Uninsured bank deposits in America currently exceed $7 trillion according to latest calculatios.

The amount of uninsured deposits with US banks is approximately three times the market capitalization of Apple or equivalent to 30% of the US GDP.

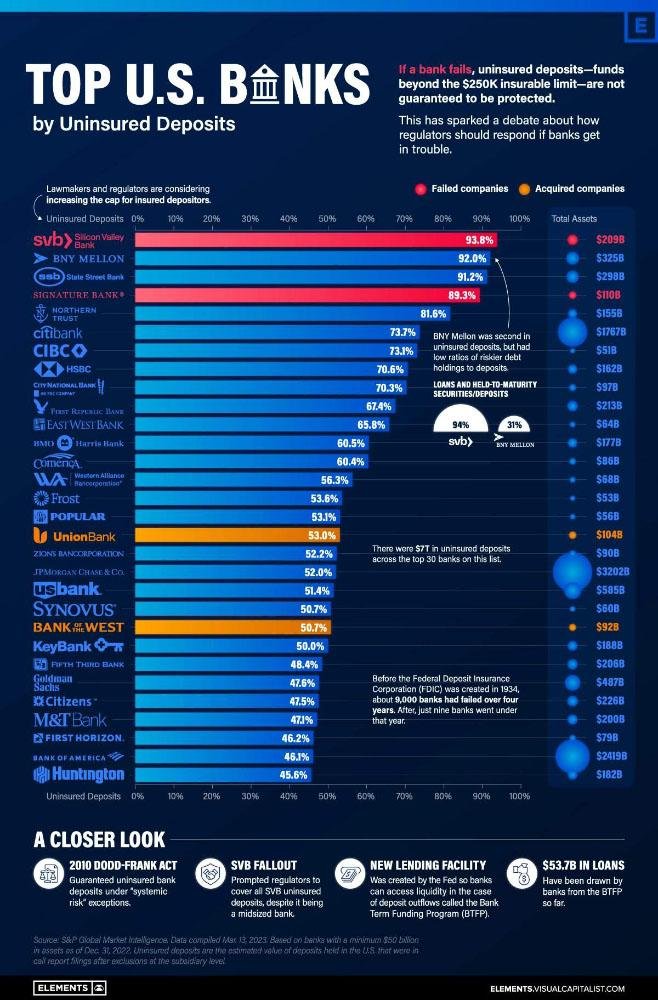

These uninsured deposits are those which surpass the $250,000 limit insured by the FDIC, accounting for approximately 40% of all bank deposits. Following the fallout of Silicon Valley Bank (SVB), data from S&P Global reveals the top 30 US banks with the highest percentage of uninsured deposits.

Recently, SVB and Signature Bank have gone under rapidly, as investors and depositors tried to pull out money simultaneously following news of the banks’ mismanagement.

BNY Mellon and State Street Bank are currently the leading active banks with the highest levels of uninsured deposits in the U.S., followed by JP Morgan. They are considered systemically important banks and as the largest custodian banks in the country, they are expected to safeguard assets and perform asset transfers for investment managers.

SVB stands out from the other banks on the list in terms of the proportion of loans and held-to-maturity securities they have as a percentage of total deposits. SVB has over 94% of its deposits in the form of loans, while BNY Mellon and State Street Bank have only 31% and 40% of their deposits in loans, respectively.

Held-to-maturity securities are a bigger concern for banks as they pose greater risks. Since interest rates have surged, many of these securities have lost their value.

This poses interest-rate risks to banks. For instance, the value of long-term U.S. treasuries fell by about 30% in 2022. If a bank sells these assets before maturity, it could face significant losses.

Out of all the banks on the list, 11 of them have loans and held-to-maturity assets that make up more than 90% of the total value of their deposits.

It seems like the U.S. banking system is literally between a rock and a hard place. The Fed may have no other option than to “save the banks”.