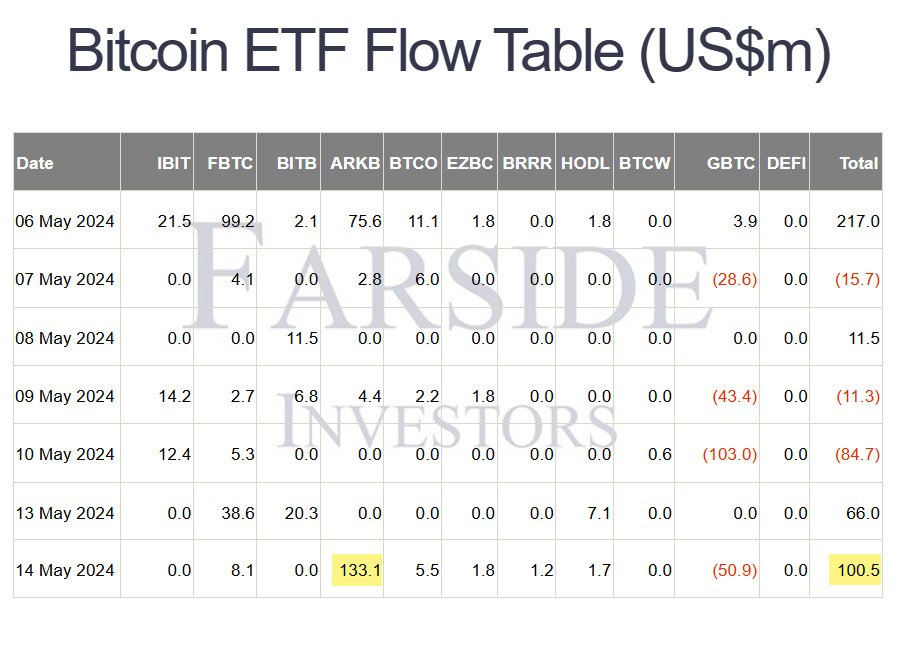

According to reports by Farside Investors, Bitcoin ETFs in the United States have seen a surge in daily net inflows, surpassing $100 million.

This influx of capital into ETFs represents a noteworthy shift in investor behavior. Notably, the ARK 21Shares Bitcoin ETF, also known as ARKB, emerged as a frontrunner in attracting investment.

The data reveals that ARKB recorded a substantial inflow of $133.1 million, marking a significant milestone for the ETF. This surge in inflows represents a positive indicator of investor confidence in Bitcoin-related investment vehicles.

Despite the overall influx into Bitcoin ETFs, the Grayscale Bitcoin Trust (GBTC) experienced a net outflow of $50.9 million. This contrast highlights the shifting preferences among investors, with ARKB overshadowing other ETFs like GBTC.

Data indicates that ARKB has seen net inflows of over $100 million for the seventh time, underscoring its appeal among investors. Additionally, the ARKB ETF’s inflow of $133.1 million, marks the first instance of such significant inflows since March 27 earlier this year.

Beyond ARKB, other Bitcoin ETFs have also experienced inflows, albeit to varying degrees. Funds such as the Fidelity Wise Origin Bitcoin Fund and the Invesco Galaxy Bitcoin ETF reported net inflows. Notably, ten days ago on March 6, Fidelity’s FBTC ETF also witnessed a remarkable $99.2 million inflow.

So far, around $11.84 billion in total net investments have been made into bitcoin exchange-traded funds (ETFs) listed in the United States.

This cumulative inflow underscores the growing interest in Bitcoin ETFs as vehicles for Bitcoin investment. However, it’s worth noting that spot Bitcoin ETF volumes have seen a gradual decline since reaching a peak in March, indicating shifting market dynamics.

The recent developments in Bitcoin ETFs carry significant implications for the broader digital asset market. As institutional and retail investors alike seek exposure to digital assets, ETFs provide a regulated and accessible avenue for investment. This influx of capital into Bitcoin ETFs could contribute to increased liquidity and stability within the market.

With ongoing developments and regulatory advancements, Bitcoin ETFs are likely to remain a focal point for investors seeking exposure to the dynamic world of Bitcoin.