Binance, the largest digital asset exchange has reached an agreement with the U.S. Securities and Exchange Commission (SEC).

The agreement between Binance and SEC aims to safeguard U.S. customer assets within the United States until the resolution of an extensive lawsuit filed by the regulatory agency earlier this month.

The agreement, which was revealed in court documents submitted on Friday evening, is pending approval from the federal judge overseeing the ongoing litigation. In order to prevent U.S. customer assets from being moved overseas, the agreement stipulates that only employees of Binance US will have access to these assets.

On June 5, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance, its CEO and founder Changpeng Zhao, and the operator of Binance US. The SEC’s allegations include artificial inflation of trading volumes, diversion of customer funds, failure to enforce restrictions on U.S. customers, and misleading investors regarding market surveillance controls.

Related reading : Bitcoin Plunges Below $26,000 As SEC Sues Binance

Related reading : Regulatory “Siege” Underway For U.S. Exchanges — Warns Ex-SEC Official

The lawsuit, along with another one filed by the SEC against prominent U.S. exchange Coinbase the next day, marks a significant escalation in the regulatory crackdown on the digital asset industry in the United States.

According to court documents, the agreement, while not resolving the SEC lawsuit, outlines that Binance US will implement measures to ensure that no Binance Holdings officials have access to private keys for its wallets, hardware wallets, or root access to Binance US’s Amazon Web Services tools.

In a statement issued on Saturday, the SEC stated that the obtained emergency relief order will safeguard the assets of Binance US customers and guarantee their ability to withdraw those assets without disruption.

In that statement, Gurbir Grewal, Director of the SEC’s Enforcement Division, emphasized the significance of the imposed restrictions, stating, “Given that Changpeng Zhao and Binance have control over customer assets on the platforms and have demonstrated the ability to commingle or divert such assets at their discretion, these prohibitions are vital for safeguarding investor assets.”

CEO of Binance, Changpeng Zhao, tweeted on Saturday that he believes the SEC’s request for emergency relief was unjustified, but they are satisfied about reaching a resolution on mutually agreeable terms regarding the matter. He emphasized that user funds have consistently remained safe and secure on all platforms associated with Binance.

As per the filed documents, the proposed agreement includes several additional provisions. Binance US will establish new digital wallets that are inaccessible to employees of the global exchange. Furthermore, they will provide the SEC with additional information and consent to an expedited discovery schedule.

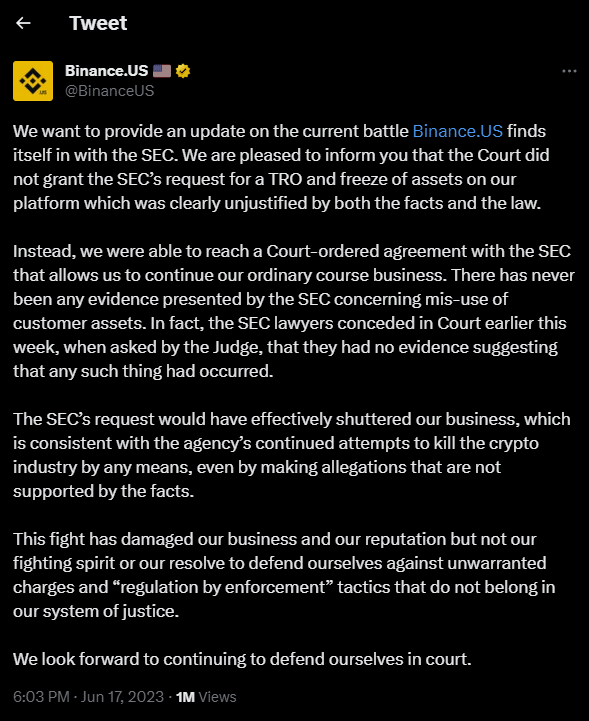

The Binance US Twitter account also released a statement regarding the recent update in the case.

It said Binance US is pleased to announce that the court did not grant the SEC’s request to freeze their assets, and they reached an agreement allowing them to stay in business.

It added that the SEC has provided no evidence of customer asset misuse, and that they believe the SEC is attempting to harm the digital asset industry with unsupported allegations, and despite the damage to their reputation, they remain determined to defend themselves in court.

Last week, Binance’s US affiliate ceased accepting dollar deposits and set a deadline of June 13 for customers to withdraw their dollar funds. This action was taken after the SEC requested a court order to freeze Binance’s assets.