On September 17, 2015, the United States Commodity Futures Trading Commission (CFTC) officially recognized bitcoin as a commodity, a distinction that still separates it from other digital currencies that, eight years later, yet have to achieve a similar status.

Bitcoin as a Recognized Commodity

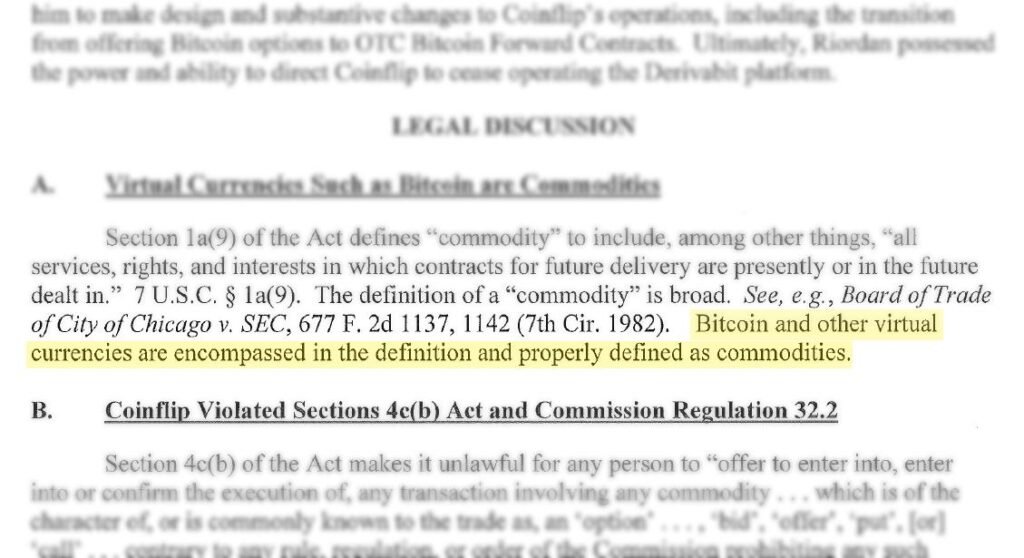

While regulatory ambiguity continues to lurk over other more centralized digital assets, the CFTC’s designation of bitcoin as a commodity established a regulatory framework for bitcoin, allowing it to be treated similarly to other traditional commodities such as gold and precious metals.

Related reading : Bitcoin Is The Only Winner In SEC Clash

The CFTC is involved when a digital currency is utilized in a derivatives transaction or when there is possibility of fraud or manipulation involving a digital asset traded in interstate commerce.

The CFTC stated in its finding that Section 1a (9) of the CEA defines commodity to include “all services, rights, and interests in which contracts for future delivery are presently or in the future dealt in.”

According to the release, “bitcoin is a virtual currency,” defined here as a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value, but does not have legal tender status in any jurisdiction in the U.S.

Bitcoin vs Altcoins

Bitcoin and other virtual currencies are distinct from “usual” currencies, which are the coin and paper money of the United States or another country that are designated as legal tender. They are circulated, and are customarily used and accepted as a medium of exchange in the country of issuance.

Under the leadership of Chairman Gary Gensler, the Securities and Exchange Commission has been actively analyzing various digital assets to see whether they should be classed as securities, a continuing examination that has created a complex and dynamic situation for digital assets.

Related reading : “Bitcoin Is In Danger In U.S.” — Warns Hedge Fund Manager Paul Tudor

Uncertainty of Regulations

Importantly, bitcoin enables anyone on the globe with access to electricity and internet to mine using their computational power to claim the newly generated bitcoin for finding the next block. Bitcoin uses proof-of-work as a consensus mechanism.

At a time when the regulatory status of other digital assets (at least in the United States) is still unclear, this distinction sets bitcoin apart from the uncertainty surrounding other digital assets and continues to be a significant driver of bitcoin’s legitimacy and growth in financial markets.

Related reading : Regulatory “Siege” Underway For U.S. Exchanges — Warns Ex-SEC Official

The Turning Point

The eight-year anniversary of bitcoin’s commodity status in the U.S. represents a pivotal turning point in the development of the digital money and blockchain technology. Since its inception, bitcoin has come a long way, evolving from a specialized idea to an asset class that is widely recognized.

Its recognition as a commodity highlights its ongoing influence and expanding acceptability in traditional finance. This milestone is a monument to bitcoin’s tenacity and its ability to impact the financial world in the years to come as the digital asset ecosystem continues to change and regulatory frameworks become more established.