The Central Bank of Nigeria (CBN) has officially lifted its ban on banks facilitating Bitcoin transactions, sparking a new wave of excitement in the Bitcoin community. The end to Nigeria Bitcoin ban was announced through an official circular that was sent to banks on Friday regarding the new changes.

As per a report, CBN recognized the growing global demand for digital assets and the increased adoption of Bitcoin as a mode of transaction. As a result, it has now removed the restrictions on banks partnering with virtual asset service providers. Moreover, the bank is aiming to introduce a comprehensive guideline for such partnerships.

CBN stated:

“However, current trends globally have shown that there is a need to regulate the activities of virtual asset service providers (VASPs), which include cryptocurrencies and crypto assets.”

Related reading: Nigerians Want Bitcoin, Not eNaira

Nigeria Bitcoin Ban Ends: Clearer Guidelines

To instill transparency and accountability, the CBN has issued clearer guidelines, particularly emphasizing stringent Know Your Customer (KYC) and anti-money laundering (AML) checks for banks engaging with VASPs. The move aligns with evolving global trends, emphasizing the imperative need to regulate the activities of entities dealing with virtual assets and digital currencies.

Notably, the CBN stated that Section 30 of the Money Laundering Act of 2022 now recognizes digital asset firms as financial companies. Additionally, it stated that the rules put in place by Nigeria’s Securities and Exchange Commission (SEC) on May 13, 2022, were another justification for lifting the ban.

Banks are now empowered to open accounts for digital asset firms, extend designated settlement accounts, and facilitate foreign exchange flows and trade. However, the CBN mandates that firms seeking partnerships with banks must obtain a license issued by the Nigeria SEC, ensuring compliance with regulatory standards.

Moreover, the digital asset exchanges are required to have a minimum paid-up capital of ₦500 million ($553,000) and need to be duly registered with the Corporate Affairs Commission of Nigeria (CAC). Those exchanges that want to issue digital assets will have to submit a whitepaper to the Nigeria SEC and wait for a period of 30 days before they can give their users access to said tokens.

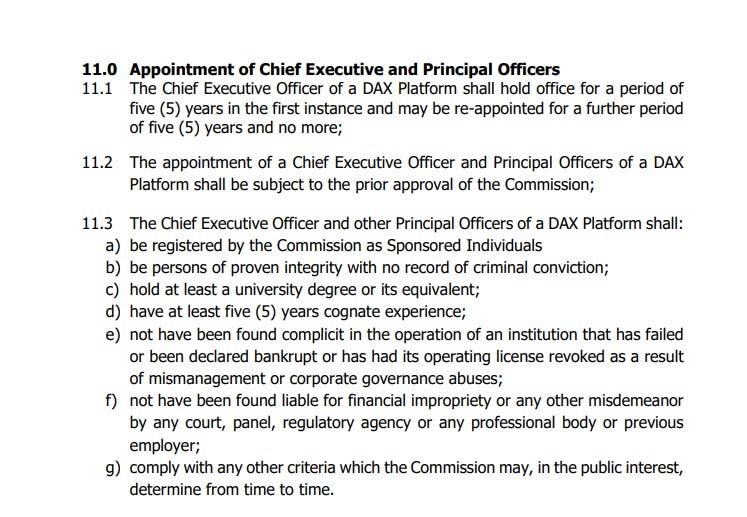

Exchange CEOs to Retire After 10 Years: Nigeria SEC

The Nigeria SEC has imposed a term limit on the chief executives of digital asset exchanges, stipulating a ten-year tenure. In a document titled “New Rules on Issuance, Offering Platforms, and Custody of Digital Assets,” it stated:

“The Chief Executive Officer of a DAX Platform shall hold office for five years in the first instance and may be re-appointed for a further period of five years and no more.”

Digital asset exchanges must now adhere to a reporting regime, submitting weekly and monthly trading information, along with quarterly and annual financial reports and compliance reports, to the Nigeria SEC. Importantly, if an exchange decides to cease operations, they will have to report it to the regulator first.

While these regulatory strides signify a positive shift in Nigeria’s Bitcoin landscape, concerns arise over certain ambiguities in the circular. Tech journalist Abubakar Idris highlights potential confusion, particularly among consumers, emphasizing the need for further clarification on specific provisions within the CBN’s circular.

As the Nigerian digital asset industry adapts to these transformative changes, stakeholders eagerly await additional guidance to navigate this evolving regulatory framework.