting is aimed at improving transparency and compliance within the digital assets space.

The IRS noted in the 2023-38 bulletin:

“With third party information reporting that specifically identifies digital asset transactions, the IRS could more easily identify taxpayers with digital asset transactions that are otherwise difficult to discover.”

The following instructions were provided alongside the document, which displays a date of 2025:

“Brokers must report proceeds from (and in some cases, basis for) digital asset dispositions to you and the IRS on Form 1099-DA,”

“If you received a Form 1099-DA, you generally sold, exchanged, otherwise disposed of a financial interest in a digital asset and should check the ‘Yes’ box next to the question on page 1 of Form 1040.”

“You may be required to recognize gain from these dispositions of digital assets.”

Expert Insights

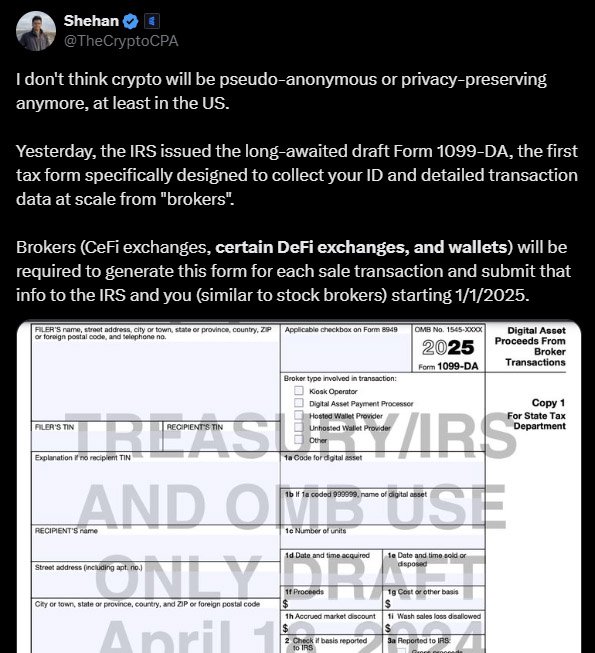

According to the IRS, starting from January 1, 2025, both centralized and specific decentralized exchanges, as well as wallets, will be required to generate form 1099-DA for each sale transaction and submit the information to the IRS and the user, akin to stock brokers.

This form includes standard details like date acquired, date sold, proceeds, and cost basis of digital assets sold. However, there are concerns about the additional data points, especially wallet addresses, being collected and reported to the IRS, which could raise significant privacy and security issues. Experts say in the future, users might need to provide KYC (Know Your Customer) information before creating an unhosted wallet or interacting with platforms via unhosted wallets, potentially altering how users engage with Bitcoin and digital asset platforms.

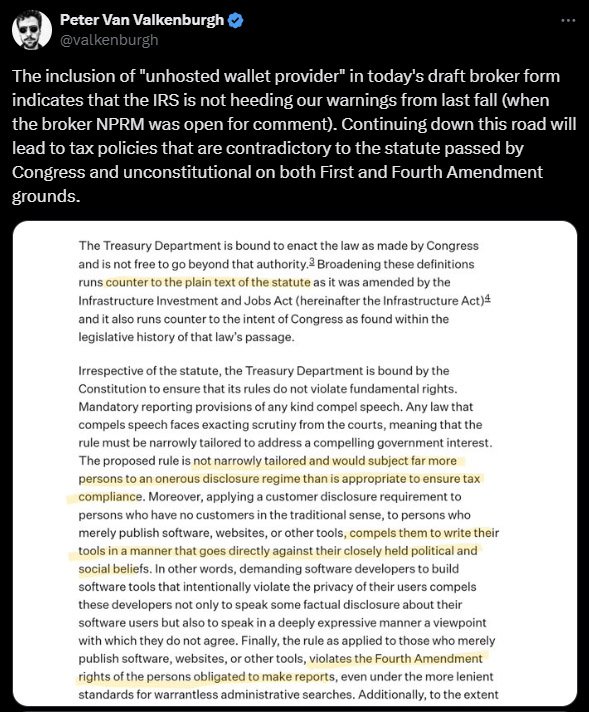

Several experts have weighed in on the implications of these draft forms. Peter Van Valkenburgh, director of research at CoinCenter, shared the news on X, stating that continuation of policies down this road will eventually result in “tax policies that are contradictory to both First and Fourth Amendment.”

Shehan Chandrasekera, head of tax strategy at Cointracker, expressed concerns about the potential privacy and security risks associated with collecting and reporting detailed transaction data, including wallet addresses, to the IRS. Chandrasekera highlighted that while the forms capture essential transaction data, the inclusion of additional information like wallet addresses could raise significant privacy concerns for users.

He stated:

“I don’t think crypto will be pseudo-anonymous or privacy-preserving anymore, at least in the US […] the first tax form specifically designed to collect your ID and detailed transaction data at scale from ‘brokers.’”

The Blockchain Association criticized the rule, stating that they contain “fundamental misunderstandings about the nature of digital assets and decentralized technology.”

Paul Grewal, Coinbase’s legal head, stated the new regulations would establish a “dangerous precedent for surveillance of the everyday financial activities of consumers by requiring nearly every digital asset transaction — even the purchase of a cup of coffee — to be reported.”

Jessalyn Dean, VP of tax info reporting at Ledgible, highlighted wash sales in the form, focusing on internal transactions by digital asset firms. She argued that clarity is needed for non-deductible losses on the form, urging for further guidance on its functionality. She added:

“As expected, the look and feel are similar to the Form 1099-B for reporting sales of traditional financial products […] [The IRS has] packed a lot of lines and boxes into this form.”

In a statement, Tony Tuths, who holds the position of principal overseeing digital assets at KPMG, remarked:

“This may indicate that Treasury is not backing down from its expansive scope definition of ‘broker,'”

Industry Response

The release of the draft forms has sparked mixed reactions within the Bitcoin industry and the broader digital assets sphere. Amy Kalnoki, COO of Bitwave, emphasized the significance of regulatory clarity for blockchain technology adoption. She noted that enterprises are more likely to embrace blockchain technology when there is clear regulatory guidance.

She said:

“Form 1099-DA shows that digital assets are becoming first-class citizens in the financial services industry […] Enterprises will only embrace blockchain technology when there is absolute regulatory clarity.

This will be net-new overhead on everyone in the ecosystem.”

However, there’s likely to be pushback from certain segments of the industry. Coin Center, a blockchain think tank, has raised concerns about the inclusion of providers of unhosted wallets as brokers. They argue that such companies provide tools for users to control their own digital assets and shouldn’t be treated as brokers responsible for reporting transactions.

Challenges Ahead

While the draft forms aim to provide clarity on digital assets’ taxation, they also pose challenges for both brokers and taxpayers. The requirement to report every transaction to the IRS could create significant administrative burdens for brokers, especially those processing large volumes of transactions.

Moreover, the inclusion of certain entities as brokers, such as providers of unhosted wallets, raises questions about the scope of regulatory oversight and the responsibilities of different players within the Bitcoin ecosystem.

Conclusion

The release of draft forms by the IRS marks a significant step towards formalizing the taxation of digital assets in the United States. While the move aims to improve transparency and compliance, it also raises concerns about privacy, security, and regulatory burdens within the industry.

As the IRS continues to accept comments on the draft forms, stakeholders in the industry will be closely monitoring developments to ensure that regulatory requirements does not stifle innovation and freedom.

Overall, the draft forms represent a crucial milestone in the ongoing evolution of digital assets’ regulation, with their finalization expected to shape the landscape of Bitcoin and digital assets taxation for years to come.