In its recently released annual report on January 31, ARK Invest, a prominent investment management firm, sheds light on Bitcoin’s historical outperformance relative to major assets and proposes an institutional portfolio allocation of up to 19.4% to optimize risk-adjusted returns.

The Ark Invest portfolio recommendation encompasses diverse research findings, primarily focusing on the technological convergence of blockchain. It aims to “tap into the exponential growth opportunities often overlooked in broad-based indices while simultaneously providing a hedge against the risks posed by incumbents facing disruption.”

Bitcoin Outperforms Every Asset

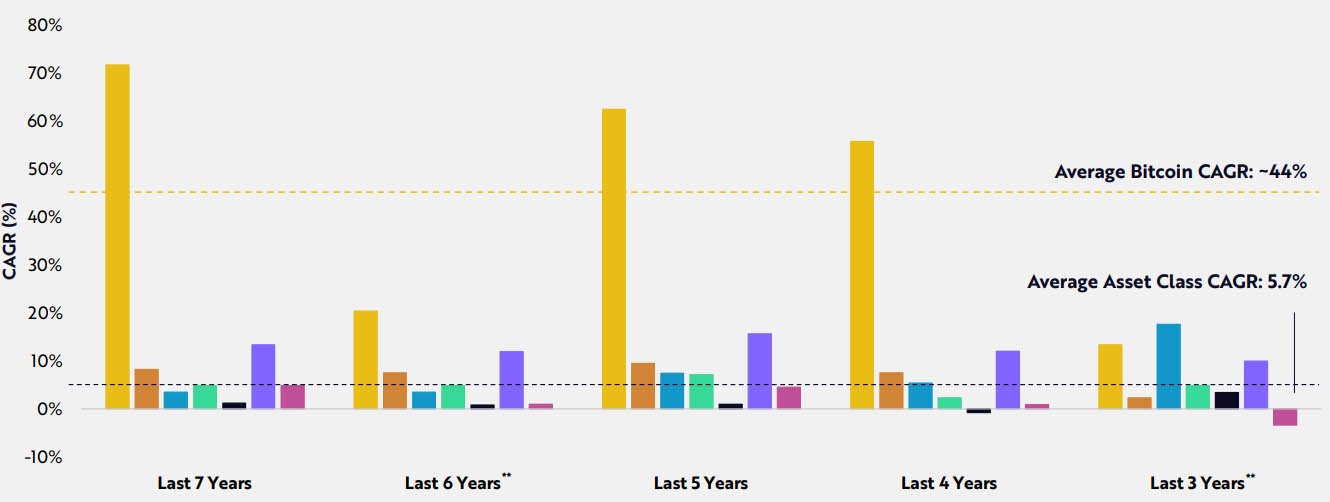

ARK’s report presents comprehensive data showcasing Bitcoin’s exceptional performance compared to other traditional investment assets in the long term.

According to the analysis, over the past seven years, Bitcoin has exhibited an annualized return averaging an impressive 44%, significantly outpacing other major assets, which averaged a mere 5.7%.

Emphasizing the importance of long-term perspectives, the report notes:

“Historically, investors who bought and held bitcoin for at least 5 years have profited, no matter when they made their purchases.”

Ark Invest Portfolio Allocation Recommendations

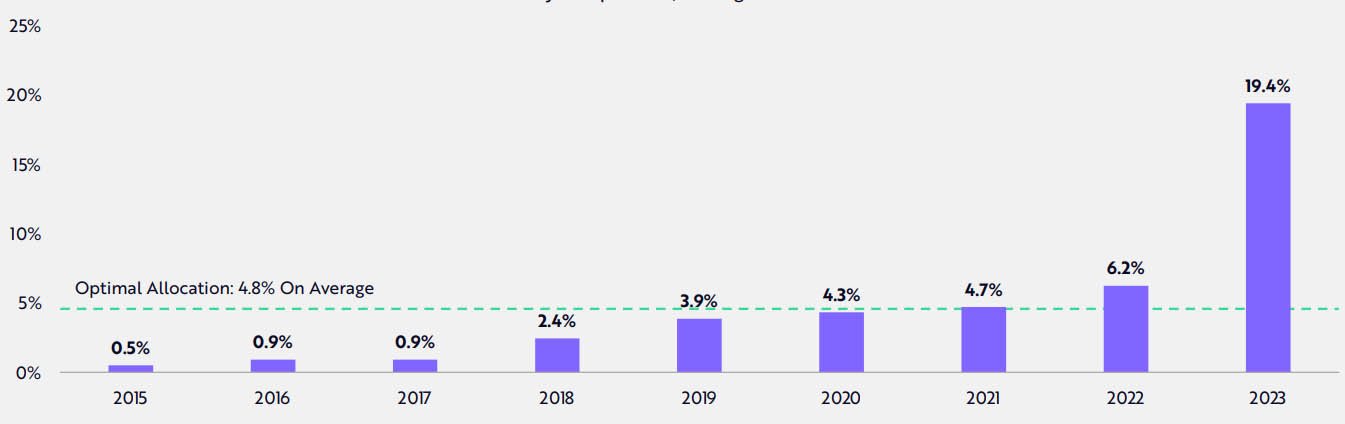

The report delves into the volatility and return profiles of traditional asset classes, proposing that a portfolio aiming for maximized risk-adjusted returns should have allocated 19.4% to Bitcoin in 2023.

ARK highlights the evolution of optimal allocations over the past decade, revealing that on a 5-year rolling basis, the recommended allocation to Bitcoin has steadily increased. In 2015, the suggested allocation was 0.5%, rising to an average of 4.8% from 2015 to 2023 and reaching a peak of 19.4% in 2023 alone.

Hypothetical Scenarios and Bitcoin Valuation

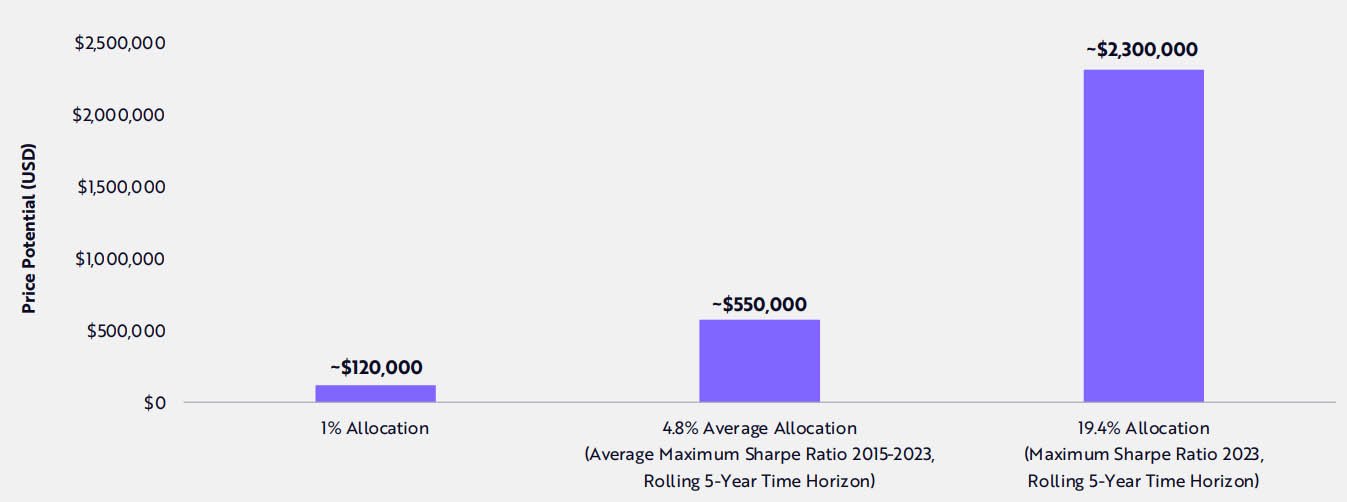

ARK’s research explores hypothetical situations based on institutional investments in the global investable asset base. Interestingly, if just 1% of the $250 trillion global asset base were invested in Bitcoin, the price per BTC could surge to $120,000.

Considering the 4.8% average maximum Sharpe ratio allocation from 2015 to 2023, Bitcoin’s price projection rises to $550,000. However, under ARK’s proposed 19.4% allocation, Bitcoin’s valuation would soar to an extraordinary $2.3 million.

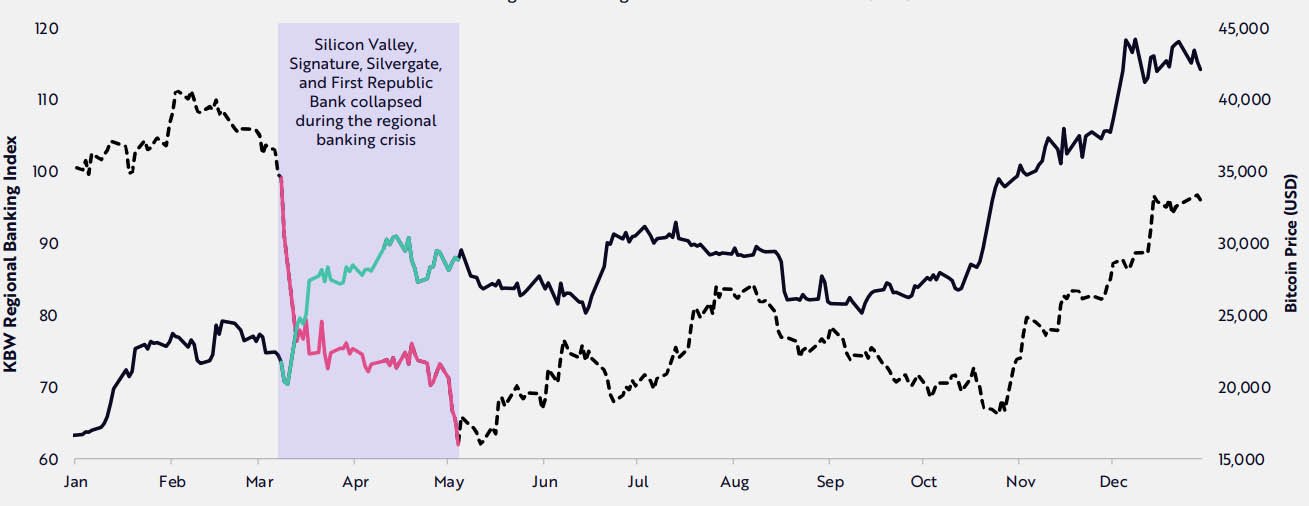

The report reflects a shift in Bitcoin investment narratives, with ARK’s current recommendation of a 19.4% portfolio allocation differing significantly from previous years. The company underscores bitcoin’s role as a hedge against counterparty risk, citing the historic collapse of US regional banks in 2023, when the BTC price appreciated more than 40%.

In January 2022, influential figures like Ray Dalio and Bill Miller suggested a more conservative portfolio allocation of 1% to 2% in Bitcoin. Similarly, JPMorgan’s investment strategists proposed a 1% portfolio allocation to Bitcoin as a hedge against fluctuations in traditional asset classes.

As the investment landscape continues to evolve, Bitcoin’s role in diversified portfolios is gaining increased attention, prompting a reevaluation of traditional investment strategies in light of the digital asset’s enduring success.