Bitcoin has recently undergone a remarkable surge in price, and a substantial number of Bitcoin addresses have entered the profitability zone. With the digital currency going through a staggering 21% increase in the past seven days, 97% of all Bitcoin wallet addresses are currently in profit for the first time in more than two years.

50.62 Million Bitcoin Addresses in Profit

According to insights from on-chain analytics platform IntoTheBlock, this indicates a substantial increase from the last month, when only 91% of addresses were in profit.

The current price level has propelled 50.62 million addresses into profit, constituting more than 97% of the total addresses. This surge matches the last significant profitability event in November 2021, when Bitcoin approached its all-time high of $69,000.

Mainstream Adoption and Holding Mentality

The surge in Bitcoin prices can be attributed to heightened mainstream adoption of traditional investing, primarily driven by the introduction of spot Bitcoin Exchange-Traded Funds (ETFs). A recent analysis by market intelligence platform Santiment reveals that bitcoin whales have accumulated around $13 billion worth of bitcoin in 2024.

Moreover, the regulatory greenlight has triggered a new wave of holding mentality among investors, with February witnessing the withdrawal of 69,244 BTC worth over $3.6 billion from digital asset exchanges.

Diminishing Impact of Selling Pressure

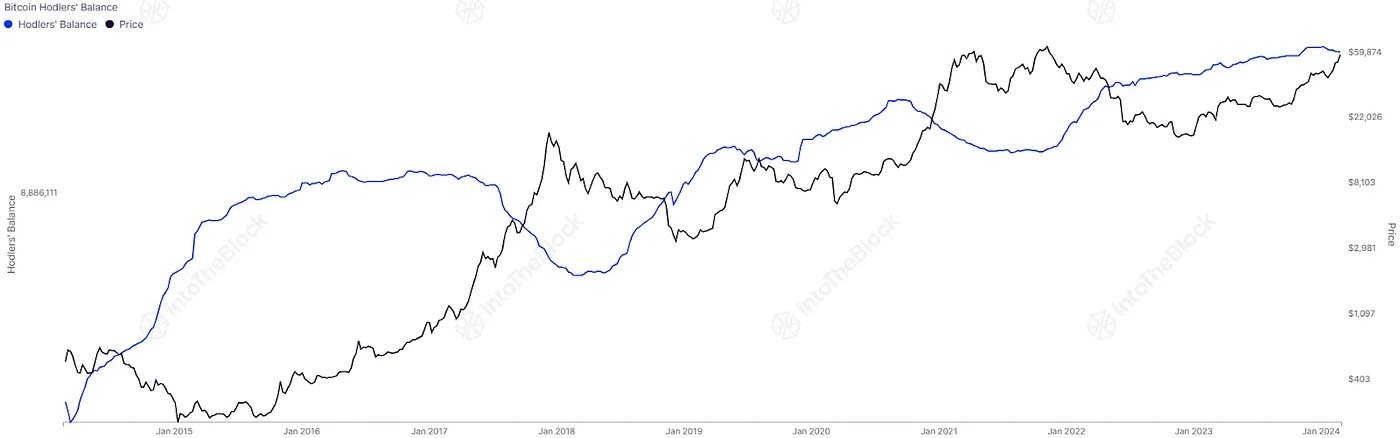

Significantly, the influx of addresses into profitability aligns with a trend where long-term bitcoin investors, often referred to as “hodlers,” have been steadily offloading their holdings. As of February 22, around 200,000 BTC have been sold since the start of the year in this gradual divestment.

Despite sporadic sell-offs and profit-taking attempts by some investors, the continuous growth in the percentage of addresses in net gains underscores the diminishing impact of selling pressure. Bitcoin has recently seen an impressive price surge, recently surpassing $60,000 and currently trading at $63,000. This has resulted in 1.28 million addresses, or 2.46% of the total, reaching a break-even point.

Investors who have held bitcoin for an extended period have reaped the most significant profits. According to IntoTheBlock, 13.6 million BTC are in the possession of long-term holders who have maintained their assets for over a year.

Optimistic Outlook

With bitcoin currently facing virtually little to no resistance, only 0.37% of addresses, totaling 193,000, are still awaiting profitability at the current price. This sets the stage for continued price surges, offering new investors an optimistic outlook for potential gains.

Most experts in the digital asset space remain bullish about bitcoin’s price potential for the remainder of 2024 and beyond. With the ongoing bull run, traders and analysts anticipate bitcoin to set new all-time highs in 2024. Interestingly, the managing partner at RUMJog Enterprises, Thomas Young, recently hinted that the BTC would reach $130,000 by year-end, citing the ‘118 multiplier’ concept.

The current market dynamics, fueled by mainstream adoption and a holding mentality, suggest a promising trajectory for bitcoin’s future performance, with the potential to redefine its all-time highs in the coming months.