Tether, the issuer of the largest stablecoin by market capitalization, USDT, has frozen 41 digital asset wallets associated with United States sanctions. As per the official announcement, Tether freezes funds within these wallets because they were using Torado Cash, a digital asset mixing platform.

In a December 9 blog post, Tether stated that it seeks to “initiate a new voluntary wallet-freezing policy designed to combat activity connected with sanctioned persons on the Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals (SDN) List.” The firm added that it aims to provide a “secure and reliable environment” for its users around the globe.

The firm decided to take action against these wallets on December 1, and as per blockchain data, these wallets have been allegedly using Tornado Cash for the past six months. It is important to note that these mixing services help users hide their identity, making their transactions difficult to trace.

Tether noted:

“Tether is taking these further proactive steps by implementing this policy to supplement existing security protocols. Tether will now offer, on the secondary market, the sanctions controls it already enforces for wallets on its platform. This initiative is a proactive effort to work even more closely with global regulators and law enforcement agencies to safeguard stablecoin usage.”

Related reading: Chainalysis: No Scientific Evidence The Surveillance Software Works, According to Head of Investigation

Tether Freezes Funds: Actions Against Digital Asset Mixers

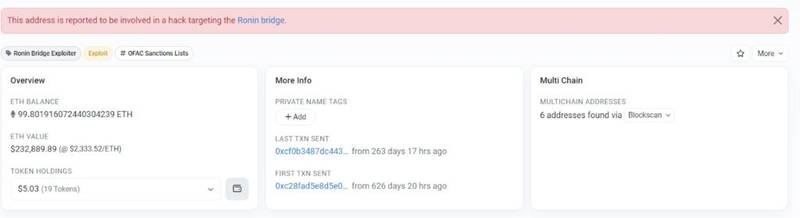

Notably, one of the digital wallets was also associated with the $625 million Ronin Bridge attack. The Lazarus Group, a North Korean hacking group, is believed to be the entity behind the Ronin Bridge attack, according to the United States Treasury Department. As a result, this wallet could possibly be associated with the hacking group.

It is important to note that the Financial Crimes Enforcement Network (FinCEN) recently targeted bitcoin mixers. As reported earlier by BitcoinNews, FinCEN is looking to introduce strict policies on bitcoin mixers due to money laundering and terrorist financing concerns. The federal agency wants to increase the transparency of mixers to prevent illicit usage by groups like the Palestinian militant group Hamas.

Tether CTO and upcoming CEO Paolo Ardoino believes that the voluntary wallet address freezing will “strengthen the positive usage of stablecoin technology and promote a safer stablecoin ecosystem for all users.”

Related reading: