2023 was a year that saw stablecoins snatch the ‘Most Wanted’ title from Bitcoin in the realm of illicit transactions. It’s like the crime world suddenly developed a taste for stability over volatility. According to the latest reports, stablecoins are now the go-to choice for the digital underworld, making up a whopping 61.5% of all the illicit transaction volume in 2023. This is a major shift from the days when Bitcoin was the bad boy on the block…chain.

Related reading: FED probes Stablecoin issuer Tether in 86-Page Denial Order

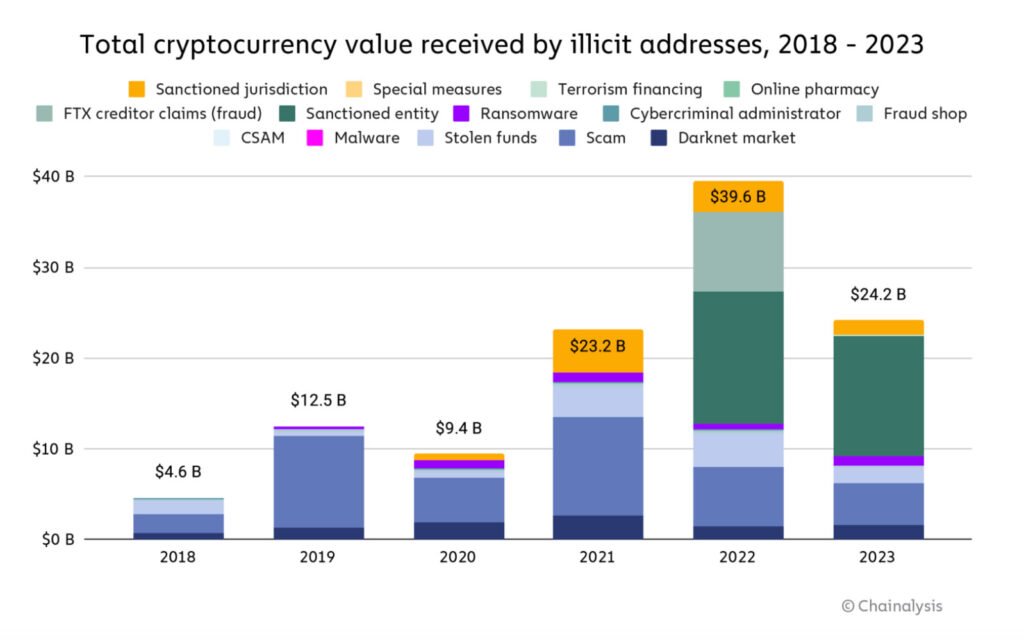

But here’s the kicker: despite the rise in stablecoin shenanigans, the total value of illicit digital asset transactions actually took a nosedive, falling by 38%. It seems even criminals are tightening their belts. The overall share of digital asset transaction volume linked to illicit activities also shrank from 0.42% to 0.34%.

Stablecoins Vs Bitcoin: Different Digital Assets For Different Crimes

Diving deeper into the murky waters, we see different digital assets being used for different crimes. Bitcoin remains the darling of the darknet and ransomware rascals, while stablecoins are the new favorites for scammers and those facing the wrath of international sanctions. Just like a carpenter wouldn’t use a hammer to cut wood or a saw to drive in nails, criminals are selecting specific digital assets based on their suitability for different illegal activities.

Regulatory actions have pushed this shift towards stablecoins. Turns out, stablecoin issuers can freeze funds linked to illicit activities. It’s a bit like playing freeze tag, but with millions of dollars and international law enforcement.

While scamming and hacking saw a decline in revenue (seems even scammers are feeling the economic effects of Bidenomics), ransomware and darknet markets are thriving like weeds in an unattended garden.

Just The Tip

But here’s the real doozy: the reported $24.2 billion in illicit transactions is probably just the tip of the iceberg. It’s like trying to guess the size of an iceberg by only looking at what’s above water. And remember, this number was a significant revision of the 2022 estimate, which jumped from $20.6 billion to $39.6 billion. It’s like finding extra change under the sofa cushions, but in billions.

This complex and ever-evolving scenario of digital-asset-related crime paints a picture where stablecoins are emerging as a key tool. Yet, the overall trend of illicit activities seems to be on the decline. It’s a bit like watching a game of Whac-A-Mole where the moles are getting smarter, but there are fewer of them.

So, while we can all agree that terrorism and other heinous acts are despicable, the irony is hard to miss. Groups that the US government sanctions are part of this illicit financial web. They, like any determined wrongdoer, will use cash, gold, and yes, even digital assets, to carry out their plans. Stripping away privacy from law-abiding citizens is like using a sledgehammer to crack a nut and expecting it not to smash everything else. It’s a reminder that in our quest to fight the bad guys, we shouldn’t forget to protect the good.

Related reading: