Jack Dorsey’s Block, the parent company of Square and Cash App, has found itself under intense scrutiny regarding regulatory compliance.

Federal prosecutors have initiated an investigation into the firm, focusing on alleged compliance failures within its digital asset units. These investigations shed light on potential violations ranging from sanctions evasion to facilitating transactions for terrorist groups.

Jack Dorsey Block: Compliance Lapses Uncovered

The investigations reveal a disturbing pattern of compliance lapses within Block‘s operations. Former employees, acting as whistleblowers, have provided substantial evidence indicating widespread deficiencies in compliance practices.

Documents suggest that Square and Cash App processed thousands of transactions for users from sanctioned countries and even terrorist organizations.

One former employee highlighted the systemic flaws, stating, “From the ground up, everything in the compliance section was flawed.” These lapses extended to inadequate customer information collection and failure to report suspect transactions to the government, as required by law.

The whistleblowers criticized Block’s model of operation, adding:

“It is led by people who should not be in charge of a regulated compliance program.”

Allegations of Sanctions Violations and Terror Financing

The allegations against Block include processing transactions involving countries under U.S. sanctions, such as Iran, Russia, Cuba, and Venezuela.

Additionally, the company purportedly facilitated digital asset transactions for terrorist groups. Such practices raise serious concerns about Block’s adherence to international sanctions and anti-money laundering regulations.

In a series of documents dumped by a former employee, Block’s methods of operation is questioned. One of the documents states:

“Due to the nature of the product, customers do not appear to leave stored balances in Cash App very long, so our ability to block a stored balance or reject funds is limited.

In virtually all situations, balances have been depleted by the time of review.”

Edward Siedle, an ex-lawyer from the Securities and Exchange Commission (SEC) representing the whistleblower, stated:

“It’s my understanding from the documents that compliance lapses were known to Block leadership and the board in recent years.”

Failure to Rectify Compliance Breaches

Despite being alerted to these breaches, Block allegedly failed to take corrective action.

The investigations suggest that the company did not address compliance lapses promptly, allowing questionable transactions to continue unabated. This failure to rectify compliance breaches underscores the severity of the allegations against Block.

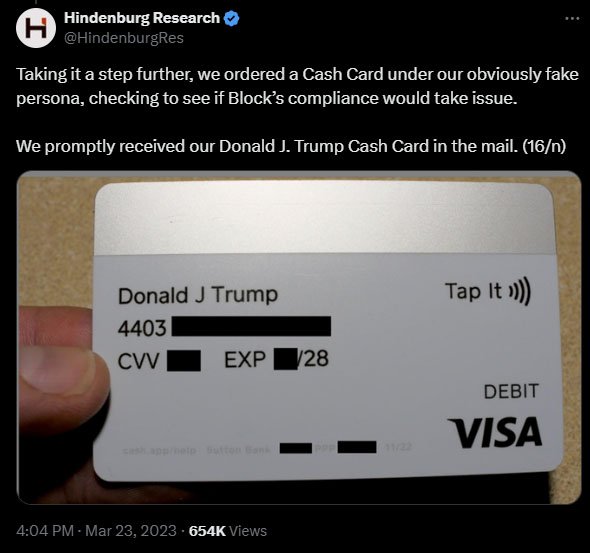

Notably, in March 2023, Hindenburg Research accused Block of lax compliance practices, alleging that it prioritized profits over regulatory adherence, enabling fraud against consumers and authorities.

Hindenburg even created Cash App accounts using public figures’ identities like Elon Musk and Donald Trump, receiving a debit card with Trump’s name. Allegedly, Cash App previously collected only the last four digits of customers’ social security numbers.

It’s worth mentioning that Block’s European counterpart, Verse Payments Lithuania UAB, faced a €280,000 fine in 2021 for widespread money laundering and terrorist financing breaches. Verse apparently mimicked Cash App’s negligent customer verification, allowing anonymous or fictitious accounts.

The Bank of Lithuania’s report criticized Verse for lacking independence in preventing financial crimes, highlighting Block’s flawed oversight. Block eventually shuttered Verse due to underperformance.

Response from Block and Legal Implications

Block has responded to the allegations by asserting its commitment to compliance.

A spokesperson emphasized the firm’s “responsible and extensive” compliance program, highlighting efforts to adapt to emerging threats and regulatory requirements. However, the investigations raise doubts about the effectiveness of Block’s compliance efforts.

The legal implications of these investigations are significant. Federal prosecutors are examining Block’s internal processes, including its digital asset business, guided by information provided by former employees.

If substantiated, the allegations could result in severe penalties for Block, including fines and regulatory sanctions.

Spokesperson noted:

“Block has a responsible and extensive compliance program and we regularly adapt our practices to meet emerging threats and an evolving sanctions regulatory environment.

Our compliance program includes systems, tools, and processes for sanctions screening, as well as investigating and reporting on sanctions issues in accordance with our regulatory obligations.”

Impact on Block’s Operations and Corporate Governance

The investigations have already had repercussions on Block’s operations and corporate governance.

Recent departures from Block’s board of directors, including Lawrence Summers, the former U.S. Treasury Secretary, raise questions about corporate oversight and governance practices.

These developments underscore the broader implications of the investigations for Block’s organizational structure and leadership.

Continued Growth Amidst Regulatory Challenges

Despite the regulatory challenges, Block continues to report significant growth in its Bitcoin business.

Recent financial reports highlight impressive profits from Bitcoin sales via its Cash App platform. However, these successes are overshadowed by the looming regulatory investigations, which threaten to undermine Block’s reputation and market position.

Conclusion

The federal investigations into Jack Dorsey’s Block represent a critical juncture for the fintech company. Allegations of compliance lapses, sanctions violations, and terror financing have cast a shadow over Block’s operations.

As the investigations unfold, Block faces mounting legal and regulatory challenges that could shape the future of the company and the broader Bitcoin industry.

In response to the allegations, Block must demonstrate a commitment to transparency, accountability, and regulatory compliance.