Binance, once a dominant force in bitcoin trading outside the United States, is experiencing a significant decline in its market share as offshore exchanges grow and regulatory landscapes evolve.

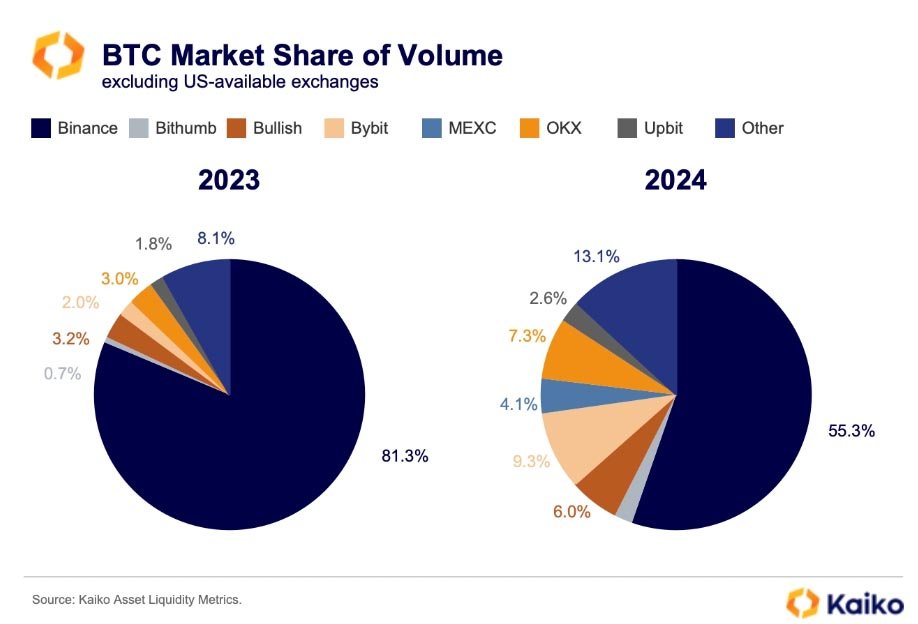

According to data from analytics company Kaiko, Binance’s share of bitcoin trading volume has dropped from 81.3% to 55.3% over the past year. This decline is attributed to the discontinuation of Binance’s large-scale Bitcoin zero-fee promotion, implemented last year, which led to a shift in market dynamics, as well as the regulatory troubles the exchange has been facing recently.

Binance had introduced “Bitcoin Zero Fee” in June 2022, aiming to enhance user experience and accessibility to digital assets by eliminating trading fees. This initiative, now discontinued, offered free trading on several Bitcoin pairs, including BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD.

Bitcoin Trading Volume: Rise of Smaller Exchanges

The diminishing dominance of Binance has paved the way for smaller exchanges like Bybit and OKX to gain traction in the Bitcoin market. Kaiko writes:

“Over the past year, offshore markets have become less concentrated, with smaller exchanges gaining momentum as trade volumes recovered. This trend was particularly noticeable in Bitcoin markets, where Binance has faced increased competition following the removal of its large-scale Bitcoin zero-fee promotion last year.”

Bybit’s portion of global Bitcoin trading outside the U.S. surged from 2% to 9.3%, while OKX’s share rose from 3% to 7.3% over the past year. Other exchanges such as Bullish, MEXC, and Bithumb have also seen notable increases in their market shares.

The decline in Binance’s market share comes amid significant developments in the digital asset market, including Bitcoin’s recent halving event.

Despite initial anticipation surrounding the event, its short-term impact has been mixed. However, historical data indicates that while short-term impacts may vary, the long-term trajectory remains bullish.

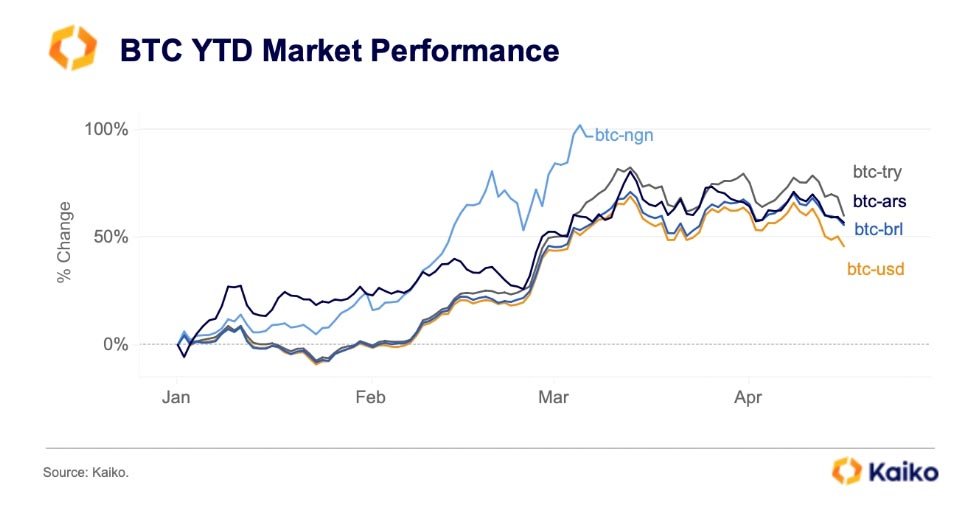

“This year, BTC has surged between 60% and 100% against some of the world’s worst-performing fiat currencies, such as the Turkish Lira (TRY), Argentinian Peso (ARS), and Nigerian Naira (NGN), compared to a 46% rise against the US Dollar,” Kaiko notes.

Binance’s Regulatory Challenges and Rebuilding Efforts

Binance has recently faced regulatory scrutiny in countries other than US, including India, where it has planned to make a solid comeback by paying a penalty of $2 million and registering with the Financial Intelligence Unit (FIU) of the finance ministry.

While Bybit and OKX expand their presence, Binance has been grappling with legal challenges. Co-founder Changpeng Zhao’s guilty plea to violation of U.S. anti-money laundering laws and sanctions breaches in November has cast a shadow on the exchange.

Under new leadership by Richard Teng, a former Singaporean regulator, Binance is striving to rebuild its reputation amid increased regulatory scrutiny. The exchange has implemented stricter token listing criteria and formed a board of directors as part of this effort.

Bitcoin’s Role as a Safe-Haven Asset

Kaiko also noted the surge in demand for safe-haven assets amid geopolitical tensions in the Middle East.

However, Bitcoin has failed to attract significant inflows, experiencing a 9% drop in the last 30 days and facing significant outflows in the Exchange-Traded Funds (ETFs) department in April. In contrast, traditional safe-haven assets like gold and the U.S. dollar have rallied.

This phenomenon could be attributed to the short-term volatility caused by the halving event, according to Kaiko, which further stated:

“There are many other factors at play, as evidenced by Bitcoin’s performance following other major market events. For example, Bitcoin surged after the US banking crisis and Russia’s invasion of Ukraine but remained mostly unchanged after the Hamas attack on Israel.”