Bitcoin of America, a leading digital currency exchange and ATM operator, announced its sudden shutdown in March 2023.

This unexpected closure sent shockwaves through the market, impacting investors and users. This article delves into the reasons behind the shutdown, its immediate consequences, and the potential long-term effects on the Bitcoin landscape.

Bitcoin of America was a digital asset exchange and Bitcoin ATM operator based in the United States. It offered services for buying and selling various digital currencies, including bitcoin (BTC).

The company operated a network of Bitcoin ATMs across multiple states, allowing users to conveniently purchase bitcoin with cash or debit cards.

The exchange was established with the mission of making Bitcoin transactions accessible and straightforward for the average user. Over the years, it garnered a substantial user base and became a notable player in the Bitcoin market.

The investigation by the United States Secret Services uncovered that Sonny Meraban, the owner and founder of S&P Solutions, along with his father Reza Mehraban, who served as a manager of the company, and William Suriano, an attorney and manager at S&P Solutions, were all implicated in the illegal operation of Bitcoin kiosks throughout Northeast Ohio.

Operating under the business name Bitcoin of America (BOA), S&P Solutions was found to be at the center of these unlawful activities.

“Further investigation revealed that they were operating the cryptocurrency kiosks without a money transmission license and that they falsely represented their money transferring capabilities to Ohio regulators in order to avoid detection.”

– Source : SecretService.gov

Reports suggest that Bitcoin of America may have experienced security breaches or was unable to ensure the protection of its users’ funds and data.

The report by United States Secret Services also highlights:

“Scammers and robocallers utilized BOA’s lack of consumer protections and anti-money laundering measures to facilitate transfers from victims in Ohio and across the U.S. BOA retained victim fee money even after being notified that the fee came from fraud victims’ transfers. The fee would average around 20% of the total amount transferred.”

Related: Vermont Lawmakers Look to Regulate Bitcoin ATMs in the State

The shutdown of Bitcoin of America had immediate and far-reaching consequences. Thousands of users who relied on Bitcoin of America’s services were left searching for alternative platforms.

The abrupt nature of the closure caused inconvenience and uncertainty among users, many of whom had funds locked within the exchange.

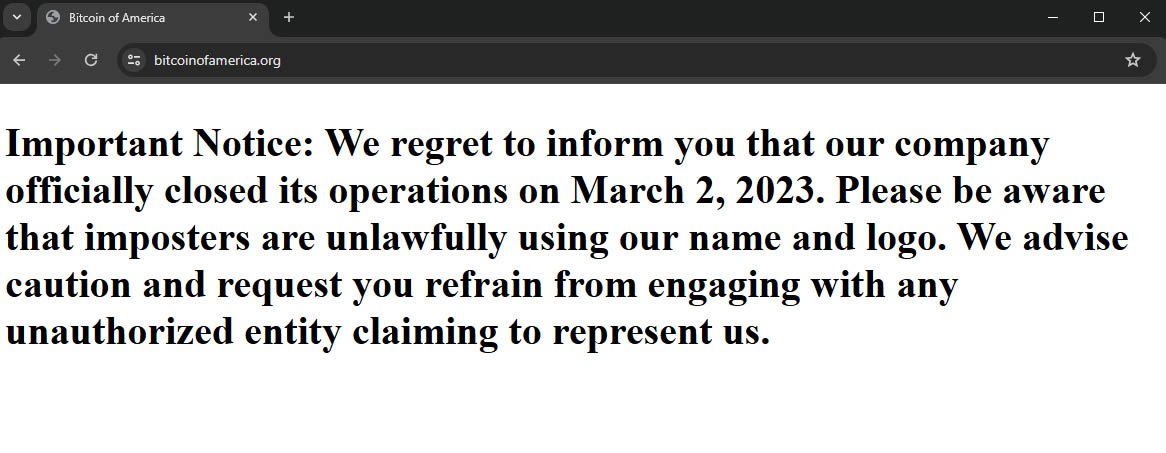

Currently, a message is shown on Bitcoin of America’s website, stating that the company has officially “closed its operations”.

Looking ahead, the shutdown of Bitcoin of America may have several long-term implications for the Bitcoin industry.

- Stricter Regulations: Governments and regulatory bodies worldwide may view this event as a catalyst for enacting more stringent regulations. This could lead to increased compliance costs for exchanges and potentially stifle innovation within the industry.

- Industry Consolidation: Smaller and less compliant exchanges may struggle to survive in this new regulatory environment. This could lead to industry consolidation, with only the most robust and compliant platforms remaining in operation.

- Enhanced Security Measures: The closure highlights the critical importance of security in the Bitcoin sector. Exchanges will likely invest more in advanced security protocols to protect user funds and data.

Sonny Meraban, the CEO and founder, faces over 55 charges, including money laundering, receiving stolen property, possessing criminal tools, and violating license requirements.

Reza Mehraban and William Suriano are also implicated in the illegal operation.

The shutdown of Bitcoin of America marks a significant event in the evolving narrative of the Bitcoin industry. It underscores the challenges that exchanges face in navigating regulatory landscapes and ensuring security.

While the immediate repercussions are evident, the long-term impact will depend on how the industry adapts to these challenges.