In a bizarre turn of events on the Bitcoin network, a user recently made headlines for an eye-watering mistake, unintentionally paying a staggering $3.1 million in transaction fees for a transfer worth $2.1 million. This payment of 83 BTC in fees has sparked discussions and concerns within the Bitcoin community, shedding light on the importance of careful verification in the world of decentralized finance.

The Costly Blunder

On November 23, an unsuspecting Bitcoin user, utilizing the address “bc1qn3d7vyks0k3fx38xkxazpep8830ttmydwekrnl” initiated a transaction to transfer 55 BTC to another address.

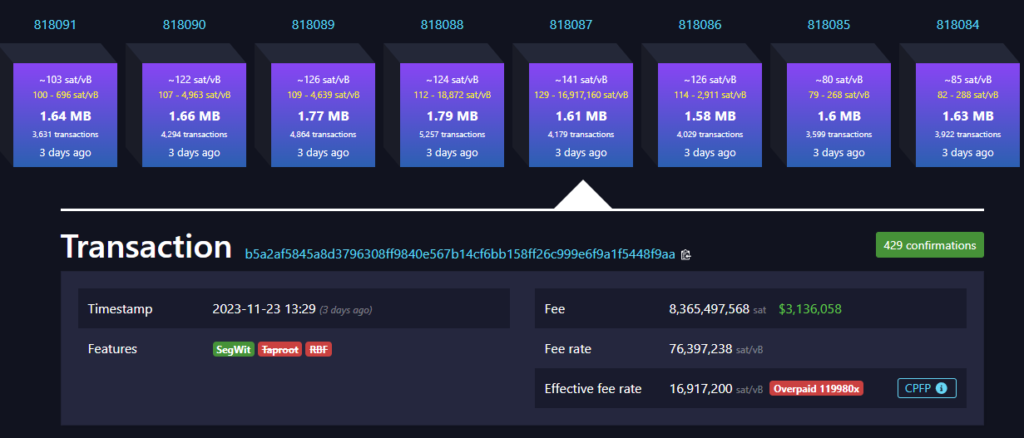

However, what should have been a routine transaction took a drastic turn when an astronomical fee of 83 BTC, equivalent to approximately $3.1 million, was attached to the transfer. This shocking error unfolded in block #818,087, mined by AntPool, making it the highest fee ever recorded on the Bitcoin blockchain.

83 BTC in Fees: Magnitude of the Mistake

The blunder becomes even more significant when considering the scale of overpayment—120,000 times the standard handling charge. In the context of the entire block, the transaction fees accounted for almost 90% of the total fees collected, overshadowing the standard mining subsidy of 6.25 BTC by an astounding margin.

This incident serves as a stark reminder of the critical importance of meticulous verification before executing transactions on the Bitcoin network. Transaction fees are set by users as incentives for miners to prioritize their transactions. Once confirmed, these fees become non-refundable, emphasizing the need for users to double-check details to avoid potentially expensive mistakes.

Related reading: Why Your Bitcoin Transaction Is Stuck On Pending

In comparison to this recent mishap, the Bitcoin community recalls a previous incident involving Paxos, where a 20 BTC handling fee was mistakenly sent on a minor transfer. However, in a more favorable turn of events, F2Pool acknowledged the error and reimbursed the excess amount to Paxos, highlighting the discretionary power of miners in such situations.

Insights from the Community

The incident sparked discussions and speculations within the Bitcoin community, as users took to online forums to analyze the situation. One Reddit user, SmoothGoing, suggested that the mining pool might consider returning the excessive fee if “asked nicely.” However, other users raised concerns about potential money or Bitcoin laundering.

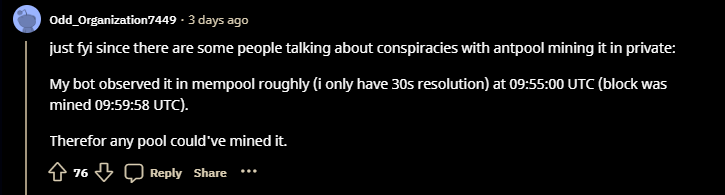

Another Reddit user, Odd_Organization7449, provided insights into the timeline of the incident, dispelling conspiracy theories about Antpool mining the transaction in private.

According to their observation the transaction was sitting in mempool for a few minutes before being mined, and any mining pool could have potentially mined the block. This, if true, disproves other theories that saw this transaction as “private” and a way to possibly launder money.

Another user, polloponzi, delved into the transaction history, pointing out the transaction was RBF’d, and the fee was indeed increased. The user found it very funny, stating:

“They originally sent the BTC transfer with a fee of 65,086,251 sat/vB and then they increased it to 76,397,238 just to be sure that was mined on the next block, lol”

Addressing the potential cause behind the exorbitant fee, another user also speculated a software bug, believing the transaction was particularly a “Child Pays For Parent” (CPFP) transaction. They pointed out the absence of a change address, implying that a software bug in the wallet might have caused the change to be treated as an additional fee.

Conclusion

The incident of the accidental $3.1 million transaction fee has not only raised eyebrows but has also sparked important conversations within the Bitcoin community. It serves as a cautionary tale for users to exercise vigilance in their transactions and for wallet developers to ensure the robustness of their software.

As the Bitcoin ecosystem continues to evolve, incidents like these contribute to the ongoing dialogue about transaction security and user responsibility.