In a significant move, Phoenix Wallet, a popular Bitcoin Lightning Network wallet, has announced its decision to withdraw its services from the United States market. The decision comes amidst increasing regulatory scrutiny and concerns over potential legal repercussions.

It’s worth mentioning that in recent days, the Bitcoin community was rattled by the news of apprehension of Samourai wallet founders over charges of money laundering.

Related reading: Samourai Wallet Founders Arrested on Money Laundering Charges: Case Breakdown

Phoenix Wallet Withdrawal Announcement

Phoenix Wallet, operated by ACINQ, revealed its plans to cease operations for U.S. customers, with the removal of the app from U.S. app stores scheduled for May 3, 2024. This announcement follows closely on the heels of regulatory actions and the indictment of executives from another wallet provider, Samourai Wallet.

The operator urged U.S.-based users to empty their wallets promptly to avoid any potential issues, emphasizing the importance of adhering to the instructions provided to prevent additional fees.

Regulatory Challenges

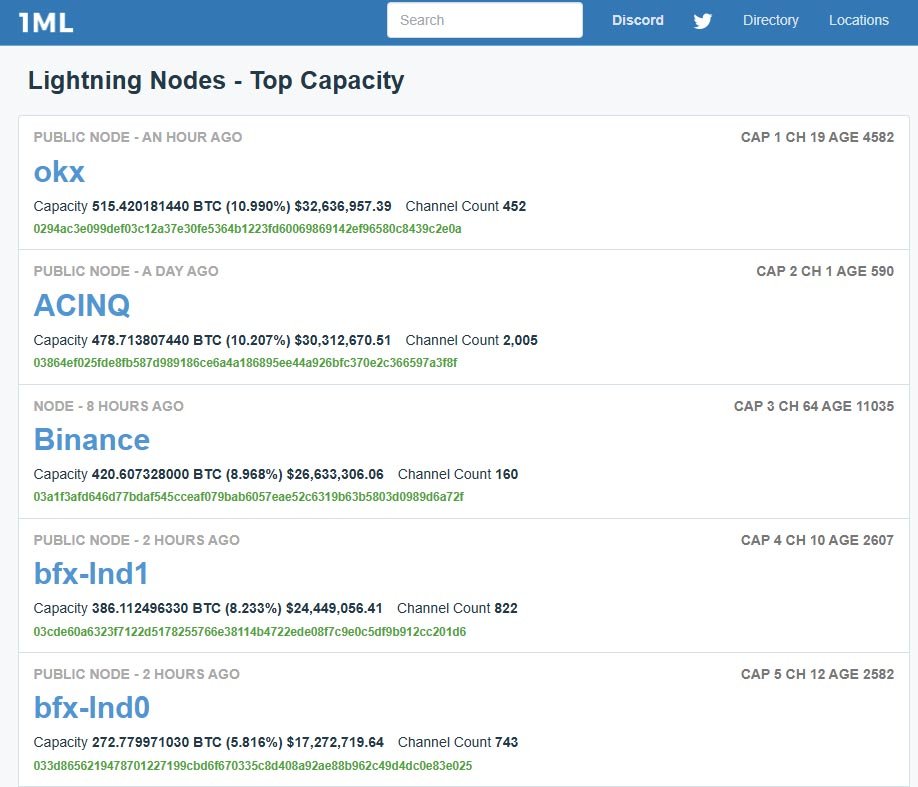

ACINQ which manages the second-largest Lightning Network node, cited regulatory complexities in the United States as a primary reason for the decision, stating:

“Recent announcements from US authorities cast a doubt on whether self-custodial wallet providers, Lightning service providers, or even Lightning nodes could be considered Money Services Businesses and be regulated as such.”

ACINQ announced that they’re taking down the Phoenix Wallet from US app stores and will be evaluating any other potential effects on their operations. One X user stated their discontent with this decision, replying to Acinq’s post, “This is exactly [what] they wanted you to do, when they indicted Samourai.”

The company expressed concerns about the regulatory landscape, highlighting the uncertainty surrounding the classification of such services and the associated regulatory requirements.

Community Response

The decision by Phoenix Wallet has sparked mixed reactions within the digital asset community. While some industry figures expressed understanding of the regulatory challenges faced by the company, others criticized the move as unnecessary.

Notably, although Phoenix has not explicitly confirmed it, many have associated this decision to the apprehension of leaders of the well-known bitcoin-mixing service provider, Samourai Wallet.

Alex Thorn, a researcher affiliated with Galaxy Digital, expressed his disappointment on the X platform, remarking, “I wish the United States still embodied the ideals of freedom.” Echoing this sentiment, George Mandrik, one of the earliest proponents of Bitcoin, remarked, “This week just keeps getting worse.”

Jack Dorsey, the CEO of Twitter and a prominent Bitcoin advocate, voiced his discontent, stating, “[This] Feels completely unnecessary.” The move also drew attention from other industry players, including Lightning Labs and Zeus, who questioned its necessity and urged compliance with regulations while defending self-custody rights.

In the meantime, provider of Bitcoin Lightning Network wallets, Zeus, asserted their uninterrupted operations, mentioning, “We’re not going anywhere.” Evan Kaloudis, the founder of Zeus, noted:

“We believe that Zeus is following the letter of the law right now. If the law changes or any judgments are made, we will make adjustments accordingly. If Zeus falls, all other Lightning node operators are next. If Lightning node operators fall, self-custody is next. This is the hill to die on: self-custody. If you don’t agree, you were never in Bitcoin for the right reasons. So get behind us, or go home. Future generations are watching and depending on us.”

Notably, Dorsey’s statement prompted a significant number of reactions. Elizabeth Stark, co-founder and CEO of Lightning Labs, expressed agreement with Dorsey’s stance, commenting, “I agree. This is not the way.”

Jack Mallers, CEO and founder of Strike, raised concerns about the decision. “Has anyone talked to Phoenix Wallet? Why was this decision made?” Mallers questioned on Dorsey’s X thread.

Pledditor on X, expressed:

“Yikes! In my opinion, Phoenix Wallet is perhaps a little too overcautious. I don’t think they are acting illegally, or that the case of “Samourai Wallet” suggests this. But I do understand the discomfort of operating in the US, it’s better to be safe than sorry when the risks are so high.”

Impact on Users

The withdrawal of Phoenix Wallet from the U.S. market has raised concerns among its user base, particularly regarding the security of their assets and the availability of alternative services. Users have been advised to withdraw their balances promptly and follow the provided instructions to avoid any potential issues.

The decision underscores the challenges faced by Bitcoin service providers in navigating regulatory environments, particularly in jurisdictions with evolving regulations and enforcement actions.

In a similar event on January 2024, “Wallet of Satoshi,” another prominent Bitcoin Lightning wallet, ceased operations in the U.S. due to recent regulatory actions targeting digital asset businesses in the region. The app, which had over 1 million transactions in November, has since been removed from both the Apple App Store and Google Play Store for U.S.-based users.

The withdrawal of prominent Bitcoin Lightning wallets from the United States, raises the question of viable alternatives for users.

Broader Regulatory Environment

The withdrawal of Phoenix Wallet from the U.S. market is part of a broader trend of increased regulatory scrutiny in the digital asset industry. Recent regulatory actions, including the indictment of executives from Samourai Wallet and warnings from regulatory agencies, have heightened concerns among industry participants.

The crackdown on Bitcoin wallets and service providers reflects what authorities call efforts to address potential “regulatory compliance issues” and “combat illicit activities,” including money laundering and illegal transactions.

Looking Ahead

As Phoenix Wallet exits the U.S. market, attention turns to the broader implications for the Bitcoin industry and the regulatory landscape. The decision highlights the challenges faced by service providers in navigating regulatory uncertainties and underscores the importance of regulatory clarity for fostering innovation and growth in the industry.

Industry stakeholders will continue to monitor developments in regulatory environments globally, seeking clarity on compliance requirements and advocating for policies that support responsible innovation while addressing regulatory concerns.

Phoenix Wallet’s withdrawal from the U.S. market underscores the complex regulatory challenges faced by Bitcoin service providers and highlights the need for clear and consistent frameworks to support innovation and protect consumers in the evolving digital economy.