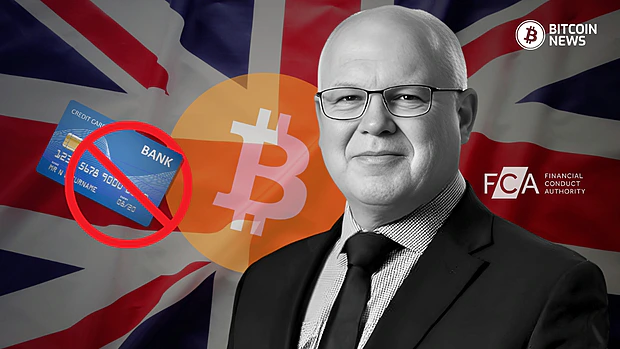

The UK regulators are looking to ban the use of borrowed funds to buy digital assets as part of a wider effort to regulate the fast-growing digital assets market and protect consumers from what they consider “debt and financial harm.”

As a result, UK citizen might lose their ability to buy bitcoin with credit cards.

The Financial Conduct Authority (FCA), the UK’s top financial regulator, has proposed a new rule that would stop people from using any kind of credit – credit cards, personal loans or lender financing – to buy digital assets like bitcoin.

The proposal is open for comment until June 13, 2025 and is outlined in a new discussion paper (DP25/1) published by the FCA.

The reason for the move is growing concern that people are going into debt to buy into digital assets, which are considered risky.

The FCA said in its paper:

“We are concerned that consumers buying crypto assets with credit may take on unsustainable debt, particularly if the value of their crypto asset drops and they were relying on its value to repay.”

According to a recent FCA survey, 14% of UK digital asset investors used credit to buy in 2024 – more than double the 6% who did in 2022. Debt-based bitcoin investing is getting the regulators worried.

The agency believes with bitcoin’s price volatility and platforms collapsing, many consumers risk losing not just their investment but end up with debts they can’t repay. The FCA says this poses “risks of significant harm,” especially for less experienced retail investors.

If implemented, the new rule would block the use of all borrowed money to buy bitcoin. That includes:

- Credit cards

- Personal loans

- Credit lines from e-money or fintech firms

- Loans from digital-asset-specific lenders

But there may be an exception for stablecoins—digital assets designed to maintain a stable value—if they are issued by FCA-regulated firms. These would be assessed separately under the regulator’s rules.

The credit ban is just one part of a wider push by the FCA and the UK government to bring the bitcoin sector under full regulatory control for the first time.

Digital asset trading has become super popular, with around 7 million UK adults – about 12% of the population – now owning some form of digital asset.

But the market has been largely unregulated. That could possibly leave many consumers exposed to fraud, misinformation and financial loss.

“Crypto is a growing industry. Currently largely unregulated,” said David Geale, the FCA’s executive director of payments and digital finance.

“We want to create a crypto regime that gives firms the clarity they need to safely innovate, while delivering appropriate levels of market integrity and consumer protection.”

The FCA is also looking at new rules for bitcoin lending, borrowing and staking – practices that allow investors to earn rewards or take out loans using their bitcoin or other digital asset holdings.

These services will likely be subject to credit checks, knowledge tests and clearer disclosure of the risks involved.

Retail access to products that are considered “high risk” such as bitcoin, including bitcoin lending may be restricted altogether, but institutional investors will still be able to participate.