Antpool, affiliated with Bitmain, a leading manufacturer of digital asset mining equipment, made waves recently by surpassing Foundry, a U.S.-based titan, in the bitcoin mining hashrate race.

Hashrate Race: Antpool’s Rise to the Top in November

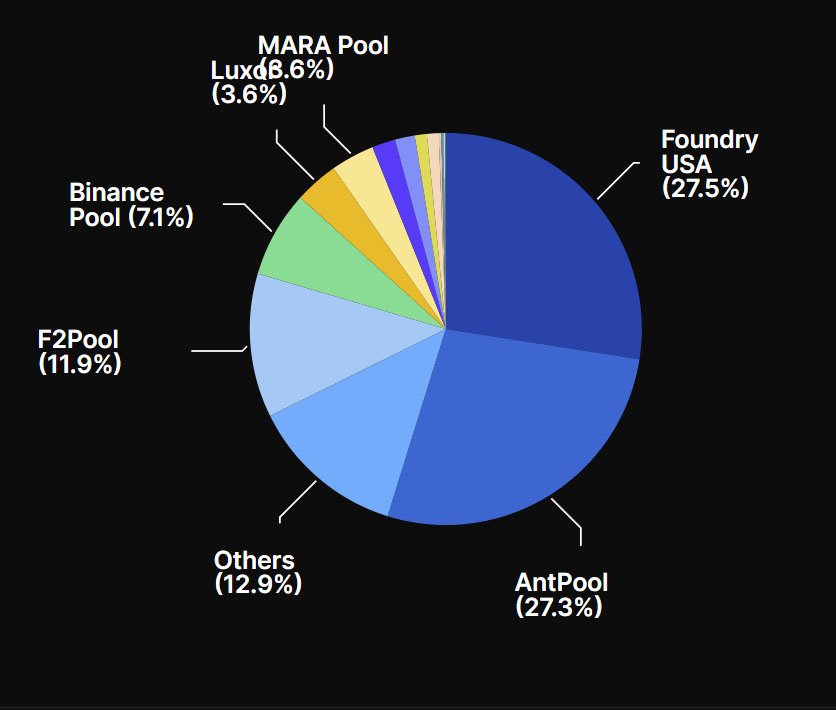

Bitcoin mining, the backbone of the Bitcoin network, often involves pooling resources to increase the chances of solving complex tasks of finding blocks and reaping rewards. In recent months, a compelling showdown has unfolded between two major players: Antpool and Foundry.

In November, Antpool mined 1,218 blocks, edging slightly ahead of Foundry’s 1,216 blocks. This marked a significant shift in dominance, reflecting Antpool’s ascent to the forefront of Bitcoin mining pools.

There are speculations that this surge aligns with Bitmain’s employment of its cutting-edge mining equipment S19XP and S19XP Hydro, increasing its hashrate. Despite this achievement, there’s been a persistent discrepancy between Antpool’s reported real-time hashrate and Foundry’s, raising questions about reporting accuracy.

Foundry’s Sturdy Foundation

Foundry, launched in 2020 by Digital Currency Group (DCG) in the U.S., swiftly gained traction for its reliability, low fees, and high hashrate. Operating under the Full Pay Per Share (FPPS) payout method, it offers stable rewards regardless of the pool’s success. With a minimum payout threshold of 0.001 BTC, Foundry empowers miners with consistent payouts for their contributions.

The pool also distinguishes itself by providing mining equipment financing, enabling miners to access top-notch hardware without substantial upfront costs. Additionally, its commitment to security and compliance, alongside dedicated customer support, positions Foundry as a reliable option for Bitcoin miners seeking stability and efficiency.

Antpool vs. Foundry: The Showdown

The competitive dynamic between these mining giants mirrors larger geopolitical tensions, with Antpool’s Chinese ties and Foundry’s U.S.-centric approach reflecting a broader narrative of competition between entities from these regions in the Bitcoin mining landscape.

As Antpool claims the top spot in blocks mined in November, its affiliation with Bitmain underscores the competitive surge between China and the U.S. in mining productivity. However, Foundry’s steadfast foundation and commitment to decentralization continue to resonate within North America’s mining operations.

Both Antpool and Foundry represent pillars of Bitcoin mining, offering distinct advantages and facing their unique challenges. While Antpool’s recent surge showcases its growing dominance, Foundry continues to position itself as a reliable choice in the North American mining ecosystem.

Antpool’s affiliation with a leading hardware manufacturer and Foundry’s focus on reliability, low fees, and financing—underscore the diverse strategies in the quest for mining supremacy.

Rise of Decentralized Mining Pools

In recent news, Mummolin Inc., led by Block CEO Jack Dorsey, has secured $6.2 million in seed funding for the launch of OCEAN, a decentralized Bitcoin mining pool.

Unlike traditional pools that control rewards and fees, OCEAN utilizes a non-custodial payout system, directly distributing earnings to miners from the block reward. This innovative approach reduces risks associated with traditional pools, ensuring miners receive their payments without relying on a centralized pool.

Notably, participants in the funding include Accomplice, Barefoot Bitcoin Fund, MoonKite, NewLayer Capital, and the Bitcoin Opportunity Fund.

In recent developments, Ocean Mining Pool found its first block on December 1, collecting a fee and reward sum of 6.54 BTC.

In a landscape characterized by technological prowess and strategic alliances, the battle for dominance between Antpool and Foundry illustrates the multifaceted nature of Bitcoin mining. The clash between Antpool and Foundry, and rise of decentralized mining pools in the meantime, not only exemplifies the competitive spirit in the mining arena but also highlights the critical role mining pools play in shaping Bitcoin’s future.