As the deadline for Bitcoin Spot ETF applications approaches, Cathie Wood-guided American investment management firm Ark Investment has executed a significant strategic shift by divesting its entire Grayscale Bitcoin Trust (GBTC) holdings. This marks a significant change in Ark Invest portfolio.

Bloomberg Intelligence ETF analyst Eric Balchunas shared this development on December 28. He noted that this move transpired within a month of GBTC becoming the largest holding in ARKW’s portfolio.

Ark Invest Portfolio Change: Rationale Behind the Move

Ark Invest’s decision to liquidate its GBTC holdings indicates its confidence in the approval of the Spot Bitcoin Exchange-Traded Fund (ETF) before the January 10, 2024 deadline.

It is interesting to note that the investment firm allocated half of a $100 million fund to acquire shares of ProShares Bitcoin Strategy ETF-BITO, introduced in October 2021. Balchunas highlighted the move as a pivotal change in its investment approach.

The Bloomberg analyst suggested that this shift is likely part of Ark Invest’s plan to utilize BITO as a liquid transition tool, ensuring the maintenance of beta exposure to bitcoin. This strategic decision aligns with the forthcoming potential launches of the ARK Next Generation Internet ETF ($ARKW) and the ARK 21Shares Bitcoin Spot ETF ($ARKB).

Notably, with its investment in BITO, Ark Invest has become the second largest owner of ProShares Bitcoin Strategy ETF shares, underscoring institutional strategies where highly liquid ETFs serve as effective transition tools. This move impressively enhances the assets under management (AUM) of Ark Invest’s ETFs, thereby optimizing expense ratios and benefiting investors. Balchunas stated:

“Just like that ARK is now the second biggest holder of $BITO, altho again this is a temporary parking spot. They (and institutions generally) use highly liq ETFs for transitions like this.”

Ark Invest Bitcoin Sentiments

Cathie Wood’s recent optimism aligns with its June report, suggesting Bitcoin’s potential to evolve into a multi-trillion dollar market. The report meticulously analyzes various metrics of the Bitcoin network, underscoring the digital asset’s resilience and durability, thereby emphasizing its robust long-term prospects.

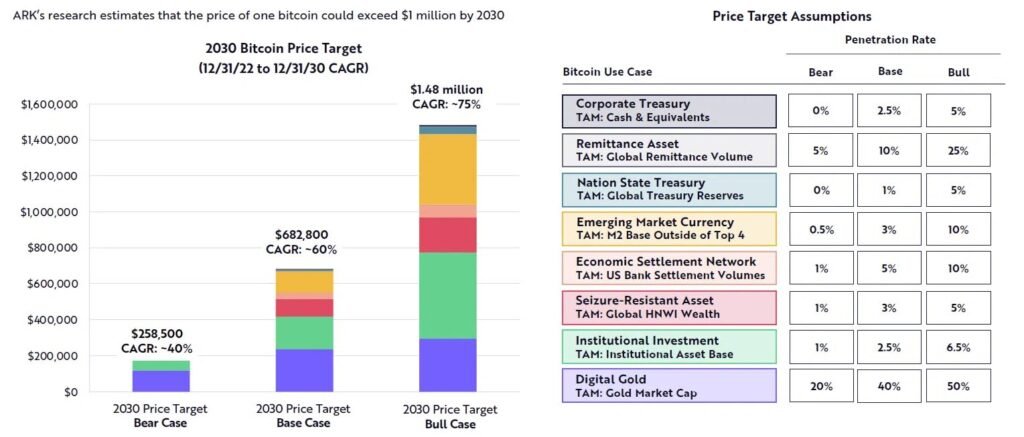

Interestingly, Ark sees the price of bitcoin surpassing $1 million within the next decade. This optimistic outlook not only reflects a positive sentiment within Ark Invest but also presents an enticing opportunity for potential investors, signaling a promising future for Bitcoin.

Cathie Wood’s exit from GBTC holdings and embracing Spot Bitcoin ETF appear to be in sync with this overarching positive outlook on the digital currency’s trajectory.

Grayscale’s Amendment Filing

Meanwhile, Grayscale, a prominent asset management firm, filed an amended S-3 for its Bitcoin Spot ETF on December 26. As reported by Bloomberg analyst James Seyffart, the updated document submitted to the United States Securities and Exchange Commission (SEC) outlines a strategic shift in Grayscale’s ETF operations.

Notably, the company has adopted a cash-only policy for ETF investments, as disclosed in the filing:

“At this time an Authorized Participant can only submit Cash Orders, pursuant to which the Authorized Participants will deposit cash into, or accept cash from the Cash Account in connection with the creation and redemption of Baskets.”

This move, aimed at enhancing operational efficiency, signifies Grayscale’s commitment to leading the competitive BTC Spot ETF market.