The Chairman of the United States Securities and Exchange Commission (SEC), said that his agency has decided to adopt a new approach to the approval of Spot Bitcoin Exchange-Traded Funds (ETFs). SEC Chair Gary Gensler hinted that the court’s ruling in the Grayscale lawsuit directed the regulator to rethink its approach to Bitcoin ETFs.

In a recent CNBC interview on December 14, the SEC Chair addressed the extensive backlog of Spot Bitcoin ETF applications from major asset management firms, such as BlackRock. Gensler disclosed that his agency is currently scrutinizing “between eight and a dozen filings,” subjecting them to a meticulous evaluation process.

SEC Chair Gary Gensler: Agency to Rethink its Approach to Spot Bitcoin ETFs

Gensler noted that his agency “had in the past denied a number of these applications” and now is considering a new approach to Spot Bitcoin ETFs after the courts weighed in. He stated:

“I’m chair of a commission. I’m not going to prejudge anything. So, that’s going through the process right now. And as you might know, we had in the past denied a number of these applications, but the courts here in the District of Columbia weighed in on that. And so we’re taking a new look at this based upon those court rulings.”

Further, when news anchor Sara Eisen asked the SEC Chair if he was referring to the Grayscale lawsuit, Gensler evaded the question while adding that the regulator performs its activities “within the laws Congress has passed and how the courts interpret them.”

Similarly, in a separate interview with Bloomberg’s Kailey Leinz on December 14, Gensler sidestepped questions regarding Spot Bitcoin ETFs. Instead, he directed attention towards the recent developments in the United States Treasury market.

While commenting on Gensler’s evasion of questions on Spot Bitcoin ETFs, U.S. Representative Bryan Steil said:

“Chair Gary Gensler obfuscates on crypto with the press like he does at committee hearings. He does not want to explain his agency’s aggressive regulatory approach, which is pushing crypto offshore.”

Losing Lawsuit Against Grayscale

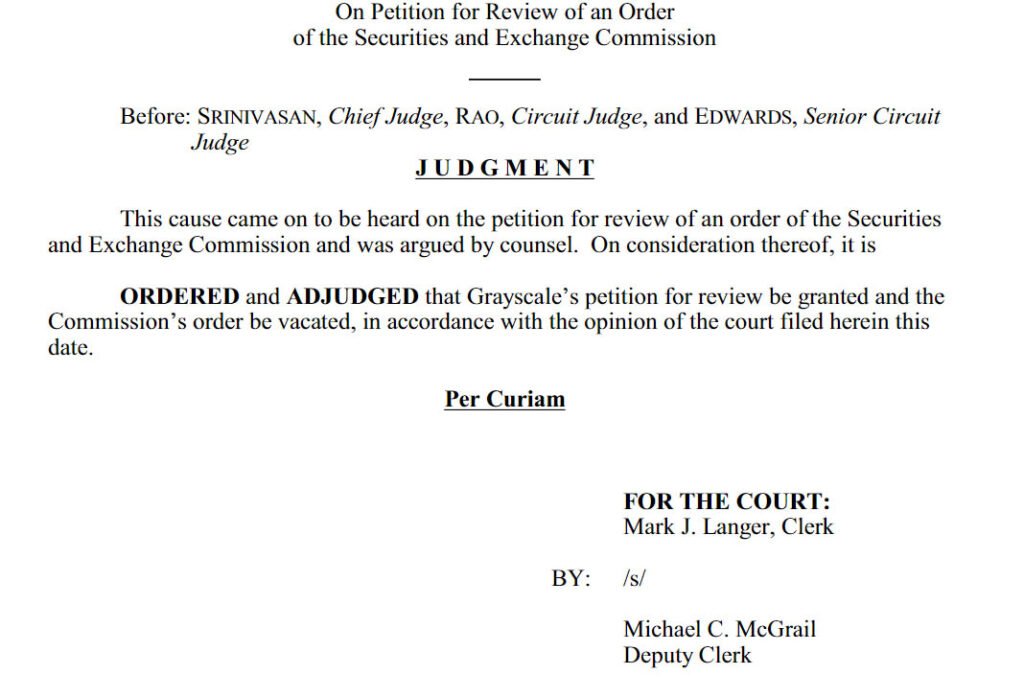

In a lawsuit wherein digital asset management firm Grayscale secured a monumental victory against the SEC, the Court of Appeals for the District of Columbia Circuit ruled in August that the regulator was wrong to dismiss the firm’s application for Spot Bitcoin ETF.

Notably, the court said that Grayscale’s application was “materially similar” to Bitcoin futures exchange-traded products already approved by the SEC. The judges said that the SEC’s decision to dismiss the asset management firm’s application was “arbitrary and capricious.”

It is also important to note that the SEC has no plans to contest the ruling in the Grayscale lawsuit by Judges Sri Srinivasan, Neomi Rao, and Harry Edwards, as per a report from Reuters.