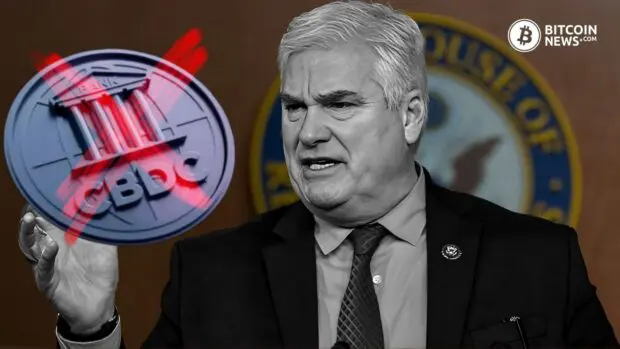

In a recent social media post, United States Representative Tom Emmer, the majority whip of the U.S. House of Representatives, echoed former President Donald Trump’s recent apprehensions about Central Bank Digital Currencies (CBDCs), emphasizing their potential threat to financial privacy.

Notably, during a campaign speech in New Hampshire on January 17, Trump strongly opposed the introduction of a CBDC by the U.S. Federal Reserve, citing concerns about de-banking risks and the potential for misuse of the currency by political actors.

CBDCs Pose a Serious Threat to Americans: Tom Emmer

Emmer recently took X to voice his concerns and express his dedication to collaborating with Trump to oppose what they both perceive as an expansion of government surveillance.

He writes:

“I agree with President Trump; CBDCs pose a serious threat to Americans’ right to financial privacy. I look forward to working with him as we continue the fight against the expanding government surveillance state.”

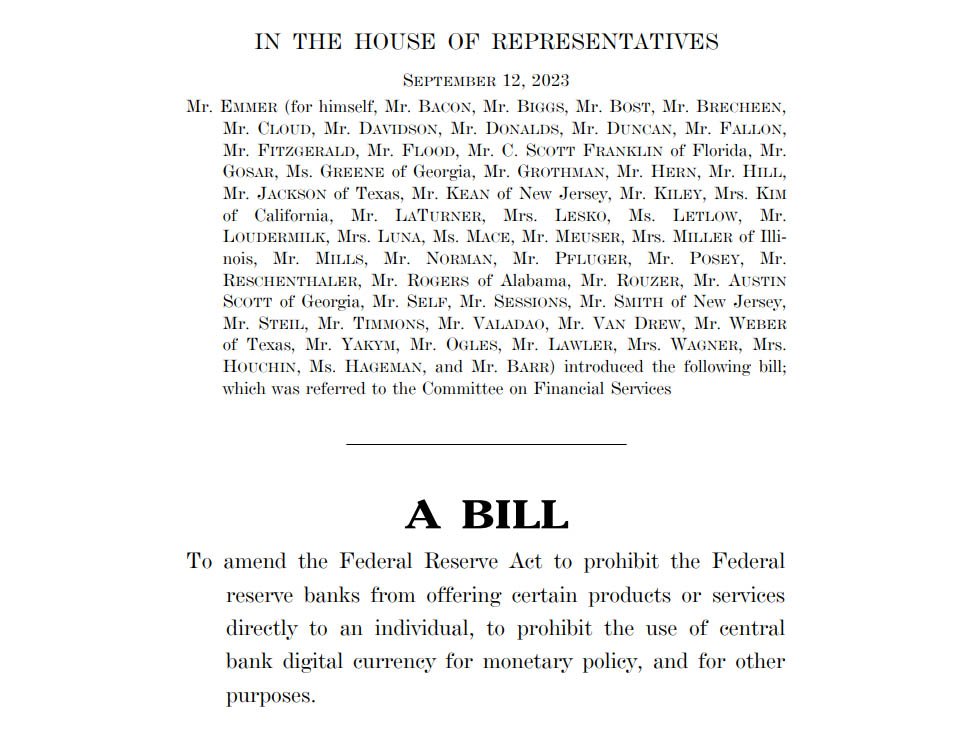

Emmer’s alignment with Trump underscores the shared concerns about the implications of Central Bank Digital Currencies on financial privacy and the need for legislative measures to address these issues. On the same note, the U.S. representative highlighted his Anti-Surveillance State Act, a proposed legislation that has garnered support from 75 co-sponsors.

If enacted, this legislation aims to “prohibit the Fed from issuing a retail Central Bank Digital Currency while protecting innovation and any future development of true digital cash.”

Several States Opposing CBDCs

Trump’s strong stance against the matter stems from his worries about the risks associated with de-banking, potentially leaving individuals without access to financial services, and the potential for the currency to be misused by political entities. He stated:

“As your president, I will never allow the creation of a Central Bank Digital Currency. Such a currency would give the federal government, our federal government, absolute control over your money… They could take your money and you wouldn’t even know it was gone.”

In addition to Emmer’s legislative efforts, several states in the U.S., including South Dakota, Utah, South Carolina, and Tennessee, have introduced bills aimed at excluding CBDCs from the definition of money.

These bills, if passed, could pose significant obstacles to the development and adoption of such digital currencies in the United States. By categorizing CBDCs differently, these states seek to establish a regulatory framework that distinguishes CBDC from traditional currencies, potentially shaping the future of digital currency regulation in the country.

Is the Digital Dollar a Possibility in the U.S.?

While the federal reserve is yet to make a decision on whether to pursue or implement a digital dollar, it has been assessing the potential advantages and risks of CBDCs through various means, including technological research and experimentation.

Interestingly, in September 2022, Dr. Alondra Nelson, head of the White House Office of Science and Technology Policy, placed CBDCs within President Biden’s vision for America, noting:

“President Biden often summarizes his vision for America in one word: Possibilities. A “digital dollar” may seem far-fetched, but modern technology could make it a real possibility.”

As discussions around CBDCs continue to unfold, the alignment between Emmer and Trump underscores a growing sentiment within certain political circles regarding the importance of safeguarding financial privacy and limiting government overreach in the rapidly evolving landscape of digital currencies.