Despite the recent slowing of bitcoin spot Exchange-Traded Fund (ETF) flows, analysts at research and brokerage firm Bernstein Research are maintaining a bullish outlook, expecting this to be a temporary pause in bitcoin’s upward trajectory.

Recent Slowdown in Bitcoin ETF Inflows

In a note to clients on Monday, analysts Gautam Chhugani and Mahika Sapra emphasized that the recent slowdown in Bitcoin ETF flows shouldn’t raise concerns. According to the analysts, the slowing of Bitcoin ETF flows can be attributed to the ‘halving’ catalyst. They stated:

“We don’t expect the Bitcoin ETF slowdown to be a worrying trend, but believe it is a short-term pause before ETFs become more integrated with private bank platforms, wealth advisors and even more brokerage platforms.”

Notably, spot Bitcoin ETFs’ collective inflows have significantly decreased since peaking at a net daily inflow of over $1 billion on March 12, as the digital asset approached its latest all-time high of $73,836.

Adding to this situation, the Depository Trust and Clearing Corporation (DTCC) recently decided to withdraw collateral support for ETFs that are exposed to Bitcoin.

This move is likely to spark speculation among spot Bitcoin ETF investors who are wondering about the future of their investments, potentially triggering a sell-off and causing the ETFs’ AUM to drop significantly in the short-term.

Bernstein Research Remains Bullish

Bitcoin has been trading in a range of $62,000 to $72,000 since late February, with no clear momentum. According to the latest data, the digital asset is down by around 10% in the last 30 days and is trading at the price of $63,000 with a market capitalization of 1.24 trillion.

Bernstein stated that it will take time for Bitcoin to become a recommended portfolio allocation. It also noted that platforms need to establish compliance frameworks for selling ETF products. Despite these factors, Bernstein remains bullish on the BTC price.

The analysts reiterated their bullish target of $150,000 for bitcoin by the end of 2025, citing the $12 billion of spot Bitcoin ETF net inflows so far.

They also noted the strong position of leading Bitcoin miners post-halving, with transaction fees normalizing at around 10% of miner revenues.

A Buying Opportunity Spotted

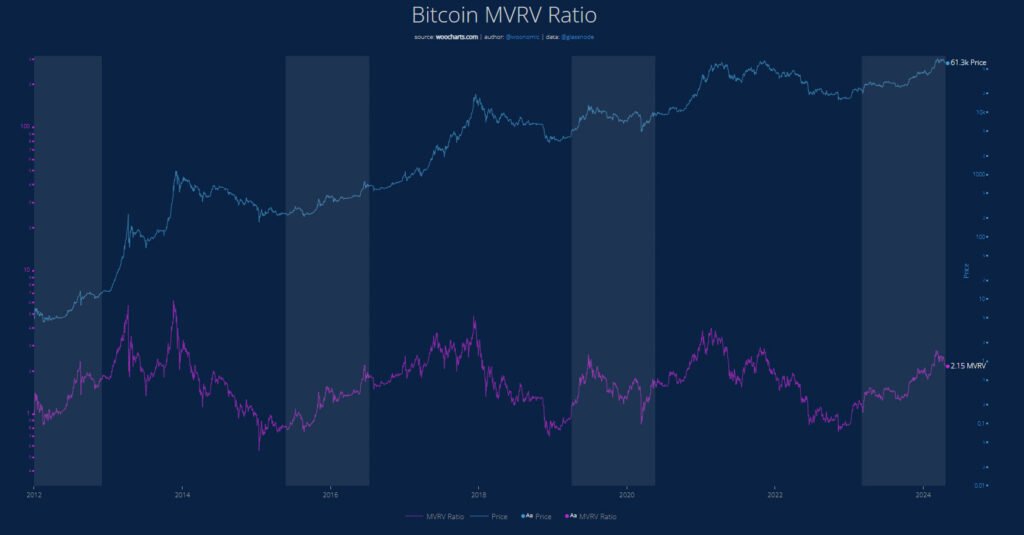

Meanwhile, the latest “Bitfinex Alpha” report observes that the open interest (OI) funding rate for Bitcoin futures and the Market Value to Realized Value (MVRV) ratio are signaling an advantageous buying opportunity.

The OI turned positive on April 24, indicating a growing interest in long positions and a shift from bearish to bullish market sentiment. Additionally, the MVRV ratio has declined to 2.21, suggesting potential undervaluation. The report explains:

“When the MVRV ratio dips below its 90-day average, which is currently at 2.44, it has been followed by significant returns for the underlying asset, averaging 67 percent. This pattern indicates that the current juncture might be a lucrative time for Bitcoin investments.”

The report also warns that bitcoin is repeatedly testing its support level, which could lead to a more significant price correction.

Interestingly, a move towards the $71,000 range highs could signal market strength and attract buyers. However, a failure to do so could indicate a bearish shift in sentiment.