In yet another development in the long-running Mt. Gox bitcoin repayment saga, the defunct exchange has announced that it will push back its repayment deadline by one more year.

Creditors of Mt. Gox, many of whom have been waiting for nearly a decade to receive compensation, will now have to wait until October 31, 2025 to be fully repaid.

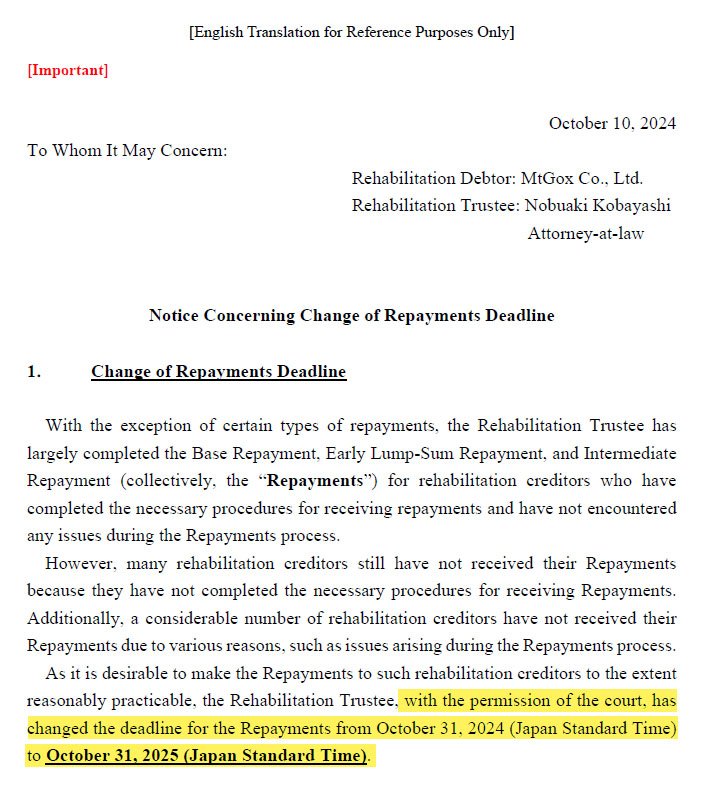

The original deadline was set for October 31, 2024, but this extension marks the second time the repayment date has been postponed.

The delay, according to Mt. Gox, is due to complications in the repayment process. Many creditors have not yet completed the necessary procedures to claim their compensation.

In addition, there have been several logistical issues that have further slowed down the process. The trustee in charge of overseeing the repayment has noted that these problems were significant enough to justify a court-approved extension.

In a statement, Mt. Gox explained the situation:

“Many rehabilitation creditors have not yet received their repayments because they have not completed the required procedures. Additionally, a significant number of creditors have faced various issues during the repayment process and have not received their funds.”

This explanation highlights the complexity of the process. Although many creditors have already received their base, interim, and early lump-sum repayments, a large number of them are still waiting for their payouts due to various procedural and technical difficulties.

Mt. Gox was once the world’s largest bitcoin exchange, handling about 70% of all Bitcoin transactions. In 2014, the exchange collapsed after a massive hack that resulted in the loss of 850,000 bitcoin—valued at approximately $58 billion at today’s prices.

Following the collapse, the exchange filed for bankruptcy, and the long process of compensating creditors began.

In 2023, the exchange had initially set a repayment deadline for October 31, 2023, but that was pushed back to October 31, 2024. Now, with this latest extension, creditors will have to wait an additional year until October 31, 2025, before they can expect full repayments.

Despite these delays, Mt. Gox has made some progress. According to Arkham Intelligence, the exchange still holds 44,905 BTC, valued at around $2.8 billion, which will eventually be used for creditor compensation.

While these delays might be frustrating for creditors, they may actually bring some relief to the broader digital asset market.

Many experts had feared that a large-scale sell-off could occur once Mt. Gox began repaying its creditors, as these individuals would likely convert their bitcoin into cash, creating immense selling pressure.

The postponement has pushed these concerns to 2025, providing the market with some breathing room.

This delay could help maintain market stability in the short term, especially as bitcoin has seen price fluctuations due to a variety of factors.

Bitcoin’s price has been on a rollercoaster in recent months. As of now, it is trading at around $63,126, down from its all-time high of $73,750 in March 2024.

The extension of Mt. Gox’s repayment deadline has added a layer of uncertainty to the market. Some believe that the delay could help prevent a sharp drop in prices, while others are wary of what might happen once creditors finally receive their payments.

Moreover, this delay coincides with increased market volatility due to the upcoming U.S. Presidential Election in November 2024.

Traders are already bracing for increased price swings, with many taking out options to hedge against potential losses or bet on a price hike.

In light of the delays, Mt. Gox has encouraged creditors to complete the necessary steps in the repayment process as soon as possible. Many creditors have yet to fulfill all the requirements to claim their compensation, which has been one of the major factors behind the postponement.

Mt. Gox’s trustee has urged those still waiting to log into the exchange’s Online Rehabilitation Claim Filing System to check their repayment status and resolve any outstanding issues. The system also offers an inquiry form for creditors who need assistance with the process.

The Mt. Gox repayment saga has been ongoing for nearly a decade, and this latest extension only adds to the frustration many creditors feel. However, the extension also provides some relief for the market, which was bracing for a potential sell-off.

For creditors, the next year will be crucial. Those who haven’t completed the necessary procedures will need to do so promptly to avoid further delays.

While Mt. Gox has recovered a significant amount of bitcoin to repay its creditors, the process has been slow and complicated. The new deadline of October 31, 2025, will hopefully mark the final chapter in this long-running case.