Digital assets’ exchange Binance finds itself entangled in legal troubles as an appeals court reverses the dismissal of a class-action lawsuit filed by Chase Williams and other investors. The decision highlights the ongoing scrutiny surrounding exchange’s alleged securities dealings, shedding light on the complexities of digital assets regulation.

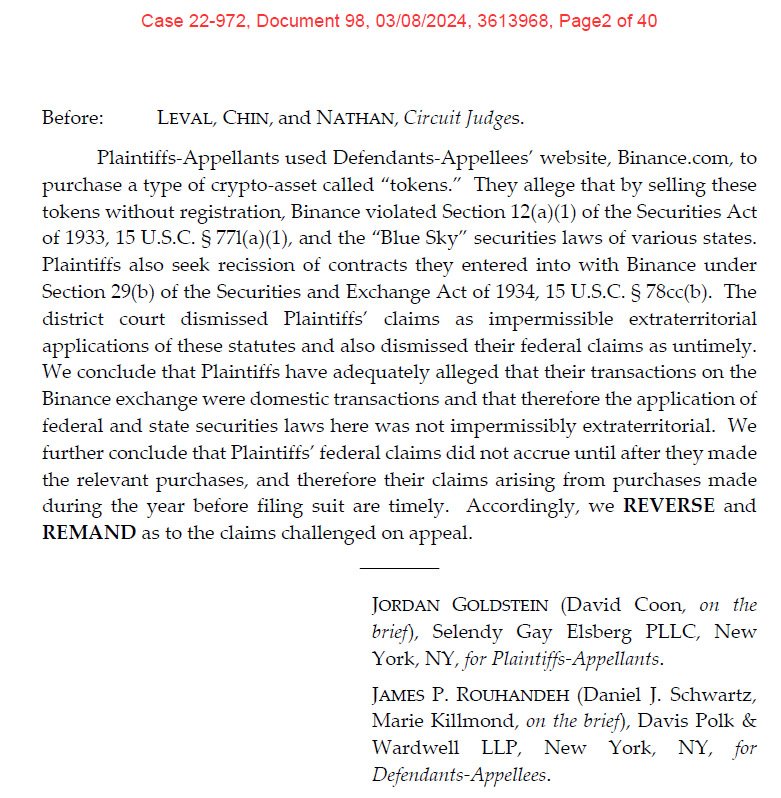

Appeals Court Ruling

The United States appeals court has overturned a previous ruling that dismissed the lawsuit against Binance. The court declared the rationale behind the dismissal as “erroneous,” signaling a significant development in the legal battle. According to the filing, the district court’s decision to dismiss investors’ claims regarding transparency issues in the exchange’s alleged sale of securities has been overturned in favor of the investors.

The pronouncement from the appeals court declared:

“We have decided that each of the reasons for the District Court’s dismissal of the Plaintiffs’ claims that come before us on appeal is erroneous.”

Chase Williams Lawsuit

The lawsuit, initially filed by Chase Williams in April 2020, represents investors who argue that Binance sold securities without proper registration. Williams, along with other investors, claimed they were deceived into purchasing “crypto currency tokens registered as securities.” The appeals court’s decision challenges the district court’s dismissal based on statutes of limitations, suggesting that the digital asset exchange may be subject to domestic securities laws.

Investors’ Claims and Allegations

Investors seek damages for Binance’s alleged violation of Section 12(a)(1) of the Securities Act of 1933. They accuse the exchange of unlawfully promoting, offering, and selling “billions of dollars’ worth of crypto-assets”, labeled as “tokens,” without proper registration as securities. The reversal of the dismissal allows investors to pursue their claims against the exchange, highlighting the potential implications for the troubled exchange.

Related reading: SEC’s Battle on “Unregistered Securities”: What is the Regulator Up To?

“Plaintiffs seek damages arising from Binance’s alleged violation of Section 12(a)(1) of the Securities Act of 1933 (Securities Act), 15 U.S.C. § 77l(a)(1), which they claim occurred when Binance unlawfully promoted, offered, and sold billions of dollars’ worth of crypto-assets called “tokens,” which were not registered as securities.”

Jordan Goldstein, plaintiffs’ attorney, a partner at Selendy Gay said:

“On behalf of investors who traded on Binance, we are pleased that a Second Circuit panel has unanimously acknowledged the strength of our claims and permitted this action to proceed. We look forward to prosecuting this class action against Binance and its founder Changpeng Zhao.”

Ongoing Legal Challenges

The appeals court’s decision comes amidst Binance’s ongoing legal battles with regulatory authorities. The U.S. Securities and Exchange Commission (SEC) has sued the digital asset exchange, its U.S. counterpart, and founder Changpeng Zhao, alleging the sale of unregistered securities and mishandling customer assets. Despite reaching a $4.3 billion settlement with the U.S. Department of Justice, the exchange continues to face legal hurdles, with Zhao facing a forthcoming criminal sentencing hearing in April.

Implications and Market Response

While the appeals court ruling signifies a victory for investors seeking accountability from Binance, the broader implications for the market remain uncertain. The decision highlights the challenges of regulating digital asset exchanges and the importance of transparency in securities transactions. Despite the legal turmoil, the market appears resilient, with Bitcoin reaching all-time high levels amidst the news.

The digital asset exchange’s legal woes deepen as an appeals court reverses the dismissal of a class-action lawsuit filed by investors. The decision underscores the ongoing struggle between exchanges and regulatory authorities, shedding light on the complexities of regulation of digital assets. As Binance navigates through legal challenges, the implications for the market remain under scrutiny, emphasizing the importance of transparency and compliance in the evolving landscape of digital assets.