The Mt. Gox Bitcoin exchange, once a dominant player in the Bitcoin space, faced a devastating hack in 2014, resulting in the loss of 850,000 bitcoin. Since then, creditors have been eagerly awaiting reimbursement for their lost funds. Recent updates suggest progress in the Mt Gox payout process, sparking both optimism and caution within the Bitcoin community.

Repayment Plans and Updates

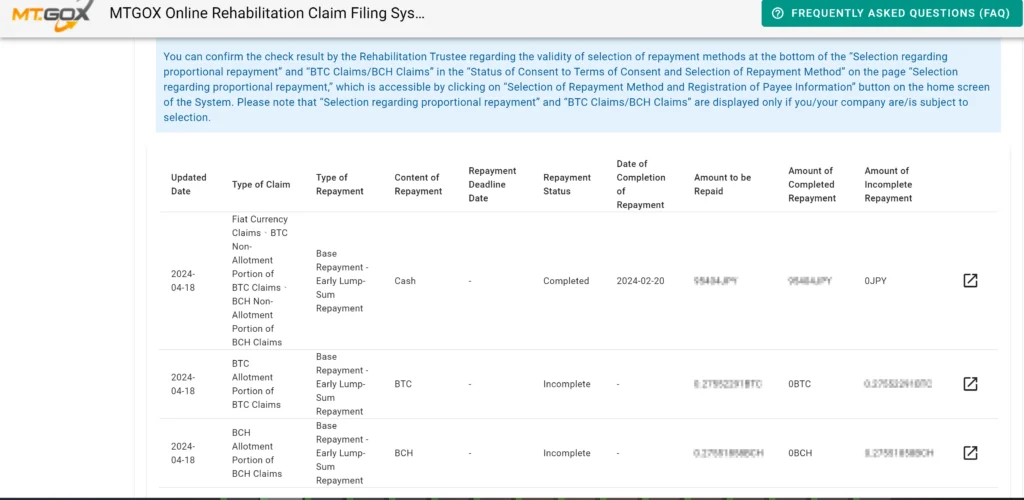

Recent reports indicate significant developments in Mt. Gox’s repayment plans, with users sharing screenshots of their Mt Gox panels, showing sections for Bitcoin and Bitcoin Cash now. The trustee overseeing the bankruptcy proceedings had earlier announced intentions to distribute substantial digital assets, including bitcoin (BTC) and bitcoin cash (BCH), to creditors by October 2024. This update in the platform has been met with mixed reactions among creditors and the broader digital asset community.

A Reddit user stated:

“The website was having technical difficulties a couple days ago. I’m pretty sure they were updating the table stuff and now everyone can see this same updated info in their table. I don’t think it makes us any closer to being paid out. I’m guessing maybe they were sick and tired of answering emails about the table and went ahead and fixed the issue so people would quit asking.“

The exchange had stated in an email back in December 2023 that the rehabilitation trustee is “making efforts to commence repayments in cash within the 2023 calendar year.” The trustee had announced plans to pay creditors 142,000 BTC, 143,000 BCH and 69 billion Japanese yen.

According to the previous trustee update, Mt. Gox had plans to initiate cash repayments “shortly” after their announcement in 2023, with the process likely extending into 2024 due to the large number of creditors involved. The specific timing of repayments for individual creditors remains uncertain, as stated by Rehabilitation Trustee Nobuaki Kobayashi.

He stated in the email:

“The specific timing of repayment to individual rehabilitation creditors is undetermined, and therefore, it will not be possible to provide advance notice to each rehabilitation creditor regarding the specific timing of their repayment,”

Fake Emails

Mt. Gox has also issued warnings about scam emails some creditors have received. Following a caution from Mt. Gox about possible fraudulent emails, an updated “repayment progress” is noted. Mt Gox mentioned in the notice that the information is false and should not be trusted. A part of the false information is cited:

“The Rehabilitation Trustee has brought forward the deadline for repayment from October 31, 2024, to March 29, 2023.

MTGOX is now proceeding with allowing all creditors to withdraw their remaining balances fully.”

These emails falsely claim to be from the Rehabilitation Trustee, pushing a false repayment deadline and asking for identity verification through a malicious link. Mt. Gox confirms these emails are indeed fraudulent.

The firm added:

“This email is a fraudulent email impersonating the MTGOX team. The fraudulent email was not sent by the Rehabilitation Trustee, and the information in the fraudulent email is completely false. Accordingly, please disregard the instructions and requests in the fraudulent email,”

Cautious Optimism and Skepticism

While the prospect of imminent repayments has generated excitement, skepticism persists due to previous delays and technical challenges. Some creditors express caution, citing Mt. Gox’s history of setbacks. One Reddit user highlighted the need to temper expectations, emphasizing the importance of monitoring the situation closely as the repayment date approaches.

Mt Gox Payouts: Market Implications

The impending distribution of digital assets by Mt. Gox could have significant implications for the broader market. Analysts anticipate heightened selling pressure as creditors liquidate their assets, potentially impacting bitcoin’s price. This concern is underscored by previous market trends, where the influx of large volumes of bitcoin led to increased scrutiny and price volatility.

Community Reactions

Community reactions to the repayment updates have been varied. While some express optimism about the closure of Mt. Gox’s long-standing repayment saga, others voice frustration over delays and uncertainties. The digital asset community remains divided on the potential market impact of the repayments, with discussions ongoing on platforms like Reddit.

On April 22, a creditor of Mt. Gox expressed:

“Money received as USD into an HSBC currency account and looks like zero fees.”

The Redditor added: “Table had been updated March 15 first then April 8 second then April 18 when BTC lines arrived.”

Another Mt. Gox creditor said:

“That’s a long wait, like 5 weeks when it was more typical to wait 2 to 3 weeks before based on what I’ve been reading.”

Conclusion

The latest updates on Mt. Gox’s repayment plans signal progress in a long-awaited process for creditors. While the prospect of reimbursements brings hope, concerns about market volatility and delays linger. As the repayment date approaches, stakeholders will continue to monitor developments closely, anticipating both the resolution of Mt. Gox’s legacy and its potential impact on the digital assets landscape.