The United States Securities and Exchange Commission (SEC) has recently stated that Binance Holdings Ltd.’s recent $4.3 billion settlement with the Department of Justice (DoJ) and other U.S. authorities serves to fortify the SEC Binance case.

Notably, the SEC is not directly involved in the November 21 settlement agreement. However, on December 8, it argued that the federal court in Washington handling its case should take into consideration admissions by Binance and its former CEO, Changpeng Zhao, in the settlement.

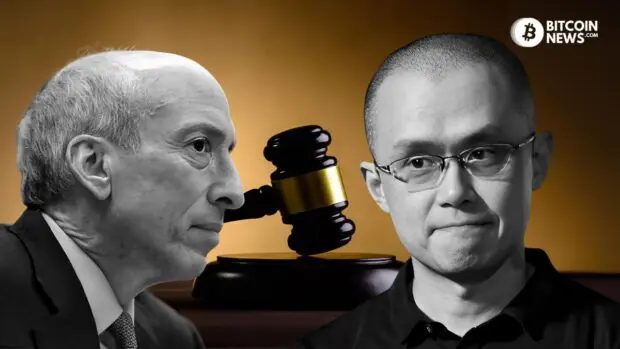

The SEC’s lawsuit, filed in June, accuses Binance and Zhao of mishandling customer funds, providing misleading information to investors and regulators, and violating securities rules. Both Binance and Zhao have sought the dismissal of the SEC’s lawsuit, emphasizing their innocence against allegations. However, the exchange’s attempt to dismiss the case was countered by the SEC, which argued that the plea lacks legal substance and is based on misinterpretations of the law.

The financial regulator believes that Binance’s defense poses a potential threat to established precedents crucial to the functioning of the nation’s securities laws. As a result, the SEC states that if Binance’s arguments were to be accepted, they would have a broader impact on the regulatory framework.

Zhao Barred from Flying to the UAE

In a related development, U.S. District Judge Richard Jones ruled on December 7 that Zhao must remain in the United States until sentencing, following his guilty plea. The judge barred Binance’s former CEO from returning to his residence in the United Arab Emirates until the completion of the sentencing for a felony crime in the US.

Notably, CZ faces a potential sentence of up to 10 years. However, the anticipated maximum sentence is 18 months in addition to a $50 million fine.

This recent ruling overturned a prior decision by a U.S. magistrate judge that had allowed Zhao to return to the United Arab Emirates, reinforcing the seriousness of the charges and the gravity of the case.

The SEC Binance Case

Binance’s record settlement with the U.S. government concluded extensive investigations by the Justice Department, various arms of the Treasury Department, and the Commodity Futures Trading Commission. Notably, this settlement did not involve the SEC.

The SEC Binance lawsuit is registered as 23-cv-01599 in the U.S. District Court for the District of Columbia (Washington, DC). The outcome of this high-stakes legal battle will undoubtedly shape the regulatory landscape for digital asset exchanges.