The Wall Street Journal (WSJ), a prominent American newspaper with a long-standing history dating back to 1889, recently published an article that ignited widespread controversy. The Wall Street Journal bias in that report fueled anti-Bitcoin sentiment in the United States.

The Wall Street Journal Bias

On October 10, the WSJ claimed in an article that Hamas, an alleged terrorist organization, and other similar groups secured significant funding via blockchain-based rails.

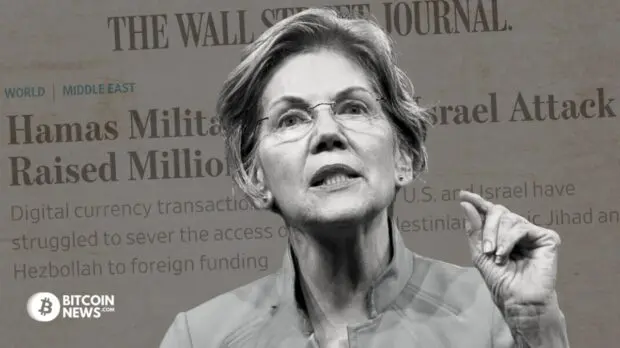

The report, titled “Hamas Militants Behind Israel Attack Raised Millions in Crypto,” alleged that the Palestinian Islamic Jihad (PIJ), a militant organization that operates in the Gaza Strip, raised close to $93 million between August 2021 and June 2023 from its supporters in digital assets.

The WSJ cited blockchain analysis provider Elliptic as its source while stating that authorities in Israel seized PIJ-linked wallets, which received $93 million over the above-mentioned time frame. On the other hand, the article also claimed that Hamas is using digital assets to further its terrorist agenda.

As a result, the WSJ’s article fueled anti-digital-asset sentiment in the United States. Senator Elizabeth Warren, along with 28 other senators and 76 members of the House of Representatives, signed a letter concerning the role of digital assets in terrorism.

Notably, the letter was addressed to Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson and National Security Advisor Jake Sullivan, urging them to “swiftly and categorically act to meaningfully curtail illicit crypto activity.” It reads:

“The deadly attack by Hamas on Israeli civilians comes as the group has become ‘one of the most sophisticated crypto users in the terror-finance domain’, [it] clarifies the national security threat crypto poses to the U.S. and our allies.”

WSJ is Making Digital Assets ‘Look Bad’: Elliptic

Interestingly, Elliptic published a report on October 25 that provided a useful insight into this matter. The firm stated that the WSJ and US lawmakers were trying to make digital assets “look bad” by manipulating data.

Elliptic said that “there is no evidence to support the assertion that Hamas has received significant volumes of crypto donations.” It also added that the actual amounts raised via blockchain-based rails “remain tiny.”

Moreover, the report clarified that in 2021, Israel’s National Bureau for Counter Terror Financing (NBCTF) issued seizure orders for digital asset wallets linked to Hamas.

On October 20, the Financial Crimes Enforcement Network (FinCEN) stated that it would introduce strict policies on bitcoin mixers, citing money laundering and terrorist financing concerns.

In an example, Elliptic confirmed that a “prominent” Hamas digital asset fundraising campaign, which is operated by Gaza Now, a pro-Hamas news outlet, had only raised $21,000 since the Hamas attack on Israel on October 7. Out of the $21,000, $9,000 was frozen by Tether, and $2,000 was frozen by a trading platform during a cash-out attempt.

After the article from Elliptic cleared the air, the WSJ partially corrected the article, stating:

“Palestinian Islamic Jihad and Hezbollah may have exchanged up to $12 million in crypto since 2021, according to crypto-research firm Elliptic. An earlier version of this article incorrectly said PIJ had sent more than $12 million in crypto to Hezbollah since 2021.”

Paul Grewal, the Chief Legal Officer at Coinbase, the largest digital asset trading platform in the United States, said in an X post that the WSJ article’s opening paragraph still framed digital assets as a leading funding source behind Hamas’ attack on Israel.

In stark contrast to the controversial allegations surrounding crypto’s involvement with organizations like Hamas, the use of digital assets for humanitarian purposes in Israel has been on the rise. One notable example is Crypto Aid Israel, an initiative that had garnered more than $185,000 in digital asset donations by October 19, aiming to support those affected by the ongoing attacks.

In conclusion, the WSJ’s erroneous article has fueled anti-crypto sentiment in the U.S. and prompted legislative and regulatory actions. Despite subsequent corrections and clarifications, it could have lasting repercussions, shaping public opinion on the digital asset industry.