In a groundbreaking development, the U.S. Securities and Exchange Commission (SEC) is reportedly attempting to shape the structure of Spot Bitcoin Exchange-Traded Funds (ETFs). SEC Bitcoin ETF now shows signs of life as the agency has started asking the exchanges of the ways they plan to engage.

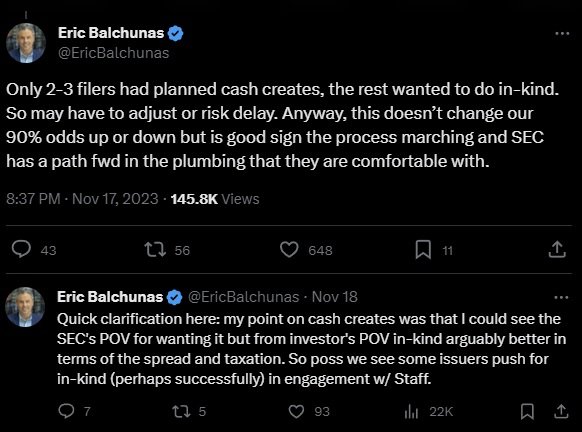

Bloomberg analyst Eric Balchunas believes that this is a positive development. On November 17, Balchunas shared a series of threads on X, revealing insightful details on discussions between the SEC’s Trading & Markets Division and digital asset exchanges. The two have been in talks about the mechanics of the proposed ETFs, highlighting a preference for cash creates over the traditional in-kind approach.

Balchunas sheds light on the positive implications of “cash creates.” This approach, according to him, eases restrictions on broker-dealers who cannot directly deal in bitcoin. He stated:

“Cash creates makes sense IMO because broker-dealers can’t deal in bitcoin, so doing cash creates puts an onus on issuers to transact in bitcoin. This keeps broker-dealers from having to use unregistered subsidiaries or third-party firms to deal with the BTC. Less limitations for them overall.”

In general, in-kind creations involve institutions providing assets, in this case bitcoin, in exchange for ETF shares. In contrast, the SEC’s suggested cash creation would involve using cash to buy these shares.

Implications for SEC Bitcoin ETF Applicants

This shift, addressed through “19b-4 filings,” indicates a significant development in ETF proposals. Notably, 19b-4 filings are typically used to petition regulators for rule changes. While only a few Spot Bitcoin ETF applicants initially considered cash creations, this preference introduces a notable deviation from the norm.

The rationale behind favoring cash creation lies in streamlining bitcoin transactions. This method allows ETF issuers direct handling of bitcoin dealings, eliminating complexities tied to unregistered subsidiaries and third-party firms. Additionally, it may enhance transaction privacy and reduce overall restrictions in the ETF ecosystem.

Balchunas notes that despite the shift in SEC preference, the probability of Spot Bitcoin ETF approval by January remains high. Notably, in October, Bloomberg ETF analyst duo Eric Balchunas and James Seyffart predicted a 90% chance for Bitcoin Spot ETF approval. Balchunas clears:

“Anyway, this doesn’t change our 90% odds up or down but is a good sign the process is marching and SEC has a path forward in the plumbing that they are comfortable with.”

The SEC’s proactive approach, seeking opinions on various ETF applications since late September, adds credibility to these claims. Discussions have focused on concerns prevalent in the digital asset market. This includes potential market manipulation and the need for robust surveillance-sharing agreements.

An Important Deadline

The imminent decision on a Spot Bitcoin ETF application from ARK Invest, expected by January 10, 2024, holds significance. This decision by the SEC could set a precedent for how it views and regulates these novel financial products. As the January deadline approaches, all eyes remain on the regulator, anticipating a decision that could redefine the future of bitcoin investments.

Related reading: