Bitcoin, the world’s most prominent digital asset, is steadily “becoming an alternative currency on a global basis”, according to Bloomberg strategist Mike McGlone. In a series of recent analyses, McGlone has highlighted key factors contributing to bitcoin’s surge towards the $70,000 mark, while also shedding light on its growing acceptance and role in the global financial landscape.

Mike McGlone: Bitcoin as a Global Alternative Currency

McGlone emphasizes that Bitcoin is increasingly being recognized as a global alternative currency, particularly as traditional markets experience volatility. He notes, “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” In a separate post on X platform, the strategist expressed his opinion:

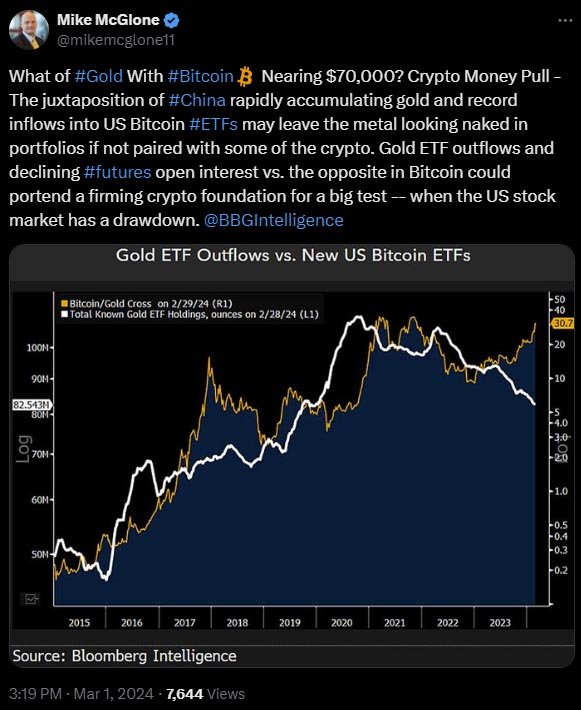

“It’s hard to fight the facts of significant gold ETF outflows and bitcoin ETF inflows.”

Related reading: Gold ETFs See Massive Outflows as Bitcoin ETFs Surge

Factors Driving Bitcoin’s Price Surge

One of the main drivers behind bitcoin’s ascent is its scarcity. McGlone explains the upcoming Bitcoin halving event, where the reward for mining new blocks is halved again, reducing the supply of new bitcoin entering the market. This scarcity model is designed to control inflation and increase bitcoin’s value over time.

As bitcoin approaches $70,000, McGlone warns of potential repercussions for traditional assets like gold. He points out that bitcoin’s massive inflows, particularly into spot Bitcoin ETFs, are diverting funds away from gold ETFs. Despite China’s continued acquisition of gold, the growing interest in Bitcoin-based investment vehicles poses a challenge to gold’s status as a safe haven asset.

He mentioned:

“Gold ETF outflows and declining futures open interest vs. the opposite in bitcoin could portend a firming crypto foundation for a big test — when the U.S. stock market has a drawdown.”

Bitcoin’s Role in Investment Portfolios

McGlone highlights the shifting landscape of investment portfolios, with Bitcoin emerging as a viable option for diversification. He notes, “The juxtaposition of China rapidly accumulating gold and record inflows into U.S. bitcoin ETFs may leave the metal looking naked in portfolios if not paired with some of the crypto.”

From a technical standpoint, McGlone discusses Bitcoin’s unique supply mechanism and its appeal as an investment compared to traditional commodities. He suggests looking at metrics such as the hash rate and the volume of transactions via tokens like Tether to gauge Bitcoin’s value and market growth.

Market Sentiment and Expert Predictions

With Bitcoin trading at around $62,000 as of the latest data, market sentiment remains bullish. McGlone’s insights are echoed by other experts in the bitcoin space, including figures like Michael Saylor, CEO of MicroStrategy, who sees Bitcoin as a superior investment compared to gold.

As bitcoin continues its upward trajectory towards its previous ATH of $69,000, the digital asset’s role as a global alternative currency is becoming increasingly evident. With its scarcity model, growing acceptance among institutional investors, and technical innovations, Bitcoin is reshaping the traditional financial landscape.

However, uncertainties remain, particularly regarding its impact on traditional assets like gold. Nonetheless, the prevailing sentiment suggests that bitcoin’s ascent is far from over, with many experts predicting further gains in the near future. Bitcoin’s rise signifies more than just a milestone in its price journey—it reflects a broader shift towards digital assets and the evolving nature of global finance.