As Bitcoin’s price continues to soar, investors are eyeing opportunities in the Bitcoin market, particularly in Bitcoin mining stocks. Analysts at Bernstein, a prominent financial research firm, have recently issued reports highlighting the potential for significant gains in mining stocks leading up to the anticipated Bitcoin halving event in April.

Price Resurgence Sparks Interest in Bitcoin Mining Stocks

Bitcoin’s recent surge past the $47,000 mark has reignited investors’ interest. Analysts at Bernstein recognize this as a strategic entry point for investors to capitalize on the digital asset’s momentum. They specifically recommend investing in mining stocks, such as Riot Platforms (RIOT) and CleanSpark (CLSK), to gain exposure to the growing market.

The report highlights:

“We expect 15% of high-cost miners to cut production in the coming halving, but we expect the low-cost and competitive miners to gain relative share (RIOT and CLSK are our preferred picks).”

Related reading: Unprepared Miners Will Suffer: CoinShares Halving Report

The Halving Event: A Catalyst for Mining Stocks

One of the key factors driving the optimism around mining stocks is the upcoming Bitcoin halving event. Scheduled for April, this event historically leads to a reduction in the reward for mining new bitcoin by half. So this highly anticipated event will cut the current block reward of 6.25 BTC down to 3.125 BTC instantly. Despite the potential challenges this poses for high-cost miners, Bernstein believes that U.S.-listed mining companies are well-positioned to weather the storm.

The report states that the halving will clear out high-cost miners, and that it believes US-listed miners are “relatively well positioned” for this event.

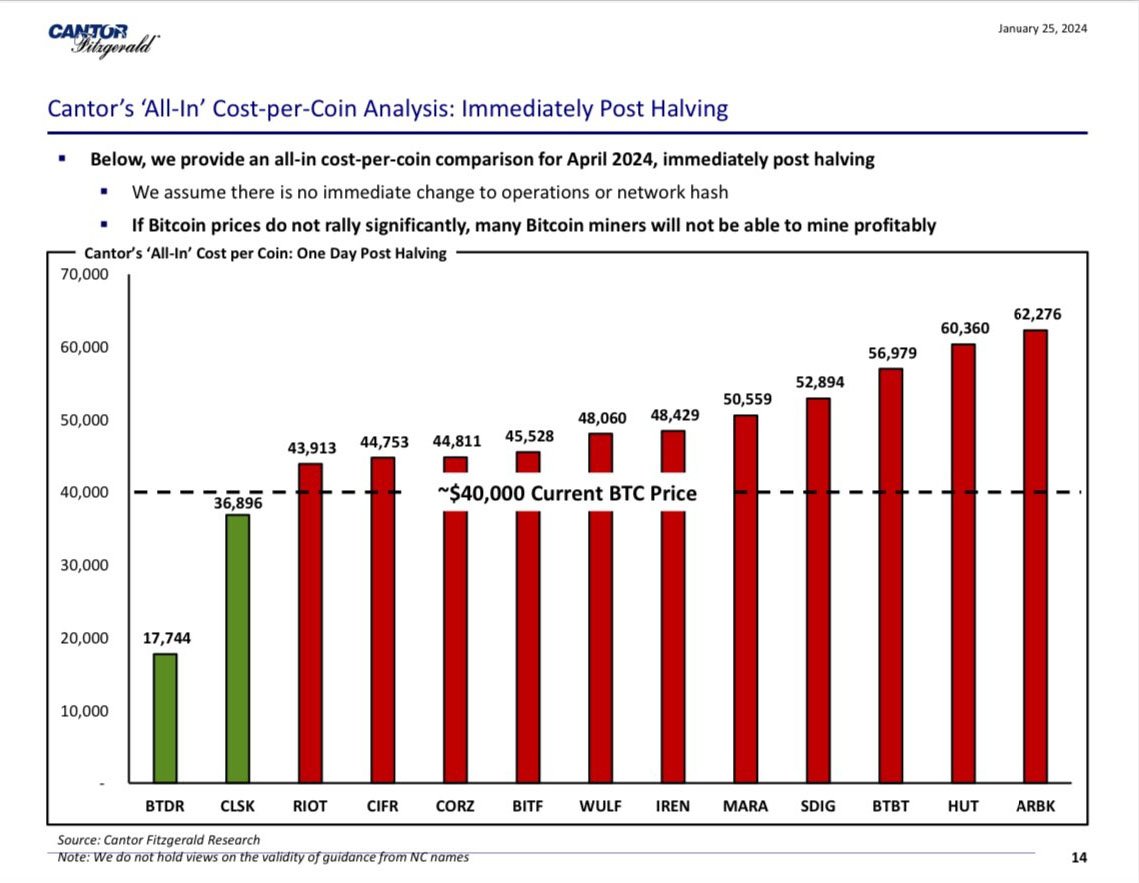

Related reading: Cantor Fitzgerald Warns Bitcoin Miners of Post-Halving Crisis

Analysts’ Recommendations: A Strategic Move for Investors

According to Bernstein analysts Gautam Chhugani and Mahika Sapra, now is an opportune time to invest in Bitcoin mining stocks. They cite positive Bitcoin Exchange-Traded Funds (ETFs) flows, resilient Bitcoin price action, and healthy miners expanding capacity as indicators of a favorable market environment. The analysts specifically highlight Riot Platforms (RIOT) and CleanSpark (CLSK) as their top picks in the mining sector.

They wrote:

“Given the positive ETF flows momentum, resilient BTC price action and healthy miners adding capacity into the halving, we feel comfortable recommending investors to enter here for our preferred names […] The institutional narrative led by bitcoin ETFs is driving demand, and bitcoin being the reflexive asset, we expect higher price will bring higher ETF inflows, leading to new highs in 2024.”

Bernstein’s research reports indicate significant potential upside for mining stocks, particularly RIOT Blockchain and CleanSpark. RIOT Blockchain, despite showing weaker performance compared to its peers, is expected to see improved price action, especially with the anticipated capacity growth at its Corsicana facility starting in the second quarter.

Chhugani and Sapra add:

“We also expect layer-2s to continue to drive transaction revenues for the miners and economic activity from token mints and NFT (non-fungible token) ordinals to sustain, as the Bitcoin developer ecosystem grows[…] Riot, in particular, has been weak versus others, but with the expected capacity growth in Corsicana coming up, starting Q2, we expect better price action.”

The Corsicana facility is touted as the largest Bitcoin mining operation globally, covering an expansive area of 265 acres. Regulatory bodies have given the green light for a staggering capacity of one gigawatt of electricity.

ETF Momentum and Bitcoin Price Resilience: Driving Investment

The recent approval of spot Bitcoin ETFs in the U.S. has further bolstered optimism surrounding mining stocks. While there has been some volatility in the market following the news, Bernstein identifies positive ETF flow momentum, along with resilient Bitcoin prices, as key drivers for investment in mining stocks.

The report adds:

“In a commodity with a known finite supply curve, any incremental buying demand at this scale will become material to price. ETFs are still 3.5% of total supply, and more than 12% of Bitcoin still sits on exchanges, but it is the net incremental demand that counts given the sell pressure is easier to model.”

Conclusion

Bernstein’s recommendations underscore the potential for significant gains in Bitcoin mining stocks ahead of the halving event. As Bitcoin continues to capture headlines with its impressive price surges, mining stocks present a strategic avenue for investors to capitalize on bitcoin’s momentum.

Bernstein believes US bitcoin miners are well positioned and ready for the halving event. This data seems to be in line with recent report from Cantor Fitzgerald on the same matter.

In its report, the financial services company stated that CleanSpark and Riot are among the top 3 most profitable mining operations in a list of 13 companies. Notably, Cantor Fitzgerald’s report was based on $40,000 BTC and the price has increased almost 20% from that mark. If this trend continues, it could significantly improve miners’ profitability.