In a display of bipartisan unity, two senators have called upon the Justice Department (DOJ) to reconsider its recent crackdown on a yet another popular Bitcoin privacy service.

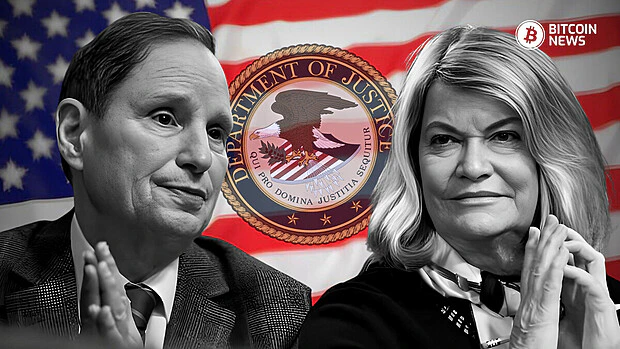

The definition of a “Money Services Business” (MSB) was the topic discussed by Senator Cynthia Lummis (R-WY) and Senator Ron Wyden’s (D-OR) in their letter, publicly urging the DOJ to revise their stance on what constitutes an unlicensed MSB.

Defining a “Money Services Business”

The senators argued that the DOJ’s recent actions, particularly the arrest of the founders of Bitcoin mixer Samourai Wallet, raised concerns about stifling innovation and misinterpreting regulations. The letter, co-authored by Lummis and Wyden, states:

“This interpretation threatens to criminalize Americans offering non-custodial crypto asset software services.”

Samourai Wallet, known for its privacy-enhancing features like CoinJoin transactions, was accused of operating as an unregistered MSB and enabling money laundering.

CoinJoin transactions involve multiple parties combining inputs and outputs, making it difficult to trace the flow of funds on the blockchain. However, Samourai never had direct control over their users’ funds, complicating their legal purview under the Bank Secrecy Act’s definition of “money transmission.”

According to the senators, the DOJ’s interpretation risks stifling innovation by criminalizing developers of non-custodial digital asset software.

They argued that existing definitions of “money transmission” were clear and aimed to prevent unintended consequences, ensuring that entities like internet service providers or postal carriers aren’t inadvertently classified as MSBs.

The crux of the issue lies in the distinction between custodial and non-custodial services. Custodial services involve the service provider controlling users’ funds, while non-custodial services, like Samourai Wallet, allow users to retain control of their private keys.

The senators emphasized that subjecting developers of non-custodial digital asset software to potential criminal liability could undermine confidence in the DOJ’s commitment to the rule of law. Senator Lummis stated on X:

“President Biden’s DOJ steamrolling the longstanding interpretation of FinCEN is legally wrong and threatens to criminalize Bitcoin software development in America.”

However, the DOJ’s stance differs, arguing that a money transmitter need not have actual control of the funds being transferred.

It likens money transmission to data transfer via a USB cable or heat transfer in a frying pan, where the intermediary (i.e. the wallet provider) is viewed as facilitating the transaction without directly controlling the funds.

In April, the DOJ issued a warning to digital asset users about the potential risks of using wallets provided by non-regulated entities that do not adhere to Money Services Business registration and anti-money laundering standards set by U.S. federal law.

The department emphasized that such wallets could lead to financial losses and could face future prosecution.

The clash between privacy-focused bitcoin services and regulatory authorities highlights the ongoing debate over how to regulate the burgeoning digital asset industry. X user Seth For Privacy warns that government may also attack self-custody wallet providers:

“While this government response is not yet enshrined in law or precedent, it paints a much clearer picture of how the state views not only the place of privacy tools, but even that of self-custodial wallet providers moving forward.”

While regulators seek to combat illicit activities, there is a delicate balance to strike between enforcement and fostering innovation.