In a comprehensive report, leading digital asset investment firm 21Shares provides insights into the upcoming Bitcoin halving cycle suggesting a departure from historical norms, primarily attributed to the burgeoning influence of spot Bitcoin Exchange-Traded Funds (ETFs).

The analysis posits that this paradigm shift may catalyze an earlier rally compared to previous halving cycles, signaling a unique trajectory for bitcoin’s price dynamics.

Increase in Demand

The introduction of spot Bitcoin ETFs has fundamentally changed the landscape of institutional investment in Bitcoin. In addition, this regulatory approval has prompted banking giants and wealth managers to start offering bitcoin investment options to clients. This surge in institutional interest has precipitated a surge in demand, underpinning bitcoin’s upward trajectory. As 21Shares writes:

“We’re starting to see the early innings of this with banks like Wells Fargo and Merrill Lynch providing access to spot Bitcoin ETFs to select wealth management clients, while Morgan Stanley is allegedly evaluating the Bitcoin funds for its brokerage platform. Cetera is also among the first wealth managers to officially roll out a formal policy on BTC ETFs, signifying that a new wave of demand is starting to roll in.”

Decrease in Supply

Meanwhile, Bitcoin’s supply dynamics are undergoing a complementary transformation. Notably, bitcoin holders are refraining from liquidating their holdings despite rising prices, thereby reducing the circulating supply. 21Shares explains:

“Although the supply long-term holders hold declined by 4% from 14.9 million to 14.29 million, the supply held by short-term holders has surged by over 33%, rising from nearly 2.3 million to 3.07 million.”

Remarkably, the dynamic equilibrium observed between these two cohorts has led to a reduction in supply, a phenomenon typically associated with the onset of a bull market following a halving event. However, 21Shares finds that this equilibrium has materialized earlier than anticipated, owing to the external demand generated by ETFs, thereby creating a near-neutralizing effect.

Concurrently, the quantity of bitcoin held on exchanges is diminishing, further constraining its availability for purchase. This tightening of supply, coupled with the impending reduction in newly minted bitcoin following the scheduled halving event, sets the stage for potential supply scarcity, exerting upward pressure on prices.

21Shares’ Analysis

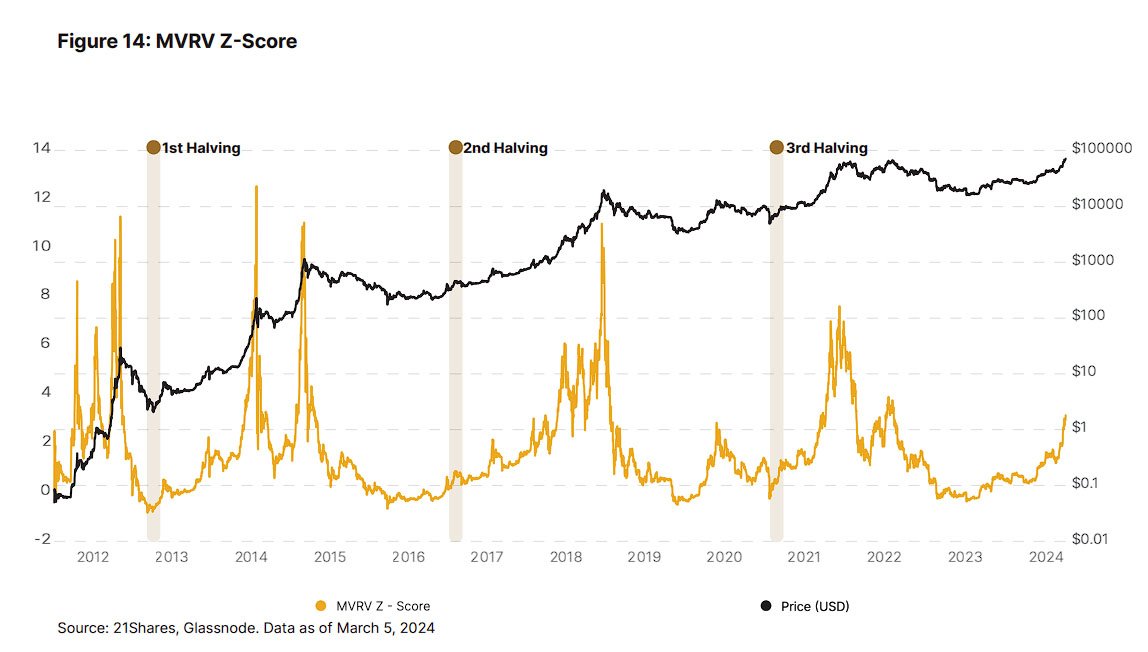

21Shares employs sophisticated technical metrics, including the Market-Value-to-Realized-Value (MVRV) and Net Unrealized Profit and Loss (NUPL), to gauge Bitcoin’s market sentiment and trajectory.

The MVRV Z-Score currently hovers around 3, indicating a valuation that, while not yet reaching the peaks of 2021, surpasses historical averages observed during previous halving cycles. Similarly, NUPL metrics suggest a growing bullish sentiment, indicative of a maturing bull market.

Earlier Price Surge

This halving cycle, characterized by the confluence of institutional inflows and tightening supply dynamics, presents a unique landscape for Bitcoin. Contrary to historical precedents, Bitcoin has already shattered previous all-time highs (ATH) ahead of the halving event, underscoring the atypical nature of this cycle. The report underscores the potential for an earlier price surge, stating:

“…the exogenous demand stemming from the ETF inflows could very well set a new precedent of growth during this cycle unlike previous ones, evident by Bitcoin’s impressive performance that broke its all-time high before the halving.”

In February, Grayscale also issued a similar statement, underscoring the fundamental differences in the 2024 Bitcoin cycle from its predecessors. The statement pinpointed several contributing factors, notably the evolving regulatory environment, operational hurdles for miners, the influence of spot Bitcoin ETFs, and the supplementary fees associated with Bitcoin Ordinals transactions.