The U.S. government will finally reveal its bitcoin and digital asset holdings on April 5, thanks to an executive order from President Donald Trump.

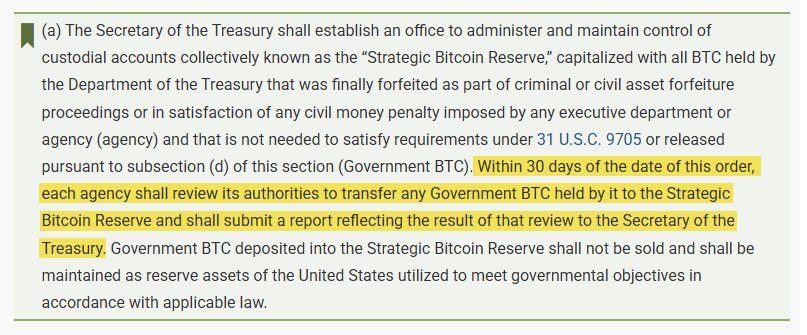

On March 6, Trump signed an order requiring federal agencies to report their digital asset holdings to the Treasury Secretary within 30 days.

That’s aimed at establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile. Bitcoin will be treated similarly to gold as a long-term national asset.

That move follows years of speculation about just how much bitcoin the U.S. government actually holds. The audit will reveal exactly how many bitcoin are in federal possession—and whether there are altcoins too.

One of the most significant aspects of this announcement is the government’s no-sell policy for the bitcoin held in the Strategic Bitcoin Reserve.

That means the bitcoin acquired through civil and criminal forfeitures will be stored there instead of being sold at auctions. That shift in policy positions bitcoin as a long-term store of value, creating a financial stronghold often referred to as a “digital Fort Knox.”

David Bailey, CEO of BTC Inc., thinks the upcoming audit could have a big impact on bitcoin’s price volatility, saying, “Depending on what we learn, [this audit] might answer many of the open questions about the recent price action.”

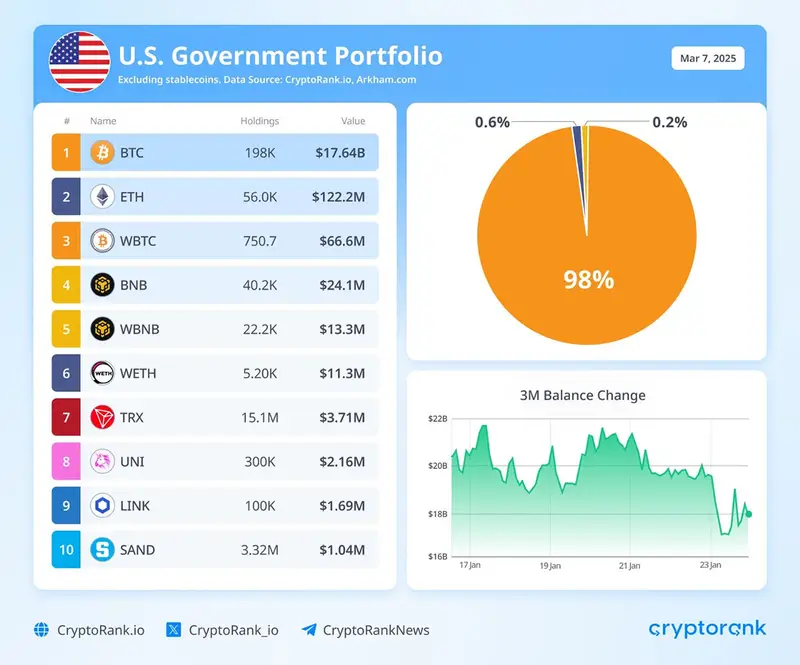

According to reports, the U.S. government currently holds around 198,000 bitcoin, valued at about $16 billion. Over the past decade, it’s seized around 400,000 bitcoin from civil and criminal asset forfeitures. Had those assets been held instead of sold, they’d now be worth over $34 billion.

The government may also hold altcoins, stablecoins and even some memecoins. The full audit will confirm just how extensive those holdings are. The April 5th disclosure is going to have big implications for the entire digital asset market and future regulations. Experts think it will:

- Clarify how the U.S. government manages its digital assets.

- Confirm if altcoins are in the national reserve.

- Impact bitcoin’s price by shedding light on recent market volatility.

- Set a precedent for global government adoption of bitcoin.

In addition to holding the bitcoin reserve, there’s talk of “₿ Bonds”—Bitcoin-backed Treasury bonds. According to the Bitcoin Policy Institute, these bonds could help reduce national debt and allow the government to buy more bitcoin without using taxpayer money.

There’s also a BITCOIN Act which would require the U.S. government to buy up to 1 million BTC over the next 5 years and prevent future administrations from selling the holdings.

Related: Bitcoin Act Returns | U.S. Lawmakers Reintroduce Landmark Bill

As the April 5th deadline approaches, investors, analysts and the community are waiting to see the results. The findings will reshape the role of digital assets in the U.S. economy and set the stage for more structured Bitcoin regulation.