After a decade of waiting, former users of the now-defunct digital-asset exchange Mt. Gox may finally see restitution for their lost funds. The exchange, which once dominated the Bitcoin trading market, announced that it will start repaying its creditors in July 2024.

This move marks a significant milestone in a saga that has stretched on for over ten years, involving legal battles, technical delays, and a significant impact on the Bitcoin world.

Mt. Gox was founded in 2010 by Jed McCaleb and later sold to Mark Karpeles, who transformed the platform from a site for trading collectible cards into the world’s largest bitcoin exchange.

At its peak, Mt. Gox handled over 70% of all Bitcoin transactions globally. However, in early 2014, the exchange suffered a catastrophic security breach, losing approximately 850,000 bitcoin, which were worth $450 million at the time.

The hack was the result of multiple unnoticed security breaches between 2011 and 2014.

This massive loss led to Mt. Gox declaring bankruptcy and sparked widespread turmoil in the Bitcoin market. Bitcoin’s price plummeted to below $500 in the immediate aftermath of the exchange’s collapse.

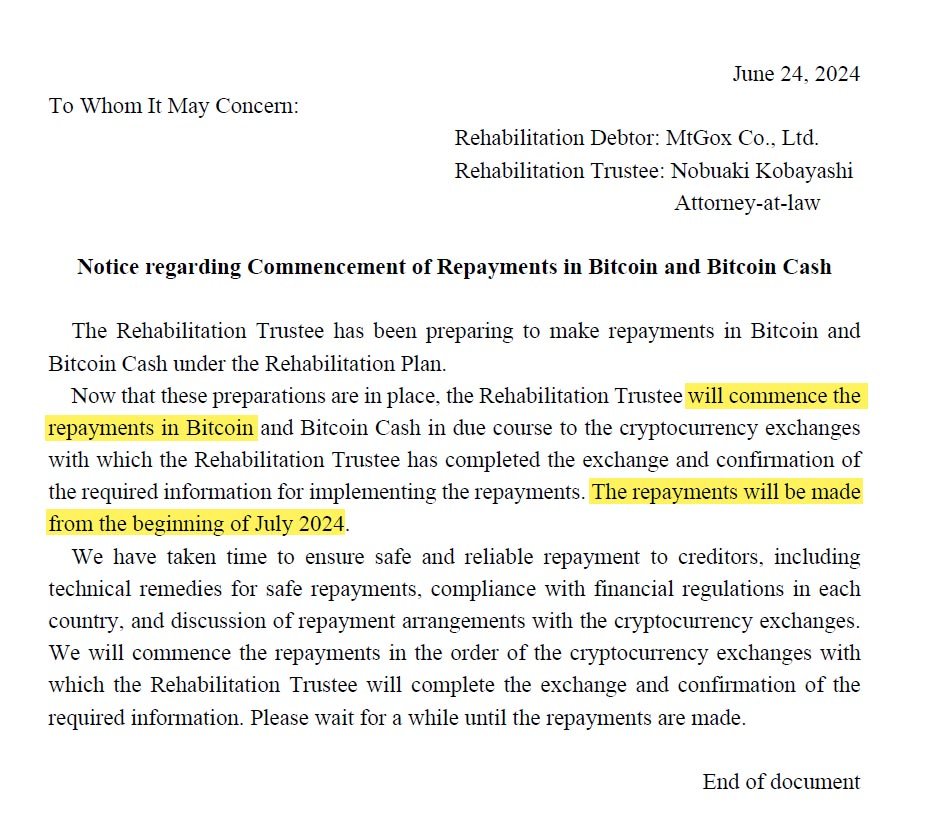

In an announcement, Mt. Gox’s rehabilitation trustee, Nobuaki Kobayashi, confirmed that repayments will commence in July 2024.

The repayments will be made in bitcoin and Bitcoin Cash, the two digital assets that creditors are owed.

Kobayashi emphasized that due diligence and necessary safety measures have been undertaken to ensure that the repayments are conducted securely and reliably.

Repayments will be distributed through various exchanges that have completed the necessary information exchange and confirmation processes with the rehabilitation trustee.

Kobayashi requested users to remain patient, as the order of payments will depend on the progress made by each exchange.

The trustee noted:

“We will commence the repayments in the order of the cryptocurrency exchanges with which the Rehabilitation Trustee will complete the exchange and confirmation of the required information. Please wait for a while until the repayments are made.”

The scale of the repayments is substantial. Mt. Gox creditors are set to receive 142,000 bitcoin, 143,000 Bitcoin Cash, and 69 billion Japanese yen (approximately $432 million).

In total, this amounts to around $9 billion worth of digital assets and fiat money. These repayments are expected to provide long-awaited relief to approximately 127,000 creditors who have been waiting to recover their lost funds since 2014.

While the repayments are a welcome development for creditors, there are concerns about the potential impact on the market.

The distribution of such a large amount of bitcoin could create selling pressure, particularly if early investors decide to liquidate their holdings, which have significantly appreciated in value since their initial purchase.

Related: Could Mt. Gox’s $9B Bitcoin Repayments Shake The Market?

Traders and market analysts are closely monitoring the situation. Some predict that the influx of repaid assets could temporarily depress bitcoin’s price, while others believe that the market has matured enough to absorb the increased supply without significant disruption.

The road to this point has been long and fraught with delays. Legal disputes and technical challenges have repeatedly postponed the repayment process.

Last year, a Tokyo court set a final deadline of October 2024 for the exchange’s civil rehabilitation plan, giving creditors hope that a resolution was finally in sight.

In May 2024, Mt. Gox moved over 140,000 bitcoin, worth around $8 billion, from its cold wallets for the first time in five years.

This significant movement of funds was part of the preparations for the upcoming repayments. The transfer, which was the first on-chain wallet movement since 2019, signaled that the rehabilitation process was progressing.

The collapse of Mt. Gox and its aftermath have been pivotal moments in the history of Bitcoin and the broader digital asset market. The exchange’s failure highlighted the importance of security and regulatory oversight in the rapidly evolving digital currency space.

For many early Bitcoin adopters and Mt. Gox users, the upcoming repayments represent a closing chapter in a long and difficult journey. It is a moment of closure and potential financial recovery for those who endured the uncertainty and loss caused by the exchange’s downfall.