Coinbase, the largest digital asset exchange in the U.S., finds itself entangled in a web of legal disputes, with multiple class-action lawsuits accusing it of selling unregistered securities. A new emerging lawsuit, filed by individual complainants, highlight regulatory challenges facing the exchange.

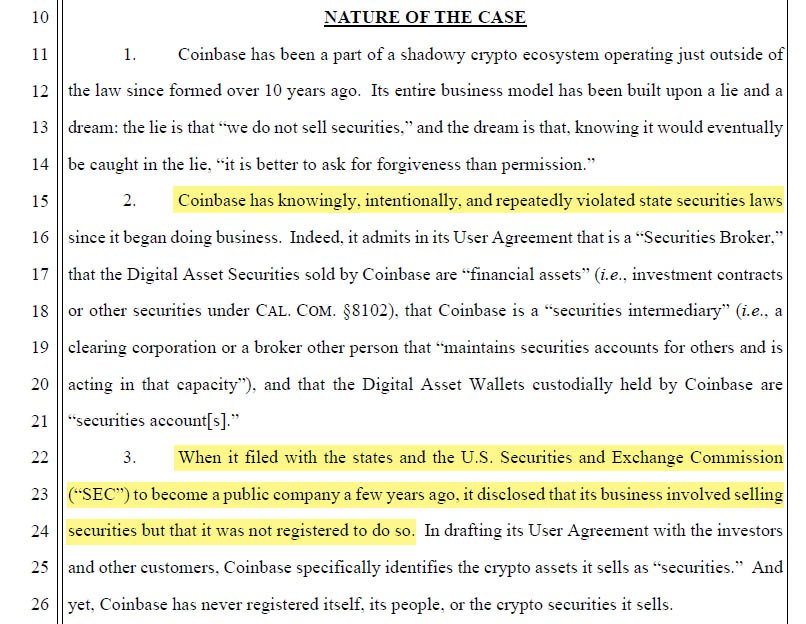

The new Coinbase lawsuit, filed in the Northern District of California, allege that Coinbase “knowingly, intentionally, and repeatedly violated state securities laws” by operating as an unregistered broker-dealer.

Plaintiffs claim that the exchange sold digital assets without the necessary registrations, leading to significant losses for investors.

The lawsuit asserts:

“Coinbase solicited every purchase and sale of Digital Assets by means of general solicitations including those on its website and in social media advertising, traditional advertising, and even Super Bowl commercials.

At all times, Coinbase was soliciting the customers to invest in the Digital Asset securities that it offered on its broker platform.“

Coinbase Lawsuit: Claims and Plaintiffs

The plaintiffs’ grievances extend beyond mere financial losses. They assert that Coinbase’s business model is both illegal and deceptive, accusing the exchange of misleading investors into purchasing securities without proper registration.

The list of tokens identified as securities includes Solana (SOL), Polygon (MATIC), Near Protocol (NEAR), Decentraland (MANA), Algorand (ALGO), Uniswap (UNI), Tezos (XTZ), and Stellar Lumens (XLM).

Related: SEC Lawyer in Coinbase Case: Bitcoin is Different

Among the individuals named as plaintiffs in the lawsuit are Gerardo Aceves, Thomas Fan, Edwin Martinez, Tiffany Smoot, Edouard Cordi, and Brett Maggard.

Spearheading the legal battle is John T. Jasnoch, a lawyer with a history of litigating against digital asset ventures, including Safemoon, Internet Computer, and Ethereum Max.

Jasnoch, as per the law firm’s website, has been involved in similar legal actions, yet he has not commented on the matter at present.

Coinbase has not remained passive in response to these legal challenges. The exchange has argued that secondary digital asset sales did not meet the criteria for securities transactions and has disputed the applicability of securities regulations.

Nevertheless, the lawsuit poses a substantial threat to Coinbase’s operations and reputation. The company issued a statement dismissing the claims as “legally baseless,” stating:

“We have full faith in the judicial process and look forward to addressing them in full at the appropriate time.”

Coinbase’s legal battles extend beyond these class-action lawsuits. The exchange is also embroiled in a highly publicized dispute with the United States Securities and Exchange Commission (SEC), revolving around the classification of tokens sold on its platform as securities.

Coinbase’s recent interlocutory appeal in response to a judge’s decision further highlights the complexity and stakes of these legal skirmishes.

The outcome of these lawsuits could have far-reaching implications for Bitcoin and the entire digital asset industry in the United States. Coinbase is the largest exchange in the country, and also servers as the custodian for the majority of Bitcoin Exchange-Traded Funds (ETFs).

These lawsuits highlight the need for clarity and regulation in the rapidly evolving landscape of digital assets. Moreover, they underscore the importance of investor protection and transparency in exchanges.