Bitcoiners and residents of Virginia have reason to celebrate as the state introduces groundbreaking legislation aimed at safeguarding and promoting the use of digital assets. State Senator Saddam Azlan Salim is spearheading these efforts with Senate Bill 339 (SB 339), which addresses various aspects of digital asset rights, including mining and tax exemptions.

Saddam Azlan Salim: Protecting Citizen’s Bitcoin Rights

In a move to empower Virginia citizens, SB 339 guarantees their freedom to independently engage in various digital asset activities. This includes storing, trading, participating in mining activities, and making payments. Senator Salim, the bill’s sponsor, presented SB 339 on January 9, 2024, with the primary goal of preventing state authorities from imposing unnecessary restrictions on digital-asset-related activities within the state.

SB 339 bears similarities to bills introduced in other states, including Missouri, Nebraska, and Indiana. All these bills find support from the Satoshi Action Fund, a non-profit organization dedicated to educating policymakers and regulators about the advantages of Bitcoin and mining.

Digital Asset Bill Overview

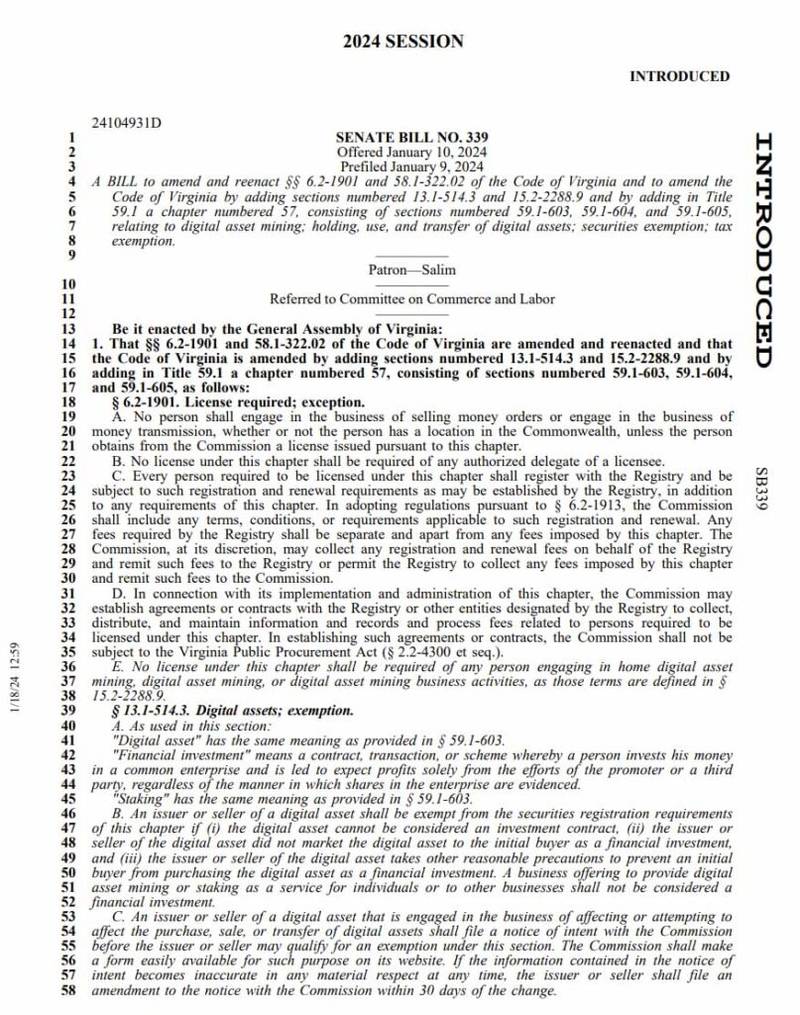

The comprehensive Senate Bill 339, introduced on January 9, 2024, touches on various aspects of digital assets, including licensing requirements, tax exemptions, and local regulations for home digital asset mining.

One of the key provisions of the bill is the exemption from licensing requirements for individuals engaging in home Bitcoin mining. This move is significant, as it acknowledges the growing popularity of Bitcoin mining activities and seeks to encourage participation without unnecessary bureaucratic hurdles. This provision ensures that residents engaging in such activities can do so without unnecessary restrictions, provided they comply with local noise ordinances.

The bill also addresses concerns about the classification of bitcoin as securities. It stipulates that issuers or sellers of the digital asset will be exempt from securities registration requirements under certain conditions. To qualify for the exemption, the digital asset must not be considered an investment contract, and the issuer should take precautions to prevent marketing the digital asset as a financial investment.

Tax Exemptions

An aspect of SB 339 that is likely to resonate with many Bitcoin users is the proposed exemption from state capital gains tax for Bitcoin transactions valued at less than $200. This exemption aims to encourage small-scale transactions, making the digital asset more accessible to a broader audience.

Studying Blockchain Technology and Bitcoin

Recognizing the evolving nature of blockchain technology and Bitcoin, SB 339 goes a step further. The bill mandates the Bureau of Financial Institutions of the State Corporation Commission to convene a workgroup to study and make recommendations related to blockchain technology and its applications. This move demonstrates Virginia’s commitment to fostering the appropriate expansion of blockchain technology within the state.

The bill states:

That the Bureau of Financial Institutions of the State Corporation Commission shall convene a work group for the purpose of studying and making recommendations related to blockchain technology, digital asset mining, and cryptocurrency and fostering the appropriate expansion of blockchain technology, digital asset mining, and cryptocurrency in the Commonwealth.

Dennis Porter, co-founder and CEO of the Satoshi Action Fund, praised the progress, emphasizing the states’ commitment to Bitcoin usage rights. Porter affirmed plans to advocate for comparable laws in at least 13 states, stating:

“We have so many states looking to pass laws that we need to raise more money to support those efforts.”

Conclusion

Virginia’s SB 339 is a commendable step towards creating a conducive environment for the growth and adoption of Bitcoin. By addressing licensing, securities regulations, local restrictions, and tax exemptions, the state is signaling its commitment to embracing the potential of blockchain technology. As the bill progresses through the legislative process, it is expected to spark further discussions about the role of Bitcoin in the future of finance and technology.

This legislation not only puts Virginia on the map as a Bitcoin-friendly state but also sets an example for others to follow. As the Bitcoin landscape continues to evolve, proactive measures like those in SB 339 will play a crucial role in shaping a regulatory framework that fosters innovation while protecting the rights of individuals engaging in the exciting world of digital assets.