Reports from 10x Research, a respected market analysis firm, suggest that bitcoin could see significant gains now that it surpassed the critical $67,500 mark. This optimism is based on observations of recent market trends and the potential impact of institutional inflows.

According to Markus Thielen, head of research at 10x Research, breaking through the $67,500 resistance level could pave the way for bitcoin to reach new all-time highs. In a recent report, Thielen emphasized the significance of this milestone, stating:

“A breakthrough above $67,500 could potentially lead to new all-time highs, a scenario that our Bitcoin ETF model predicts.”

One strategy gaining attention amidst this anticipation is the “covered strangle” options strategy, recommended by 10x Research to enhance returns for bitcoin holders.

This strategy involves selling call and put options while holding bitcoin in the spot market.

Thielen explains:

“Our favorite strategy is to buy bitcoin Spot, Sell 100,000 strike call, and Sell 50,000 strike put for the December 2024 expiry. Selling the call could yield 11%, and selling the put could yield 6%.”

The covered strangle strategy aims to capitalize on low volatility and gradual upward trends in the market, potentially increasing yield by 17%.

With this approach, investors have the potential to secure a reliable cushion against potential losses or alternatively, enjoy an increased yield, contingent upon bitcoin’s performance by the end of December.

However, it’s important to note the risks associated with this strategy. If bitcoin falls significantly below the put option strike price of $50,000, investors could face amplified losses compared to conventional covered call strategies.

Recent market developments provide further context for Bitcoin’s potential surge. Positive inflows into spot Bitcoin exchange-traded funds (ETFs) in the United States indicate growing institutional interest in the digital asset.

These ETFs accumulated over $200 million in net inflows, contributing to bitcoin’s recent recovery above the $66,000 mark.

Institutional involvement has been a driving force behind bitcoin’s rally to new highs. As of February 15, Bitcoin ETFs accounted for about 75% of new investments in bitcoin, underscoring the significant role played by institutional inflows.

Other analysts are optimistic about bitcoin’s price after a period of consolidation. QCP Capital expects bitcoin could reach $74,000 highs soon.

They point out the significant purchases of $100,000 to $120,000 Calls for December 2024 suggesting faith in its upward trajectory, mentioning, “US CPI numbers triggered a break out of the range across risk assets. BTC has since traded back above 66k.”

Tether’s issuance of USDT stablecoins could further boost bitcoin’s price. Tether has announced plans to invest 15% of its net profit in bitcoin, making moves earlier this year when the firm acquiring 8,888 BTC, valued at ~$618 million, making them the seventh-largest global bitcoin holder.

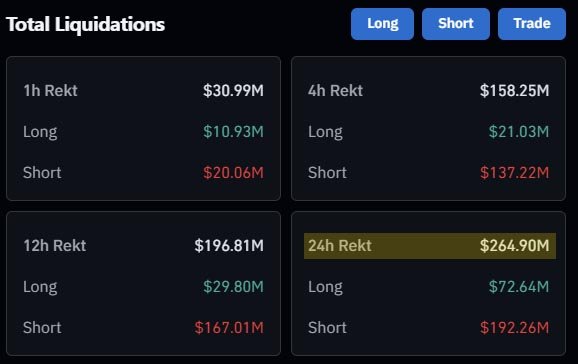

The recent shattering of the $67,500 price level has liquidated nearly $264 million worth of leveraged positions across all digital asset exchanges.