The founders of Samourai Wallet, a popular bitcoin mixing service, have been arrested and charged with money laundering and operating an unlicensed money transmitting business. This article aims to provide a comprehensive overview of the case, examining the allegations against the founders and the implications of their arrest.

Allegations Against Samourai Wallet Founders

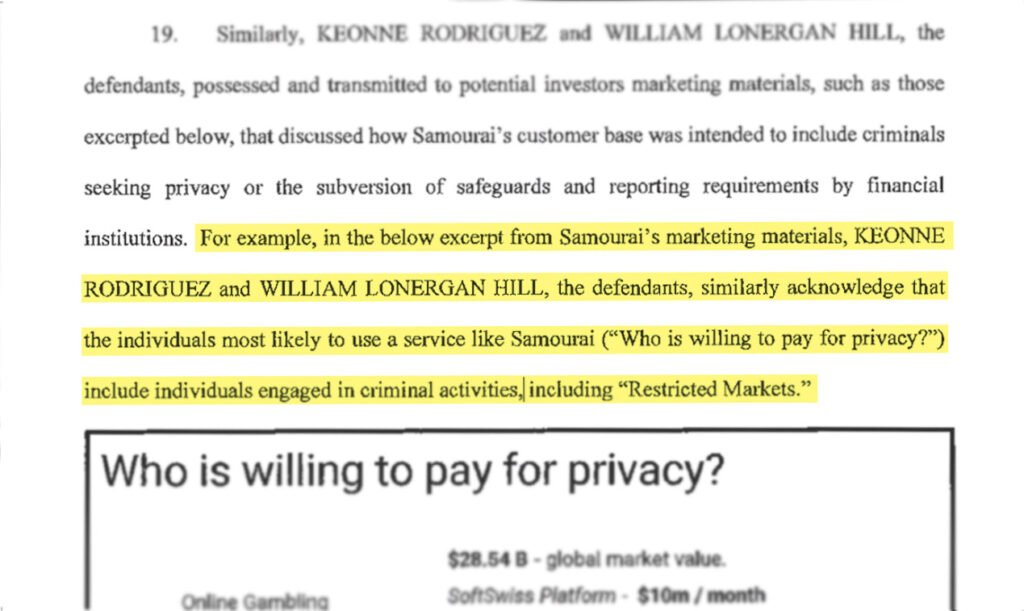

The United States Department of Justice (DOJ) has brought forth serious allegations against Keonne Rodriguez and William Lonergan Hill, the CEO and CTO of Samourai Wallet, respectively. According to DOJ reports, the duo is accused of orchestrating a “cryptocurrency mixer” that facilitated over $2 billion in unlawful transactions and laundered more than $100 million in criminal proceeds from illegal dark web markets such as Silk Road and Hydra Market.

The DOJ press release said:

“These charges arise from the defendants’ development, marketing, and operation of a cryptocurrency mixer that executed over $2 billion in unlawful transactions and facilitated more than $100 million in money laundering transactions from illegal dark web markets, such as Silk Road and Hydra Market; a web-server intrusion; a spearphishing scheme; and schemes to defraud multiple decentralized finance protocols.”

According to DOJ, Rodriguez and Hill “encouraged and openly invited users to launder criminal proceeds.”

James Smith, the Assistant Director in Charge of the FBI, declared:

“[Samourai wallet] provided criminals a virtual haven for the clandestine exchange of illicit funds, the facilitation of more than $2 billion in illegal transactions, and $100 million in dark web money laundering. The FBI is committed to exposing covert financial schemes and ensuring no one can hide behind a screen to perpetuate financial wrongdoing.”

One private message credited to Hill mentioned: “At Samourai we are entirely focused on the censorship resistance and black/grey circular economy […] This implies no foreseeable mass adoption, although black/grey markets have already started to expand during covid and will continue to do so post-covid…”

Legal Charges and Maximum Sentences

Rodriguez and Hill each face charges of conspiracy to commit money laundering, which carries a maximum sentence of 20 years in prison, and conspiracy to operate an unlicensed money transmitting business, which carries a maximum sentence of five years in prison.

Arrests and Extradition

Rodriguez was arrested in Pennsylvania, while Hill was apprehended in Portugal. The United States is seeking Hill’s extradition to stand trial. The coordinated arrests demonstrate the international scope of the investigation into Samourai Wallet’s activities.

In conjunction with law enforcement authorities in Iceland, the servers and domain of Samourai Wallet were seized. Additionally, a warrant was served to halt downloads of the company’s app from the Google Play Store. These actions signify a concerted effort to disrupt the operations of the bitcoin mixer.

The arrests of Rodriguez and Hill are part of a broader crackdown by U.S. authorities on bitcoin mixing services. These services, while purportedly offering privacy-enhancing features, have increasingly come under scrutiny for their potential use in facilitating illegal activities such as money laundering.

Reaction from Law Enforcement

Speaking on the case, U.S. Attorney Damian Williams emphasized the scale of Samourai Wallet’s alleged criminal activities, stating that it served as a “haven for criminals to engage in large-scale money laundering.” IRS-CI Special Agent Thomas Fattorusso echoed these sentiments, highlighting the lack of oversight in transactions processed by unlicensed money transmitters.

Response from Bitcoin Community

The arrests have elicited mixed reactions from the digital assets community. While some have condemned the alleged criminal activities associated with Samourai Wallet, others have expressed concerns about the broader implications for privacy-enhancing technologies in the Bitcoin space.

Ki Young Ju, founder of CryptoQuant, criticized the arrest of Samourai wallet founders, suggesting it targeted the wrong individuals instead of actual criminals. He said:

“The U.S. DOJ has arrested pioneers in #Bitcoin privacy technology. Privacy stands as a core value of Bitcoin. Mixing itself is not a crime. Even crypto exchanges use mixing to safeguard user privacy. It’s like punishing the inventor of the knife instead of the one who uses it.”

Stacks Co-founder Muneeb Ali echoed Buterin’s position on the legal troubles of Samourai Wallet founders, underscoring the need for clarity. He expressed: “Privacy should be normal, not illegal.”

Yan Pritzker from Swan Bitcoin had mixed feelings about Samourai Wallet. He supported their privacy features but criticized them for provoking the U.S. Department of Justice. He noted:

“Samourai were trying to do the right thing to provide privacy tech for many legitimate people. Criminal use is a small fraction of mixing use. The merchant where you spend your Bitcoin shouldn’t know how much Bitcoin you own […] But they were wrong to go around promoting a service to criminals, and the design using a centralized coordinator run by a company was an obvious SPOF and was predictably attacked after they kept poking the bear.”

Comparison with Other Cases

The case against Samourai Wallet founders mirrors similar actions taken by U.S. authorities against other digital asset mixing services. For example, Tornado Cash, another popular mixer, saw its founders arrested following sanctions from the Office of Foreign Assets Control (OFAC).

Future of Mixers

The crackdown on Samourai Wallet and other digital asset mixers underscores the growing regulatory scrutiny facing the Bitcoin industry. As governments around the world ramp up efforts to combat money laundering and illicit finance, the future of privacy-enhancing technologies in the sector remains uncertain.

The arrest of Samourai Wallet founders represents a significant development in the ongoing battle between law enforcement and digital asset platforms. While the case highlights the challenges posed by anonymity-focused services in combating financial crime, it also raises important questions about the balance between privacy and regulation in the digital age. As the legal proceedings unfold, the Bitcoin community will be closely watching to see how this case shapes the future of mixing services.